Wake North Carolina Granter Retained Annuity Trust (GREAT) is a specific type of estate planning tool commonly used in Wake County, North Carolina. It allows a granter to transfer assets into a trust while retaining an annuity payment for a specified period. This legal mechanism provides certain advantages in terms of tax savings and wealth transfer. A Wake North Carolina GREAT can be classified into two main types: a Standard GREAT and a Zeroed-Out GREAT. The choice between the two depends on the specific goals and circumstances of the granter. 1. Standard GREAT: This type of GREAT involves the granter transferring assets to the trust while retaining an annuity payment for a fixed term. The annuity payment amount is determined at the inception of the trust and is usually a percentage of the initial fair market value of the assets. At the end of the specified term, any remaining assets in the trust pass to the named beneficiaries, typically family members or loved ones. The main benefit of a Standard GREAT is the potential for transferring wealth to beneficiaries at a reduced taxable value. 2. Zeroed-Out GREAT: In a Zeroed-Out GREAT, the annuity payment is set at a level that effectively reduces the taxable gift to zero. The granter sets the annuity payment amount equal to the present value of the assets transferred into the trust, so there is no taxable gift for gift tax purposes. This type of GREAT is often used to mitigate gift tax liability, especially when the granter anticipates significant appreciation in the assets over the specified term. Both types of Wake North Carolina Grants can offer advantages such as: — Tax Efficiency: By transferring assets into a GREAT, the granter can potentially reduce their taxable estate, gift taxes, and generation-skipping transfer taxes. Grants can be used to leverage tax exemptions and reduce the overall tax burden on the estate. — Wealth PreservationGrantsTs allow for the transfer of wealth to beneficiaries while retaining an income stream for the granter. This can be particularly beneficial for granters who wish to provide for their loved ones while ensuring financial security and control over their assets during their lifetime. — Asset Appreciation: If the assets in the trust appreciate at a rate higher than the IRS interest rate assumption (known as the 7520 rate), the excess appreciation passes to the beneficiaries free of gift and estate taxes. This feature can provide significant wealth transfer opportunities. In conclusion, Wake North Carolina Granter Retained Annuity Trusts (Grants) are a valuable tool for estate planning in Wake County, North Carolina. They offer potential tax benefits, wealth transfer advantages, and the ability to preserve and manage assets for future generations. The choice between a Standard GREAT and a Zeroed-Out GREAT depends on the granter's objectives and the specifics of their financial situation. It is advisable to consult with an experienced estate planning attorney or financial advisor for personalized guidance in establishing a Wake North Carolina GREAT.

Wake North Carolina Grantor Retained Annuity Trust

Description

How to fill out Wake North Carolina Grantor Retained Annuity Trust?

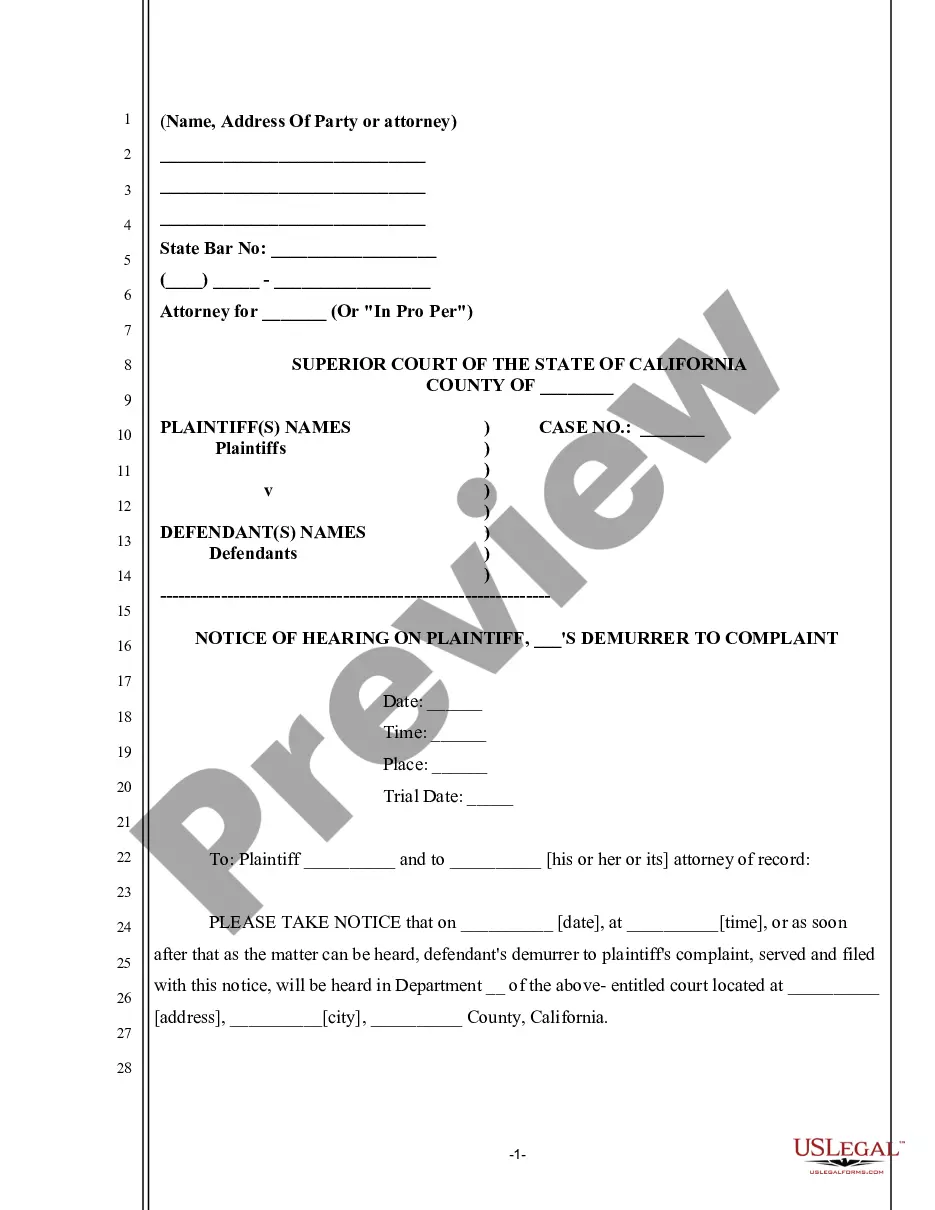

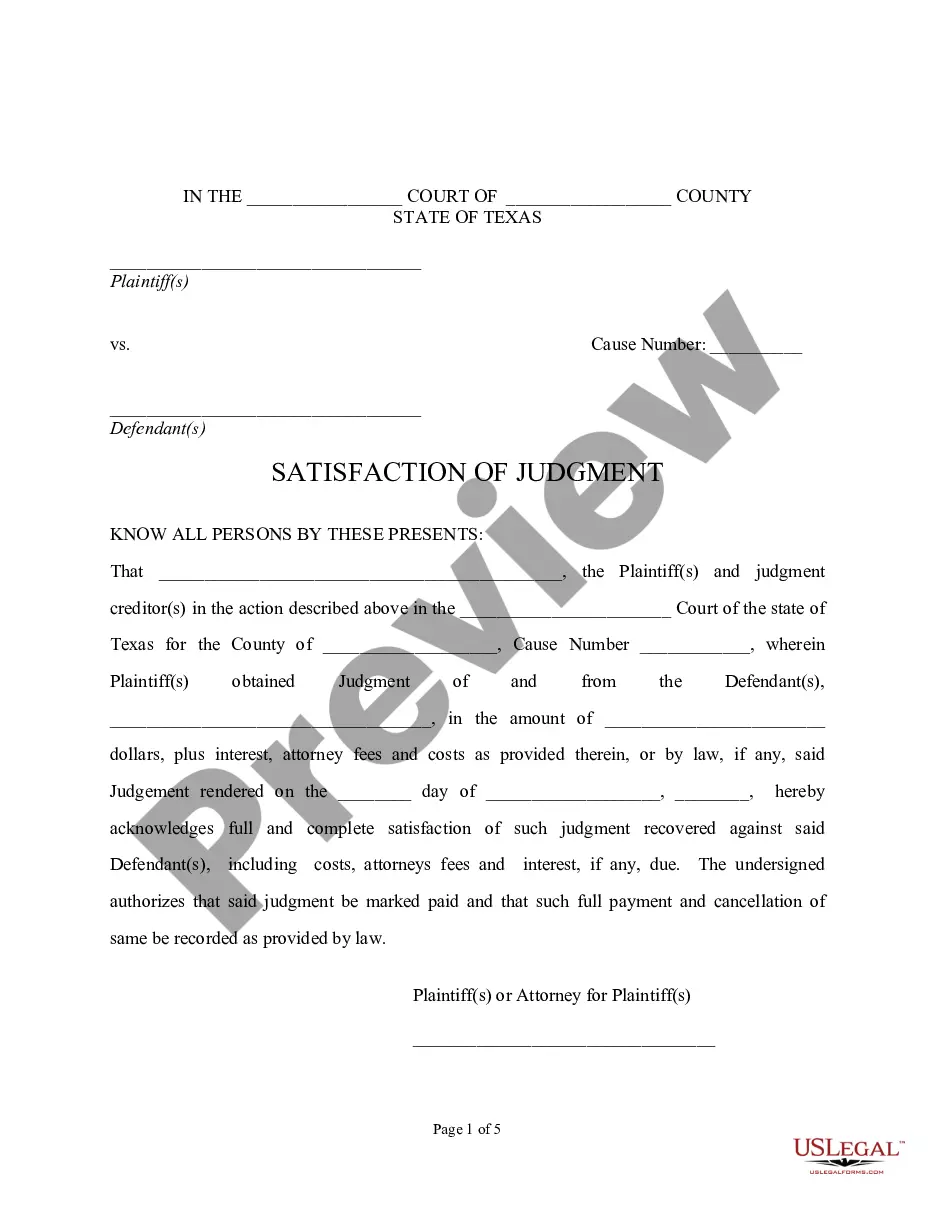

Creating documents, like Wake Grantor Retained Annuity Trust, to take care of your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents intended for different cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Wake Grantor Retained Annuity Trust template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Wake Grantor Retained Annuity Trust:

- Ensure that your document is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Wake Grantor Retained Annuity Trust isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!