Collin Texas Private Annuity Agreement: A Comprehensive Guide In Collin County, Texas, a Private Annuity Agreement refers to a legally binding contract between two parties, known as the annuitant and the obliged, related to a private annuity. This agreement provides a mechanism for the transfer of assets in exchange for a lifetime income stream. Private annuity agreements can be a valuable tool for estate planning, tax optimization, and wealth transfer strategies. Key Features of Collin Texas Private Annuity Agreement: 1. Lifetime Income Stream: The annuitant, typically the owner of assets seeking to transfer them, agrees to receive regular annuity payments from the obliged until their passing. The payments are predetermined and structured to provide financial stability. 2. Asset Transfer: The obliged, usually a family member or a trust established by the annuitant, assumes ownership of the transferred assets. By entering into the agreement, the annuitant effectively transfers the assets and relinquishes control over them. 3. Tax Benefits: Collin Texas Private Annuity Agreements offer potential tax advantages. By deferring capital gains taxes and eliminating estate tax liability upon death, annuitants can maximize the financial benefits of their assets. Types of Collin Texas Private Annuity Agreements: 1. Traditional Private Annuity: This standard form of private annuity agreement involves an individual transferring assets to another individual or entity in exchange for regular annuity payments. It is commonly used for transferring real estate, appreciated securities, or business interests. 2. Family Private Annuity: This type of agreement is specifically designed for intergenerational wealth transfer within a family. Family members can utilize this arrangement to pass assets while also ensuring a continued income stream, which can be particularly useful in estate planning and preserving family wealth. 3. Charitable Remainder Private Annuity Trust (CAT): This specialized private annuity agreement involves transferring assets to a trust, where not only the annuitant but also a charitable organization receives regular payments. Cats provide a means for philanthropic giving while still guaranteeing an income stream for the annuitant. 4. Private Annuity Installment Sale: This variation combines a private annuity agreement with an installment sale. It allows the annuitant to sell appreciated assets to an obliged and receive regular annuity payments, minimizing immediate tax burdens associated with a lump sum sale. Why Consider a Collin Texas Private Annuity Agreement? Collin Texas Private Annuity Agreements can be a powerful tool for individuals seeking to transfer assets, achieve tax optimization, and ensure a stable income stream. These agreements offer flexibility and control over the transfer process, allowing annuitants to tailor the arrangement to their specific needs. However, given the complex nature of such agreements, it is crucial to consult with a qualified financial advisor or an attorney experienced in estate planning and tax law before entering into any private annuity agreement.

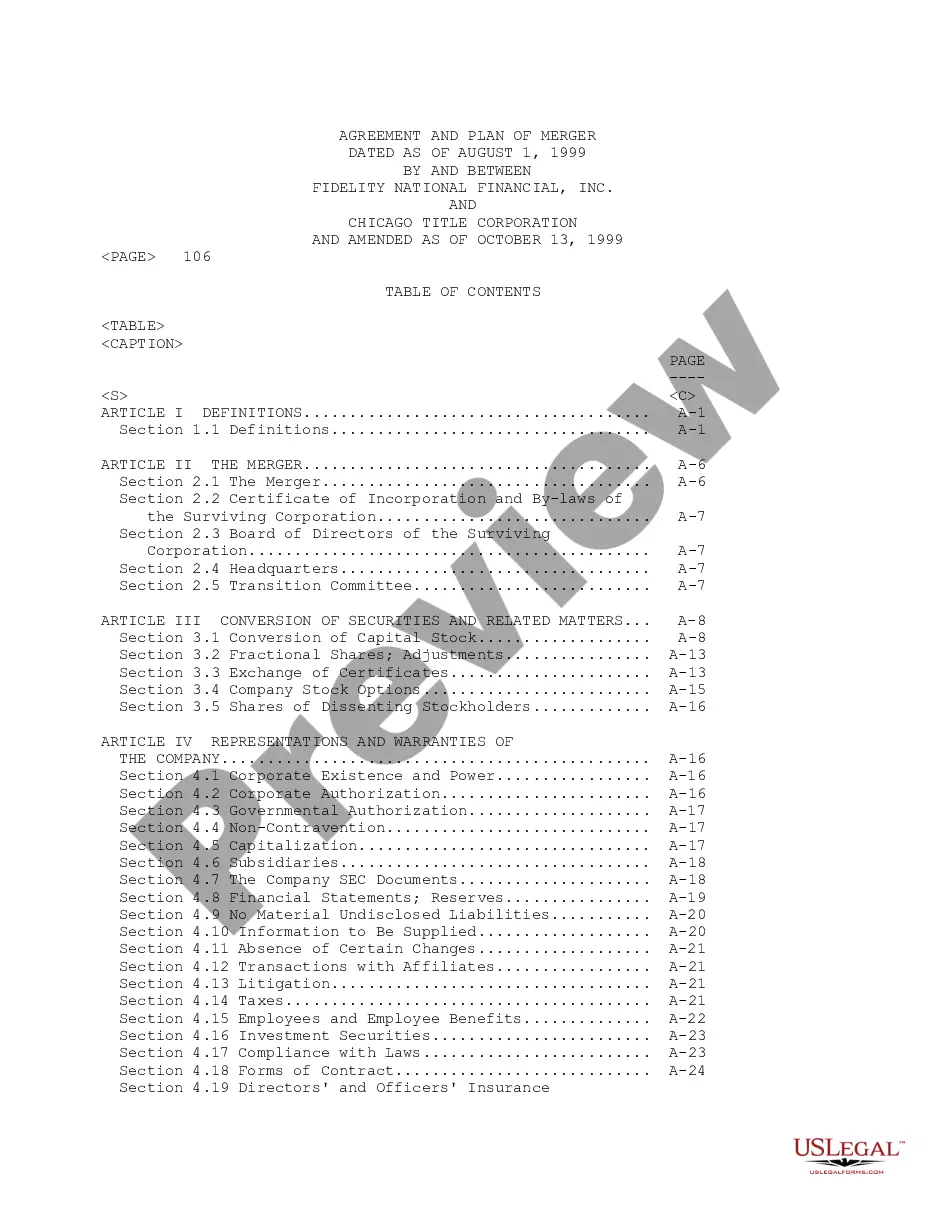

Collin Texas Private Annuity Agreement

Description

How to fill out Collin Texas Private Annuity Agreement?

Do you need to quickly draft a legally-binding Collin Private Annuity Agreement or maybe any other document to take control of your own or corporate matters? You can go with two options: contact a legal advisor to write a legal document for you or create it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Collin Private Annuity Agreement and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Collin Private Annuity Agreement is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Collin Private Annuity Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!