A Salt Lake Utah Security Agreement Covering Goods, Equipment, Inventory, Etc. is a legal contract that outlines the terms and conditions for securing a loan or financing against assets such as goods, equipment, inventory, and other tangible property located in Salt Lake, Utah. This agreement serves as collateral for the lender and helps protect their interests in case the borrower defaults on the loan. The Salt Lake Utah Security Agreement is typically entered into between a borrower and a lender, where the borrower pledges certain assets as security to the lender. The agreement defines the specific assets being used as collateral, the amount of the loan, the interest rate, repayment terms, and any applicable fees or penalties. The primary purpose of a Salt Lake Utah Security Agreement is to provide security to the lender, allowing them to seize and sell the secured assets if the borrower fails to repay the loan as per the agreed terms. This helps mitigate the lender's risk and provides an additional layer of protection in case of default. There can be different types of Salt Lake Utah Security Agreements covering various assets, including: 1. Goods Security Agreement: This type of agreement covers tangible goods owned by a business, such as inventory, raw materials, finished products, or merchandise. It ensures that the lender has the right to take possession and sell these assets in case of default. 2. Equipment Security Agreement: This agreement pertains to specific equipment or machinery being used in a business or personal capacity. It secures the lender's interest in the equipment, which can range from heavy machinery and vehicles to computers and tools. 3. Inventory Security Agreement: An inventory security agreement covers the borrower's stock of goods that are intended for sale. It provides a safety net for the lender by allowing them to seize and liquidate the inventory if the borrower fails to meet their financial obligations. 4. Mixed Collateral Security Agreement: In some cases, a security agreement may cover a combination of different assets, such as goods, equipment, and inventory. This ensures that the lender has a claim to various types of collateral for added protection. In conclusion, a Salt Lake Utah Security Agreement Covering Goods, Equipment, Inventory, etc., is a legal contract that safeguards a lender's interests by using specific assets as collateral. These agreements can be tailored to cover different types of assets, including goods, equipment, and inventory. By understanding the terms and conditions outlined in the agreement, both borrowers and lenders can ensure a fair and secure financial arrangement.

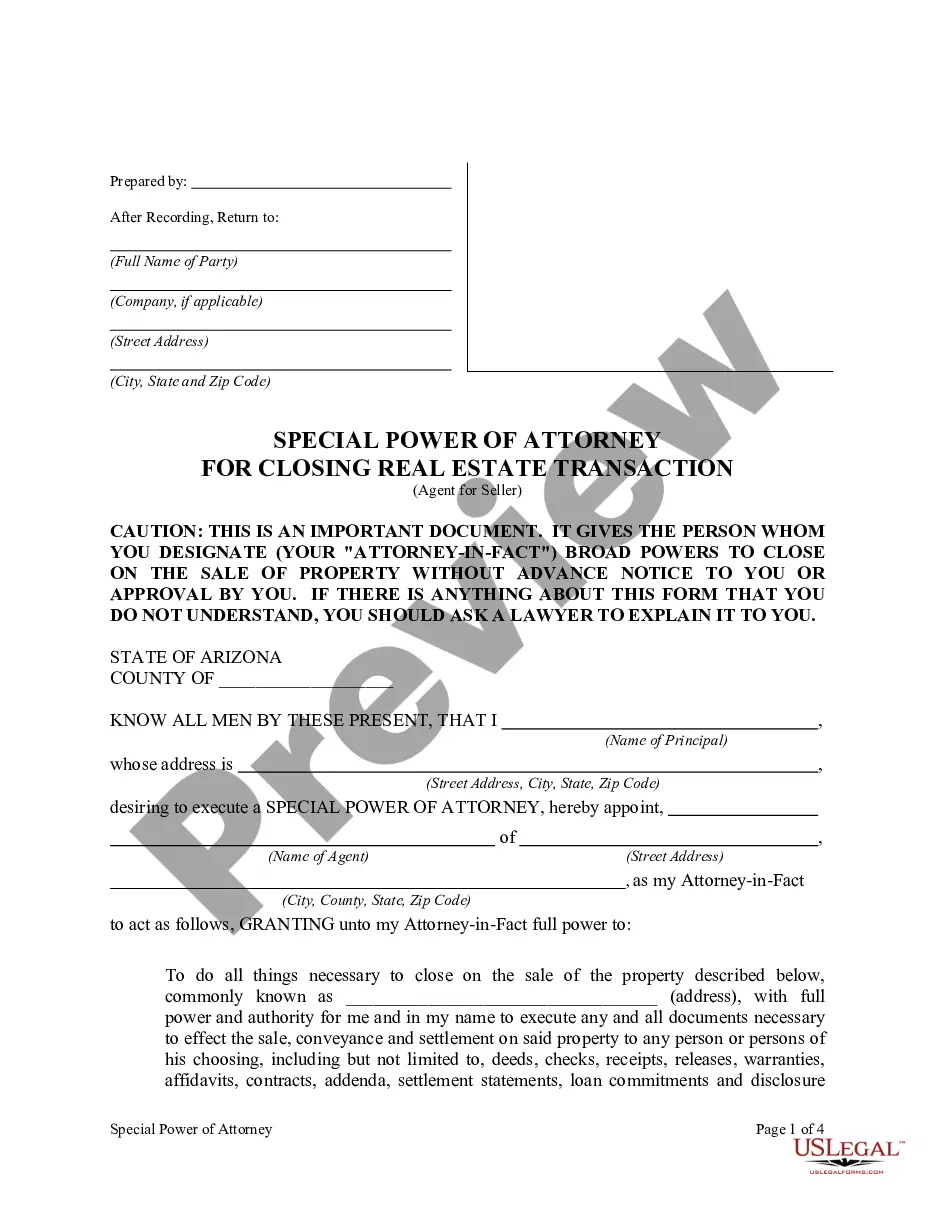

Security Agreement Format

Description

How to fill out Salt Lake Utah Security Agreement Covering Goods, Equipment, Inventory, Etc.?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Salt Lake Security Agreement Covering Goods, Equipment, Inventory, Etc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any activities associated with paperwork execution straightforward.

Here's how you can find and download Salt Lake Security Agreement Covering Goods, Equipment, Inventory, Etc..

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Salt Lake Security Agreement Covering Goods, Equipment, Inventory, Etc..

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Salt Lake Security Agreement Covering Goods, Equipment, Inventory, Etc., log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you have to cope with an extremely complicated case, we advise using the services of a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!