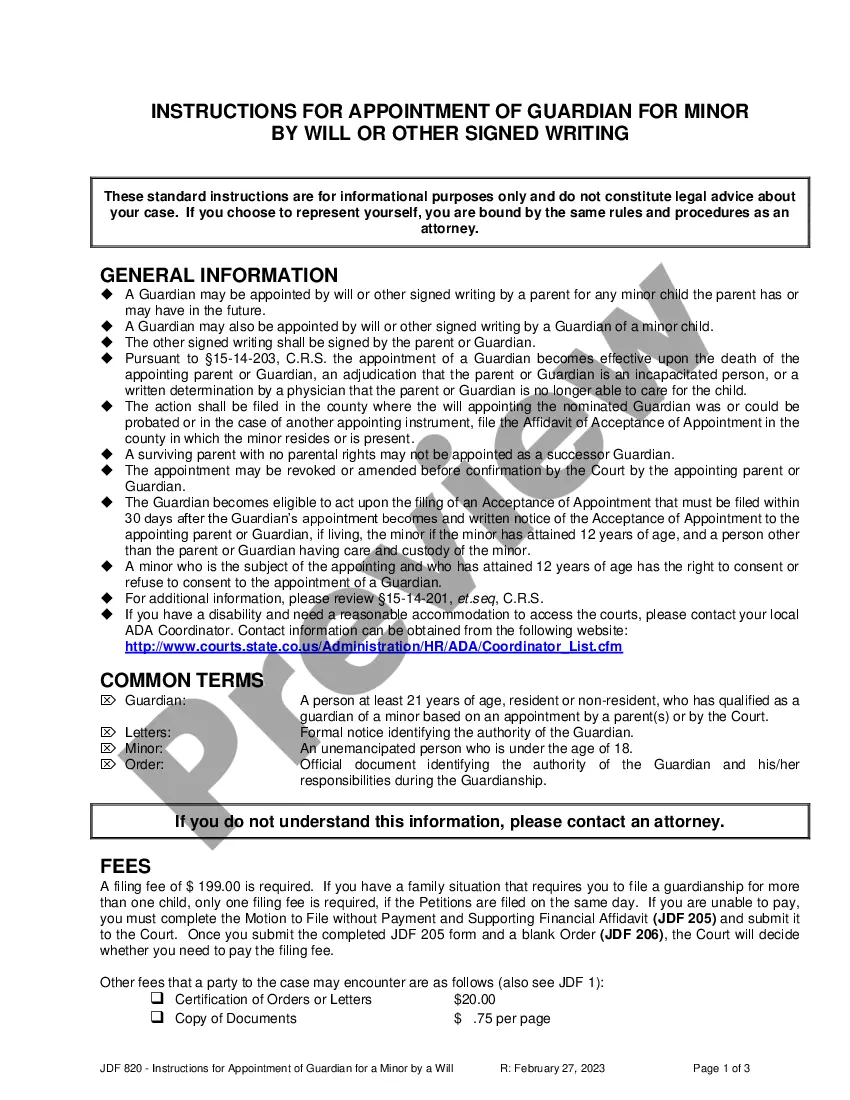

Maricopa Arizona Pot Testamentary Trust is a legal entity designed to protect and distribute assets after someone's passing while taking advantage of the tax benefits and flexibility offered by the state of Arizona. This type of trust allows individuals (the granters) to set specific instructions regarding the distribution of their assets, including their "pot" or collection of assets. A Pot Testamentary Trust in Maricopa, Arizona is typically established in a will and comes into effect only upon the granter's death. This type of trust allows the granter to leave their assets to multiple beneficiaries or groups of beneficiaries, rather than specifying individual shares or amounts. This can be useful when the granter wants to distribute assets among a group of beneficiaries fairly, but without specific allocation. There are different types of Maricopa Arizona Pot Testamentary Trusts that individuals can consider based on their specific needs and preferences. Here are a few common types: 1. Discretionary Pot Testamentary Trust: This type of trust gives full discretion to the trustee to determine how and when the assets are distributed among the beneficiaries. The trustee considers individual circumstances, needs, and other factors before making distribution decisions. 2. Fixed Pot Testamentary Trust: In a fixed pot trust, the granter specifies a predetermined percentage or allocation for each beneficiary, ensuring a fixed share for each without granting trustee discretion. 3. Power of Appointment Pot Testamentary Trust: This trust allows the beneficiary or another designated individual ("appointee") to have power over the distribution of assets within the pot trust. The appointee can modify, amend, or even terminate the trust under certain conditions. 4. Sprinkling Pot Testamentary Trust: This trust gives trustees the ability to distribute assets unevenly among the beneficiaries, depending on their unique circumstances and needs. 5. Accumulation Pot Testamentary Trust: In an accumulation pot trust, the trustee has the authority to accumulate income generated by the trust's assets, rather than distributing it immediately. This can be beneficial when the beneficiaries are not yet prepared to manage the assets or when the granter wants to protect the assets for future generations. Establishing a Maricopa Arizona Pot Testamentary Trust requires thorough understanding of estate planning and legal procedures. It is advisable to consult with an experienced attorney who specializes in estate planning to ensure that the trust is drafted accurately and aligns with the granter's wishes.

Maricopa Arizona Pot Testamentary Trust

Description

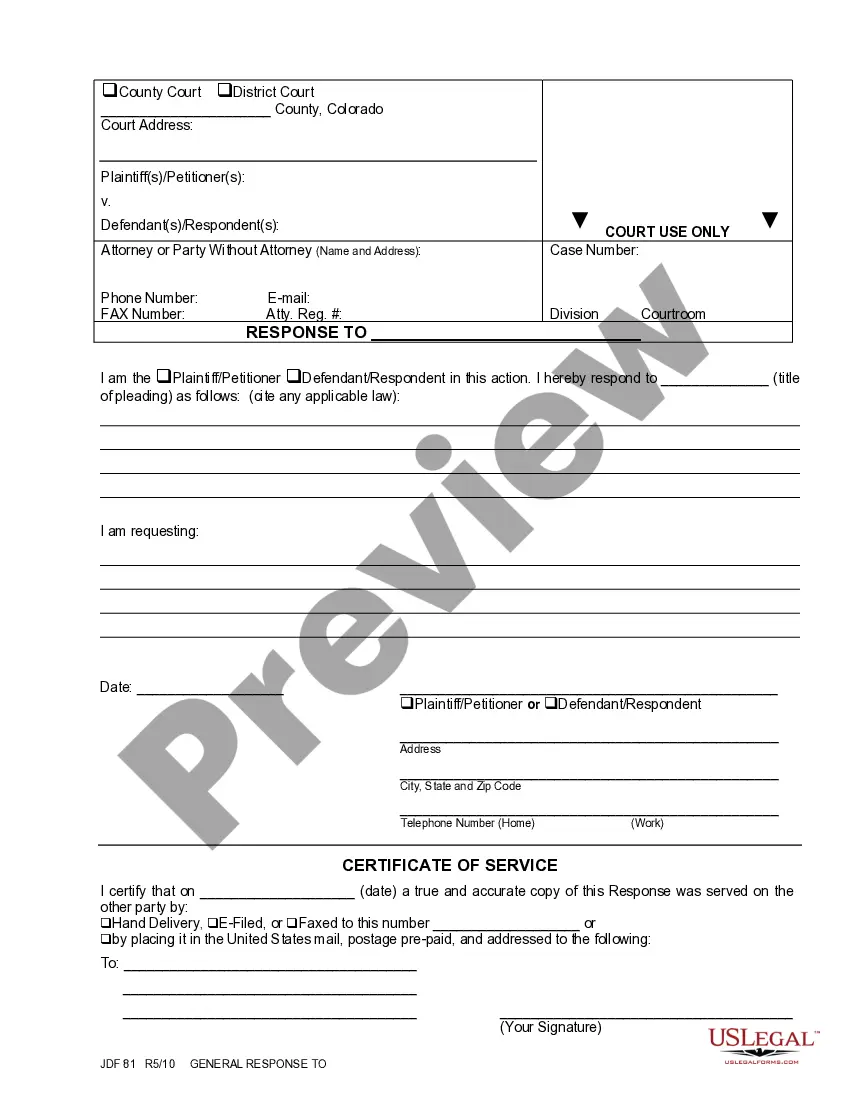

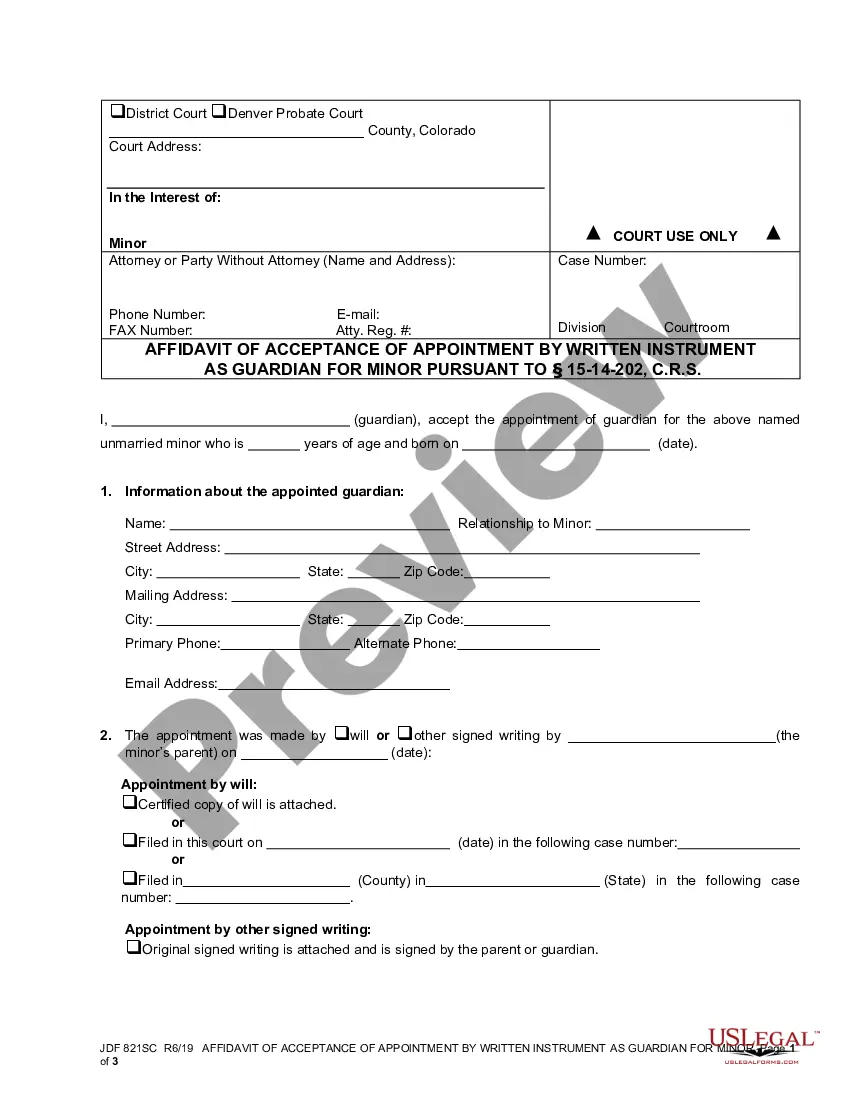

How to fill out Maricopa Arizona Pot Testamentary Trust?

Creating paperwork, like Maricopa Pot Testamentary Trust, to take care of your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for various cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Maricopa Pot Testamentary Trust form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Maricopa Pot Testamentary Trust:

- Ensure that your document is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Maricopa Pot Testamentary Trust isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!