A security agreement is a legal document that outlines the terms and conditions under which a lender may take possession of certain assets to secure a loan or debt. In the context of San Jose, California, a security agreement covering goods, equipment, inventory, etc., refers to a specifically tailored agreement that includes assets within these categories to secure a loan or debt in the city of San Jose. This agreement assures the lender that if the borrower defaults on the loan payment, they have the right to seize and sell these assets to recoup their losses. San Jose, being a major technology hub and home to numerous businesses, often witnesses the utilization of security agreements covering goods, equipment, inventory, etc., to safeguard financial transactions. Keywords relevant to these agreements in San Jose include "security agreement," "goods agreement," "equipment agreement," "inventory agreement," "collateralized loan," and "asset-based lending." Different types of security agreements covering goods, equipment, inventory, etc., in San Jose may include: 1. Goods Security Agreement: This type of agreement focuses on tangible goods that a borrower pledges as collateral to secure a loan. These goods could include any physical property like machinery, vehicles, furniture, or inventory owned by a business. The lender can claim ownership of these goods in case of a loan default. 2. Equipment Security Agreement: This agreement specifically covers machinery, tools, appliances, and other relevant equipment owned by an individual or business. It ensures that the lender has a secured interest in the equipment being used as collateral. 3. Inventory Security Agreement: Inventory refers to the goods held for sale by a business. This type of agreement secures the lender's interest in the inventory, which could include raw materials, finished products, or goods in various stages of production. In case of non-payment, the lender can seize and sell the inventory to recover the outstanding debt. 4. Combined Security Agreement: In some cases, a borrower may secure a loan using a combination of goods, equipment, and inventory. In such cases, a combined security agreement is drafted, listing all the collateral involved to provide comprehensive protection to the lender. Whether it's a good, equipment, inventory, or combined security agreement, the documents are legally binding and include details such as the amount of the loan, repayment terms, interest rates, events of default, as well as the rights and obligations of both parties involved. These agreements play a crucial role in facilitating transactions in San Jose and ensuring that lenders have recourse in case of non-payment.

San Jose California Security Agreement Covering Goods, Equipment, Inventory, Etc.

Description

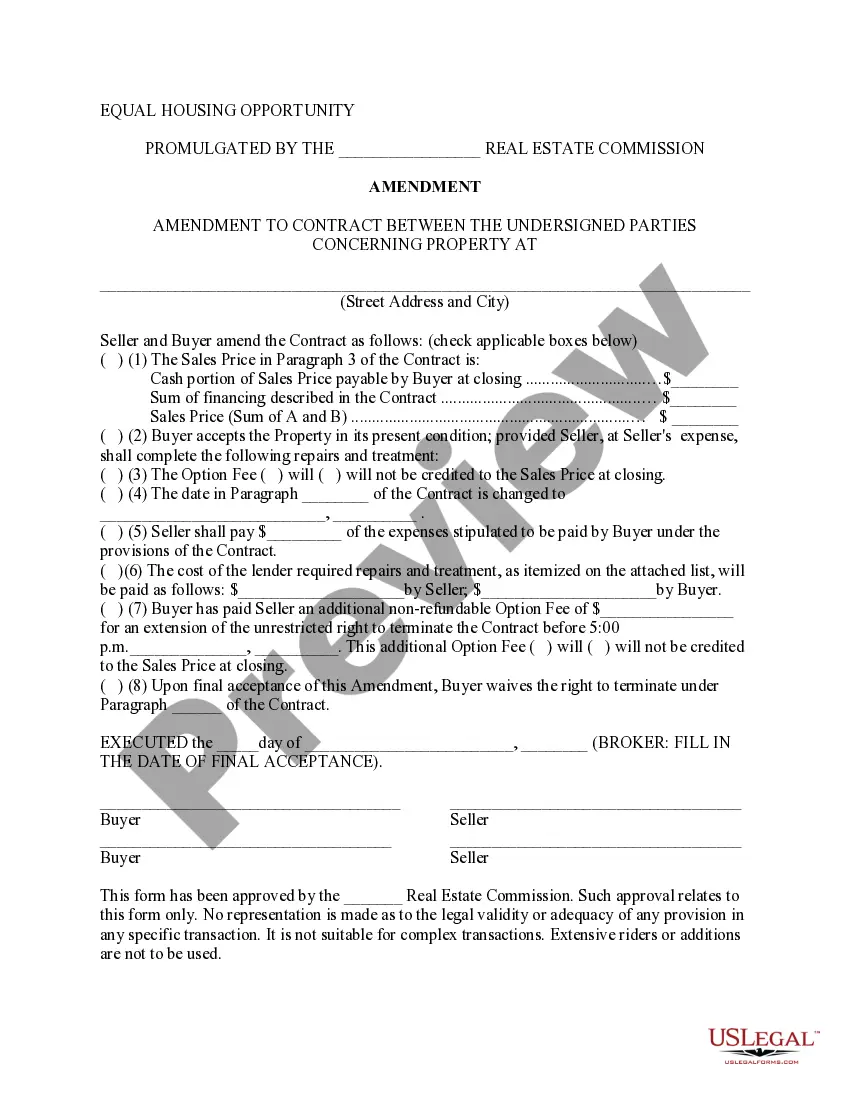

How to fill out San Jose California Security Agreement Covering Goods, Equipment, Inventory, Etc.?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like San Jose Security Agreement Covering Goods, Equipment, Inventory, Etc. is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the San Jose Security Agreement Covering Goods, Equipment, Inventory, Etc.. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Security Agreement Covering Goods, Equipment, Inventory, Etc. in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Overview. "There are only four kinds of consensual security known to English law: (i) pledge; (ii) contractual lien; (iii) equitable charge and (iv) mortgage.

A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

What is the purpose of a general security agreement? With a general security agreement, a lender can efficiently and effectively obtain security over personal property. In the event that the borrower fails to repay or defaults on their loan, the lender may have the rights to seize or sell the secured property.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A SECURITY AGREEMENT is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

Security agreements can be used to secure personal or business loans. A general security agreement (GSA) is often used in commercial lending. It enables a lender to access the assets of a business as collateral. With a GSA, the borrower has a security interest in all the borrower's present and future assets.