Oakland Michigan Security Agreement Covering Goods, Equipment, Inventory, Etc. A security agreement is a legal document present in Oakland, Michigan, that provides security for loans or other financial transactions involving goods, equipment, inventory, and other assets. This agreement ensures that the lender has a claim over the specified assets in case the borrower defaults on the loan. In Oakland, Michigan, there are different types of security agreements that cover various types of assets. Some common types include: 1. Equipment Security Agreement: This type of security agreement focuses specifically on equipment owned by a business entity. It outlines the terms and conditions of the loan, including how the equipment will be used as collateral to secure the loan. 2. Inventory Security Agreement: Businesses often use their inventory as collateral to secure loans. An inventory security agreement specifies the details of the loan and how the inventory will be managed and protected until the loan is repaid. 3. Goods Security Agreement: This type of agreement covers a broader category of assets, including both equipment and inventory. It provides comprehensive security for multiple types of goods. 4. Personal Property Security Agreement: While not specific to Oakland, Michigan, a personal property security agreement is widely used across the United States. This agreement covers various movable assets, such as machinery, vehicles, and tangible goods, allowing borrowers to use these assets as collateral for loans. The Oakland Michigan Security Agreement Covering Goods, Equipment, Inventory, Etc., typically includes essential components such as: 1. Identification of the Parties: Clearly identifying the borrower (debtor) and the lender (secured party) involved in the agreement. 2. Description of Collateral: A detailed description of the assets being used as collateral, including any serial numbers, model numbers, or unique identifiers. 3. Security Interest: This section outlines the lender's security interest in the collateral, explaining how the assets will be used to secure the loan. 4. Loan Terms: The agreement should mention the loan amount, repayment terms, interest rates, and any other relevant financial details. 5. Default and Remedies: The document should outline the borrower's obligations and consequences if they fail to meet their repayment obligations. It should also specify the lender's rights, including the ability to seize and sell the collateral to recover loan amounts. 6. Governing Law: The security agreement should clearly state that it is subject to the laws and regulations of Oakland, Michigan. It is important for both parties involved in a security agreement to carefully review and understand the terms before signing. Consulting with legal professionals experienced in Oakland, Michigan's laws regarding security agreements can ensure a comprehensive and legally sound document that protects both the borrower and the lender's interests.

Oakland Michigan Security Agreement Covering Goods, Equipment, Inventory, Etc.

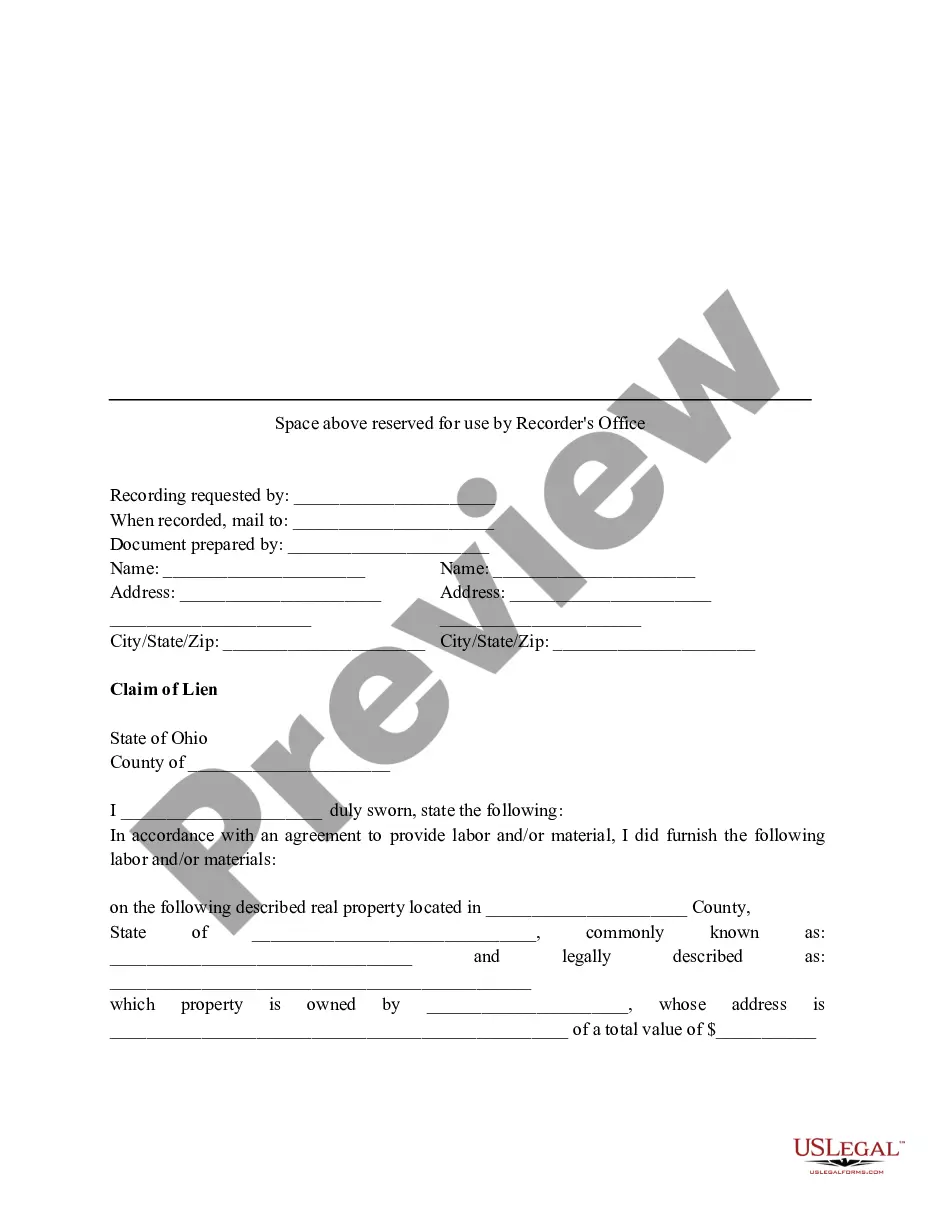

Description

How to fill out Oakland Michigan Security Agreement Covering Goods, Equipment, Inventory, Etc.?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, locating a Oakland Security Agreement Covering Goods, Equipment, Inventory, Etc. meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Oakland Security Agreement Covering Goods, Equipment, Inventory, Etc., here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Oakland Security Agreement Covering Goods, Equipment, Inventory, Etc.:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Security Agreement Covering Goods, Equipment, Inventory, Etc..

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!