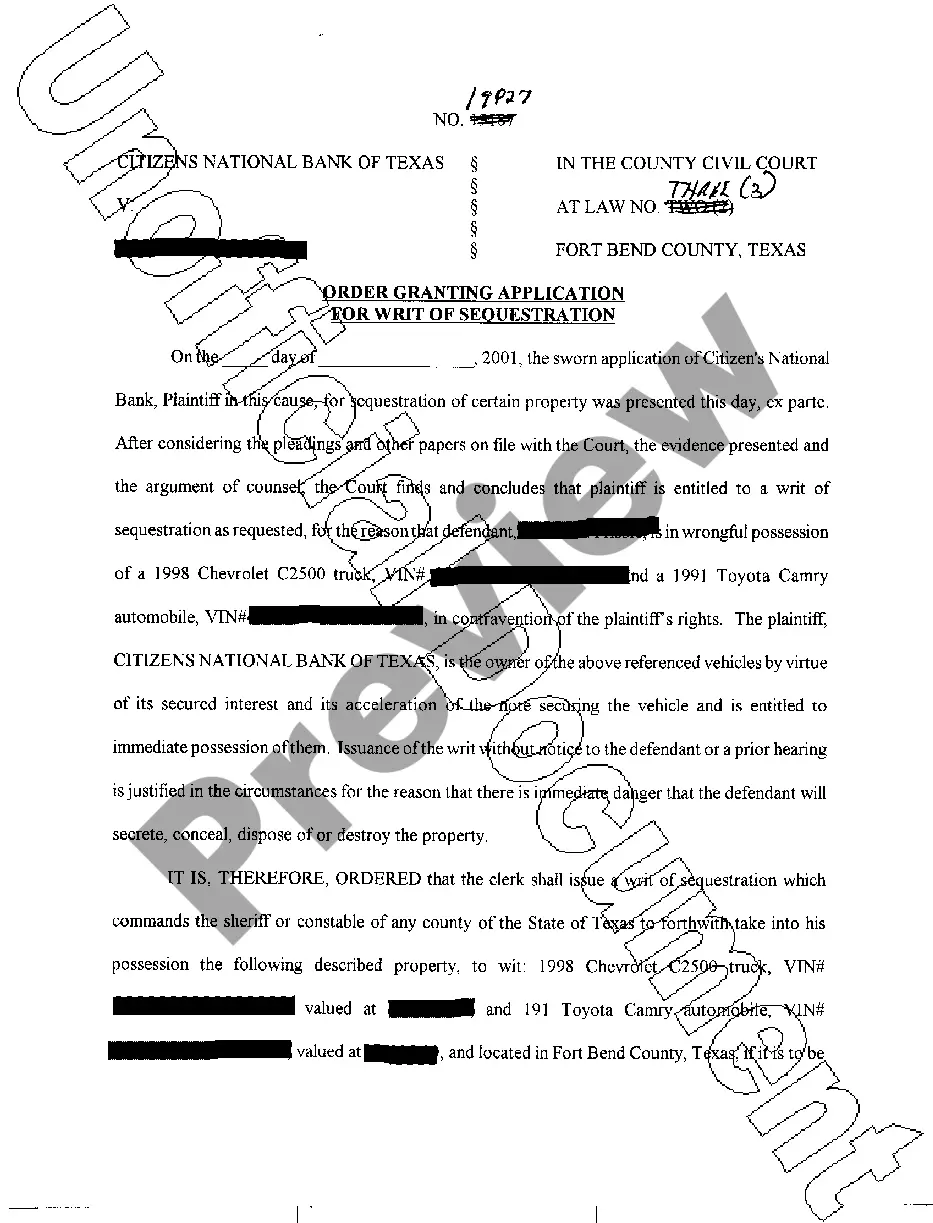

Clark Nevada Agreement to Manage Business is a legal contract that outlines the responsibilities and obligations of two parties who wish to enter into a business management agreement. This type of agreement specifically pertains to businesses that are located in the Clark County of Nevada, United States. The main purpose of a Clark Nevada Agreement to Manage Business is to establish a formal relationship between the managing party and the business owner. It sets out the terms and conditions under which the managing party will operate and manage the business on behalf of the owner. Key elements covered in a Clark Nevada Agreement to Manage Business include the scope of the management services, duration of the agreement, compensation terms, termination clauses, and any specific requirements or expectations from both parties. This agreement ensures clarity and transparency in the business management arrangement, protecting the interests of both the managing party and the owner. Different types of Clark Nevada Agreements to Manage Business may exist to cater to specific business scenarios. Some variations could include: 1. Full-Service Management Agreement: This type of agreement grants the managing party the authority to oversee all aspects of the business, including operations, marketing, finance, and human resources. 2. Limited Scope Management Agreement: Unlike the full-service agreement, a limited scope management agreement may only involve specific areas or departments within the business. It allows the owner to maintain control over certain aspects of the operation while relying on the managing party for expertise in other areas. 3. Property Management Agreement: This specific type of agreement focuses on the management and oversight of real estate properties owned by the business. It covers tasks such as leasing, rental collection, maintenance, and tenant management. 4. Strategic Management Agreement: In situations where the business requires to be specialized strategic guidance, a strategic management agreement can be formulated. This agreement outlines the specific responsibilities of the managing party in formulating and executing long-term business plans, market research, and competitive analysis. In conclusion, a Clark Nevada Agreement to Manage Business is a comprehensive and legally binding document that formalizes the working relationship between a managing party and a business owner in Clark County, Nevada. Its purpose is to safeguard the interests of both parties and establish clear guidelines for the effective management of the business. Various types of this agreement exist to address different business scenarios, ensuring the arrangement meets the specific needs of the parties involved.

Clark Nevada Agreement to Manage Business

Description

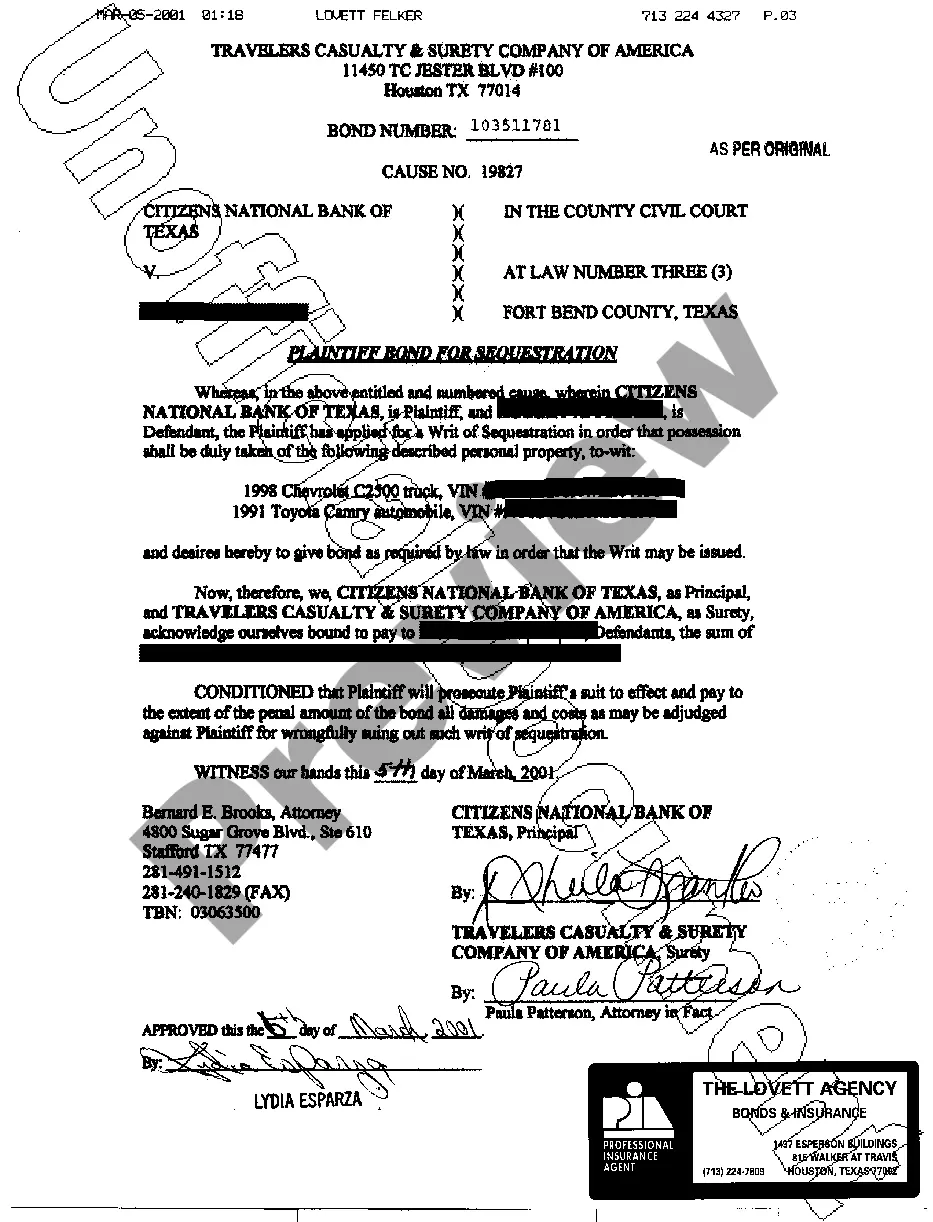

How to fill out Clark Nevada Agreement To Manage Business?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Clark Agreement to Manage Business.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Clark Agreement to Manage Business will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Clark Agreement to Manage Business:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Clark Agreement to Manage Business on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Sole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

The State Business License Fee is $500 for Corporations, and $200 for all other business types. The State Business License must be renewed annually. For entities that are formed under NRS Title 7, the business license fee is due at the time an Initial List of Officers or Annual List of Officers is due.

OPTION 1: APPLY ONLINE Apply online at Clark County Business License Online Application. If you have any questions about the online application, you may email us at chap@ClarkCountyNV.gov or call us at (702) 455-0174 between am and pm Monday through Thursday.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

GENERAL LICENSE APPLICATIONS: Apply online at Clark County Business License Online Application. If you have any questions about the online application, you may email us at chap@ClarkCountyNV.gov or call us at (702) 455-0174 between am and pm Monday through Friday.

In the State of Nevada all businesses are required to obtain a business license within the city / county in which they operate.

Any person who wishes to operate a business in Unincorporated Clark County is required by Clark County Code to obtain a business license. A general license is a term used to describe a basic application.

Any person who wishes to operate a business in Unincorporated Clark County is required by Clark County Code to obtain a business license. A general license is a term used to describe a basic application.