An Orange California Security Agreement Covering Goods, Equipment, Inventory, etc., is a legal document used to secure the interest of a lender or creditor in collateral provided by a debtor located in Orange County, California. This agreement ensures that the lender has a priority claim on the specified assets in case the debtor defaults on the loan or fails to fulfill their obligations. There are various types of Orange California Security Agreement Covering Goods, Equipment, Inventory, etc., which may include but are not limited to: 1. Goods: This refers to tangible personal property that can be seen, touched, and moved, such as vehicles, machinery, furniture, office equipment, electronics, and other items used for business purposes. The security agreement may outline specific details about the goods being pledged as collateral, including their identification numbers, descriptions, and approximate value. 2. Equipment: This category encompasses machinery, tools, appliances, and devices used in the course of business operations. Examples include manufacturing equipment, construction machinery, medical instruments, IT infrastructure, and any other specialized equipment relevant to the debtor's industry. The security agreement may specify the types of equipment covered, their condition, and any usage or maintenance restrictions. 3. Inventory: Inventory represents the stock of goods, products, or merchandise held by a business for sale or distribution. It includes raw materials, finished goods, work in progress, and supplies. The security agreement may outline the specific inventory items being used as collateral, their quantities, valuation methods, and any restrictions on handling or selling the inventory. 4. Accounts Receivable: In some cases, a security agreement may include accounts receivable as collateral. Accounts receivable refers to money owed to a business by its customers for goods or services provided on credit. This type of agreement may detail the terms of the accounts receivable, including the debtor's obligations regarding payment collection, record-keeping, and the rights of the lender in case of default. 5. Intellectual Property: Although not as common, certain security agreements may cover intellectual property assets, such as patents, trademarks, copyrights, or trade secrets. These agreements would typically outline the specifics of the intellectual property being pledged as collateral, including its legal status, registration details, and any limitations or restrictions on its use or transfer. It's essential for both parties involved in an Orange California Security Agreement Covering Goods, Equipment, Inventory, etc., to carefully review and understand the terms and conditions laid out in the agreement. Engaging legal counsel is highly advised to ensure compliance with relevant state and federal laws, as well as to protect the rights and interests of all parties involved.

Orange California Security Agreement Covering Goods, Equipment, Inventory, Etc.

Description

How to fill out Orange California Security Agreement Covering Goods, Equipment, Inventory, Etc.?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Orange Security Agreement Covering Goods, Equipment, Inventory, Etc. suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Orange Security Agreement Covering Goods, Equipment, Inventory, Etc., here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Orange Security Agreement Covering Goods, Equipment, Inventory, Etc.:

- Examine the content of the page you’re on.

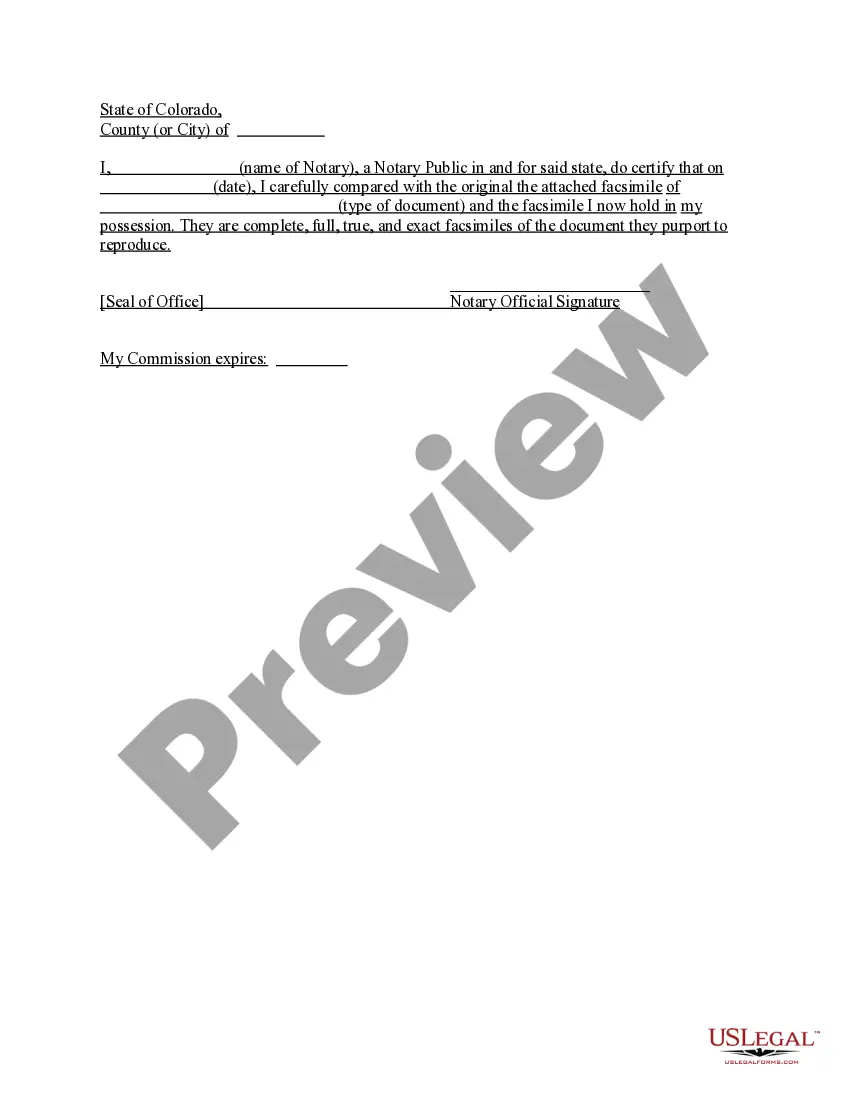

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Orange Security Agreement Covering Goods, Equipment, Inventory, Etc..

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!