A Granter Retained Annuity Trust (GREAT) is a commonly used estate planning tool that individuals in Los Angeles, California, can utilize to transfer assets to their beneficiaries while minimizing estate taxes. A GREAT is an irrevocable trust created by a granter, who transfers assets into the trust and retains the right to receive fixed annuity payments for a specified term. After the term ends, the remaining assets in the trust pass on to the named beneficiaries, typically the granter's children or other family members. The Los Angeles California Granter Retained Annuity Trust provides several distinct types, including: 1. Standard GREAT: This is the most common type of GREAT, where the granter contributes assets to the trust and, at regular intervals, receives annuity payments based on a predetermined fixed percentage of the initial trust value. The annuity payments are typically made annually. 2. Zeroed-Out GREAT: Also known as a Walton GREAT, this variant of the GREAT is designed to minimize estate taxes to almost zero. The granter sets the annuity payments to equal the trust's total value, resulting in no taxable gift. 3. Rolling GREAT: A rolling GREAT allows for multiple Grants to be created successively, each with its own annuity term. This strategy can be useful when there is a significant appreciation potential for the transferred assets. 4. Charitable GREAT: This type of GREAT involves naming a charitable organization as the remainder beneficiary. By doing so, the granter can receive annuity payments for the specified term, receive an income tax deduction, and contribute to a charitable cause. Los Angeles California Granter Retained Annuity Trusts offer several advantages. Firstly, the granter has the opportunity to transfer assets to their beneficiaries while potentially reducing gift and estate taxes. Secondly, should the assets appreciate beyond the annuity payments set, the excess value can pass on to the beneficiaries with minimal tax consequences. Lastly, since the granter retains the right to annuity payments, they can ensure a steady income stream during the trust term. It is crucial for individuals considering a Granter Retained Annuity Trust in Los Angeles, California, to consult with experienced estate planning professionals and attorneys familiar with the specific laws and regulations governing trust creation and taxation in the state.

Los Angeles California Grantor Retained Annuity Trust

Description

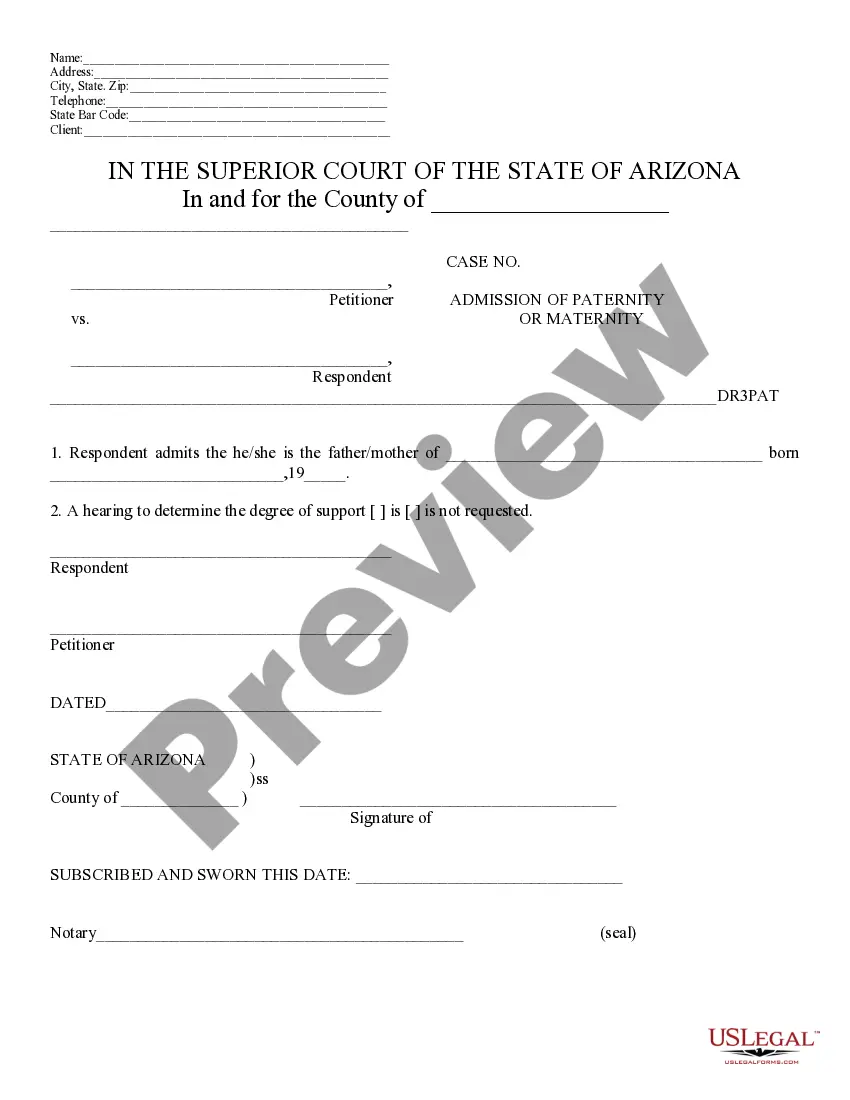

How to fill out Los Angeles California Grantor Retained Annuity Trust?

Draftwing paperwork, like Los Angeles Grantor Retained Annuity Trust, to manage your legal matters is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for various cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Los Angeles Grantor Retained Annuity Trust form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before downloading Los Angeles Grantor Retained Annuity Trust:

- Make sure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Los Angeles Grantor Retained Annuity Trust isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!