Travis Texas Business Trust is a legal entity formed under the laws of the state of Texas to manage businesses and investment assets. This type of trust provides numerous benefits and opportunities for individuals and organizations seeking to create and maintain businesses in Texas. Travis Texas Business Trust offers a unique structure for protecting and managing the assets and operations of a business. It is designed to provide flexibility, privacy, and limited liability to its beneficiaries, allowing them to effectively run their businesses while minimizing risks and maximizing profits. The main objective of Travis Texas Business Trust is to separate the legal ownership of business assets from the personal assets of the beneficiaries. By doing so, it ensures that any potential liabilities incurred by the business do not directly affect the personal wealth of the owners or shareholders. This characteristic is particularly attractive to entrepreneurs, investors, and business owners who want to shield their personal assets from potential risks associated with their business ventures. There are different types of Travis Texas Business Trusts available, including: 1. Simple Business Trusts: These trusts are commonly formed by individuals or small businesses with straightforward objectives. They provide a flexible framework for managing the business activities, often with a single owner or a small group of beneficiaries. 2. Family Business Trusts: These trusts are specifically created to manage family-owned businesses and maintain their legacy over generations. They ensure a smooth transition of ownership and effective management within the family, while also providing tax benefits and asset protection. 3. Investment Trusts: These trusts primarily focus on managing investment assets, such as real estate, stocks, bonds, or intellectual property rights. They are used by individuals or entities seeking to diversify their investment portfolios and maximize returns while maintaining a separation between personal and business assets. 4. Charitable Business Trusts: These trusts serve as a hybrid between business operations and philanthropic endeavors. They allow individuals or organizations to establish and manage businesses that generate profits, which then fund charitable activities or organizations. Such trusts provide a unique way to combine business interests with social responsibility. 5. Non-Profit Business Trusts: These trusts are created for the purpose of running non-profit organizations or community projects. They focus on delivering social benefits or advancing a particular cause, rather than maximizing profits. Non-profit business trusts can qualify for tax-exempt status and receive donations, grants, or other forms of financial support. In conclusion, Travis Texas Business Trust is a versatile and powerful legal structure that allows individuals and organizations to effectively manage their businesses in Texas. With various types available, entrepreneurs and investors can choose the trust that best suits their specific objectives, whether it is protecting personal assets, passing down a family business, managing investment portfolios, contributing to charitable causes, or serving the community.

Travis Texas Business Trust

Description

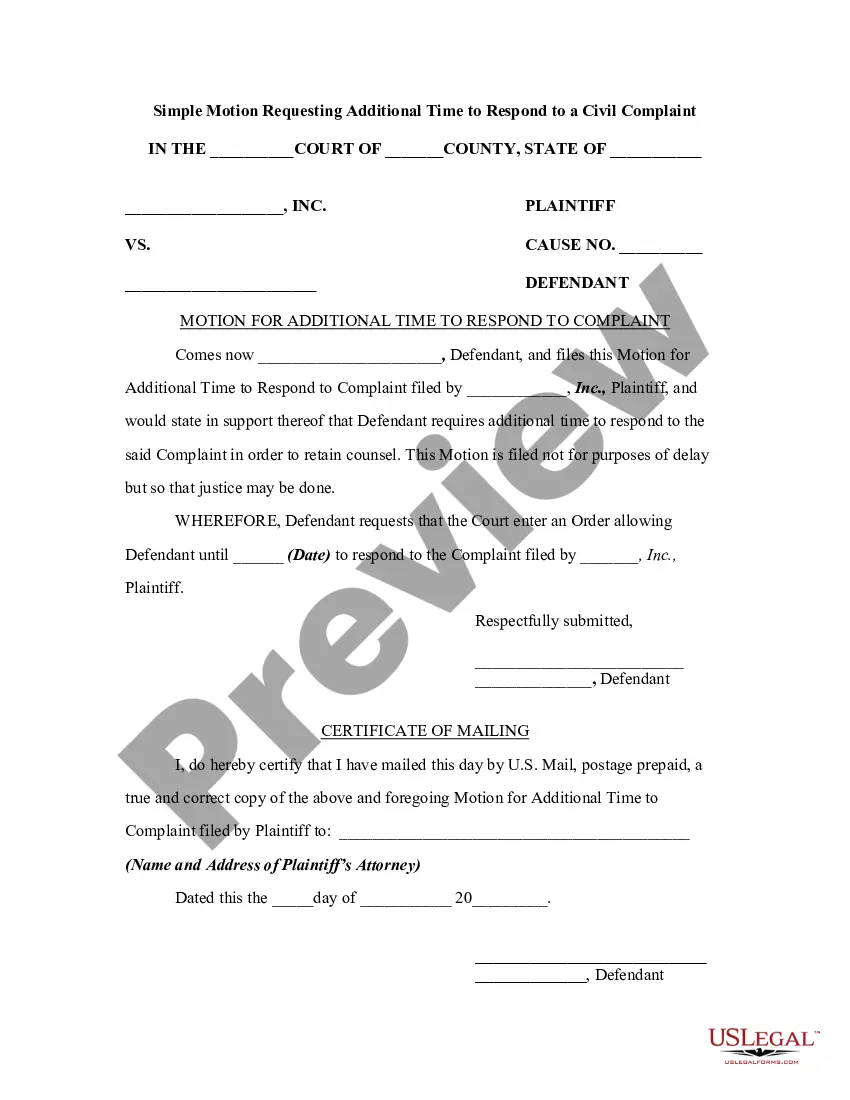

How to fill out Travis Texas Business Trust?

Are you looking to quickly draft a legally-binding Travis Business Trust or maybe any other form to manage your personal or corporate affairs? You can go with two options: hire a professional to write a legal paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific form templates, including Travis Business Trust and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the Travis Business Trust is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Travis Business Trust template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The Travis Credit Union Mobile App gives you access to your money and an array of online financial tools whenever and wherever you need them. We're focused on your financial wellness, so our app is loaded with great features that make managing your money quick, easy and convenient.

Members now have access to electronic statements for their Trust and Business Accounts through their personal account log in via Online Banking. Simply click on the Estatements tab to get started.

It was established in 1951 and as of March of 2022, it had grown to 683 employees and 228,794 members at 25 locations. Travis Credit Union's money market rates are 9X the national average, and it has an A health rating....Health Grade Components. OverallEmployees683Primary Regulator2 more rows

Travis Credit Union was founded in 1951 by military and civilian workers at Travis Air Force Base in Fairfield, CA. We're part of a movement that began back in the 1930s and we're proud to help make a financial difference in the lives of our members.

Mobile Deposit is a free, time-saving feature of our Mobile App. This feature allows you to take a picture of the front and back of your paper check and submit it for deposit or to make a loan payment electronically. Mobile Deposit is easy to use and you'll save time traveling to a branch or ATM to make a deposit.

Call-24 Phone Banking makes it easy to review your TCU accounts, anytime, anywhere. Give us a call today at (707) 449-4000 or (800) 877-8328.

To get started, log into your online banking or mobile app and select "Send Money with Zelle®". Enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it, accept terms and conditions, and you're ready to start sending and receiving with Zelle.

Members now have access to electronic statements for their Trust and Business Accounts through their personal account log in via Online Banking. Simply click on the Estatements tab to get started.

If you still can't log in and need to initiate a payment, please call Travis Credit Union at (800) 877-8328 during normal business hours.

Although both financial institutions do similar things, each offer different pros for their members. The biggest difference between a bank and a credit union is that a bank is a for-profit institution and a credit union is a non-for-profit institution.