Oakland Michigan Revenue Sharing Agreement is a legal contract that governs the distribution and sharing of revenue derived from the licensing and custom modification of software in Oakland, Michigan. This agreement serves to establish clear terms and conditions between the software owner/licensor and a business or individual licensee who wishes to use or modify the software for income-generation purposes. Keywords: Oakland Michigan, revenue sharing agreement, income, licensing, custom modification, software. The purpose of the Oakland Michigan Revenue Sharing Agreement is to outline the rights and responsibilities of both parties involved in the licensing and custom modification of software. It ensures that the software owner receives a fair share of the revenue generated from these activities while enabling the licensee to profit from their efforts. Types of Oakland Michigan Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software can vary based on specific terms, conditions, and revenue-sharing structures. Below are a few common types: 1. Traditional Revenue Sharing Agreement: This type of agreement outlines a predetermined percentage or share of revenue that the licensee must provide to the software owner. The distribution of income is typically based on the specific terms outlined in the agreement. 2. Royalty-Based Revenue Sharing Agreement: In this type of agreement, the licensee pays the software owner a fixed royalty for each unit of software or modification sold or used. The royalty amount may be fixed or calculated based on a percentage of the sales price. 3. Usage-Based Revenue Sharing Agreement: This agreement model considers the actual usage or consumption of the software by the licensee. The revenue sharing is based on the number of users, installations, or other usage metrics, allowing for a more granular and fair distribution of income. 4. Time-Based Revenue Sharing Agreement: This type of agreement involves sharing revenue according to a specific time period, such as monthly, quarterly, or annually. The income generated during that period is distributed based on the agreed-upon terms, ensuring regular and timely revenue sharing. These various types of Oakland Michigan Revenue Sharing Agreements ensure that the software owner and licensee have a clear understanding of how income from the licensing and custom modification of software will be shared. It eliminates potential conflicts and ensures a fair and equitable distribution of revenue based on the terms agreed upon in the specific agreement.

Oakland Michigan Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Oakland Michigan Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Oakland Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any activities related to document completion simple.

Here's how you can purchase and download Oakland Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

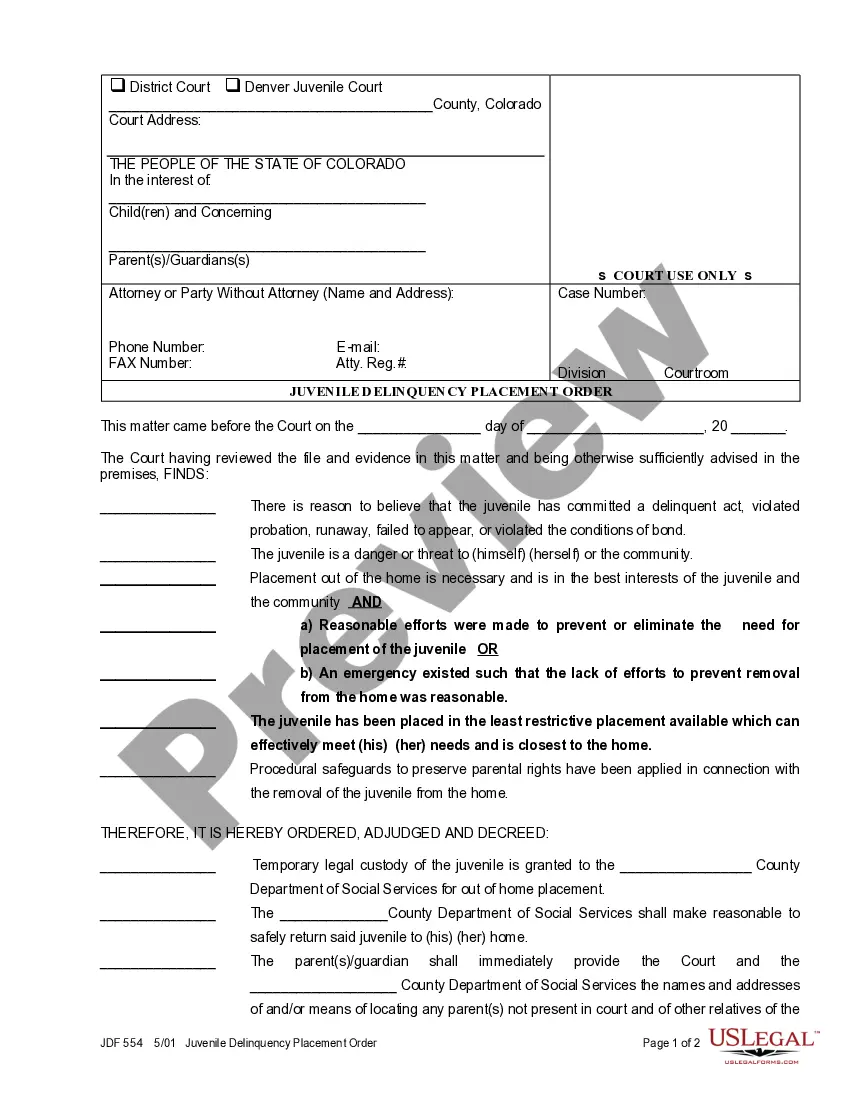

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some documents.

- Examine the similar forms or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Oakland Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Oakland Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you need to deal with an exceptionally challenging case, we recommend using the services of a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!