Dallas Texas Irrevocable Pot Trust Agreement is a legal document that establishes a trust arrangement where the granter designates funds and assets to be held and managed by a trustee for the benefit of multiple beneficiaries. This type of trust agreement provides flexibility in how the assets are distributed among the beneficiaries, allowing the trustee to determine the distribution according to their discretion. One type of Dallas Texas Irrevocable Pot Trust Agreement is the Generation-Skipping Trust Agreement. This trust allows the granter to skip a generation and transfer assets directly to grandchildren, great-grandchildren, or other individuals who are at least 37.5 years younger than the granter. By utilizing this type of trust, the granter can potentially avoid estate taxes and provide for future generations. Another type of Dallas Texas Irrevocable Pot Trust Agreement is the Charitable Remainder Trust Agreement. This trust is designed to benefit both charitable organizations and non-charitable beneficiaries. The granter contributes assets to the trust, receiving an income stream during their lifetime. After the granter's passing, the remaining assets are distributed to the designated charitable organizations. This type of trust provides potential tax advantages for the granter and supports philanthropic causes. Dallas Texas Irrevocable Pot Trust Agreement offers several benefits for granters and beneficiaries. First, it ensures that the granter's assets are protected and properly managed by a trustee, providing professional oversight and expertise. Second, it allows the granter to have control over how the assets are distributed among multiple beneficiaries, tailoring the trust to their specific wishes and needs. Finally, this type of agreement can provide potential tax advantages, asset protection, and support charitable causes, depending on the specific type of trust established. In conclusion, a Dallas Texas Irrevocable Pot Trust Agreement is a legal document that establishes a trust arrangement where funds and assets are held and managed for the benefit of multiple beneficiaries. With different types such as Generation-Skipping Trust Agreement and Charitable Remainder Trust Agreement, this type of trust provides flexibility, control, and potential tax advantages for granters and beneficiaries alike.

Dallas Texas Irrevocable Pot Trust Agreement

Description

How to fill out Dallas Texas Irrevocable Pot Trust Agreement?

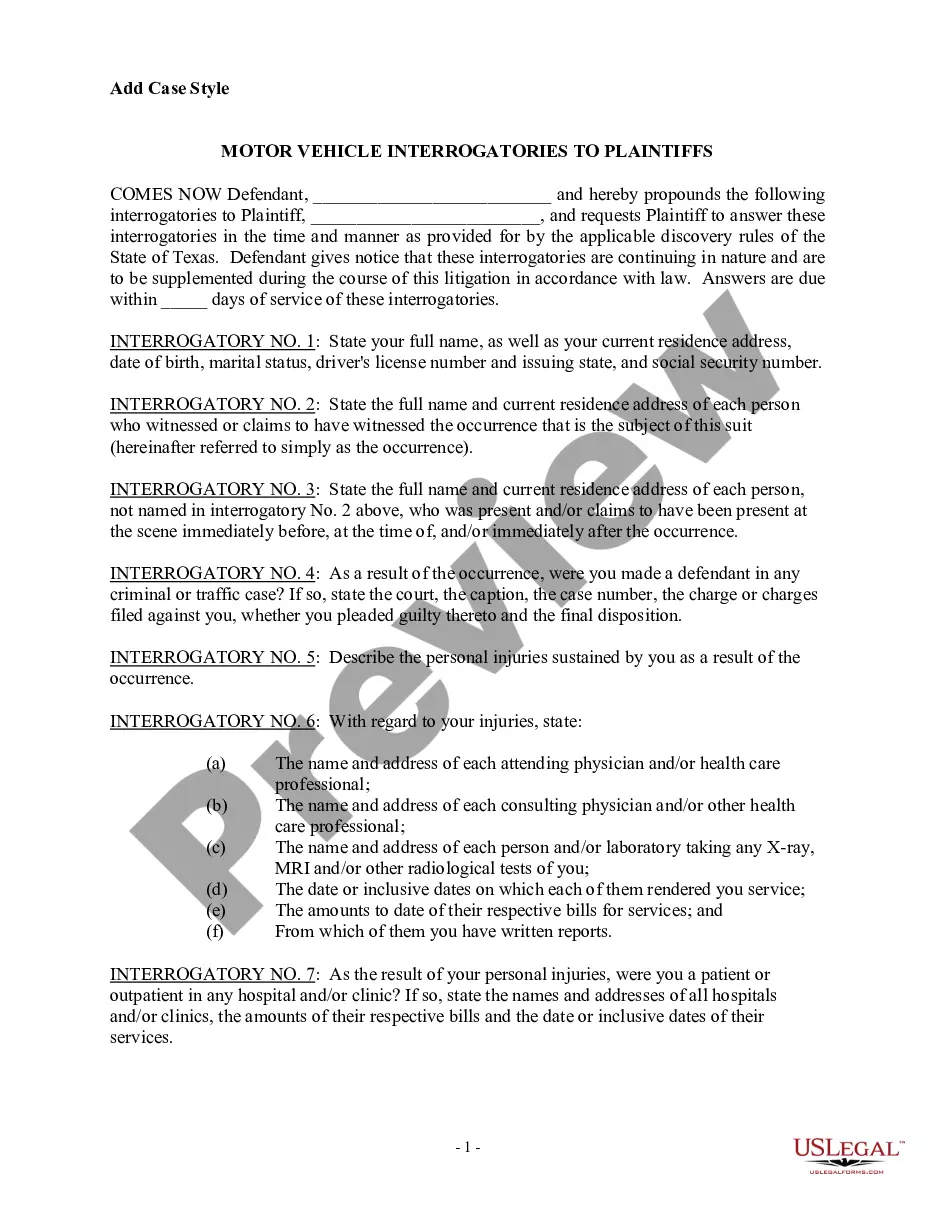

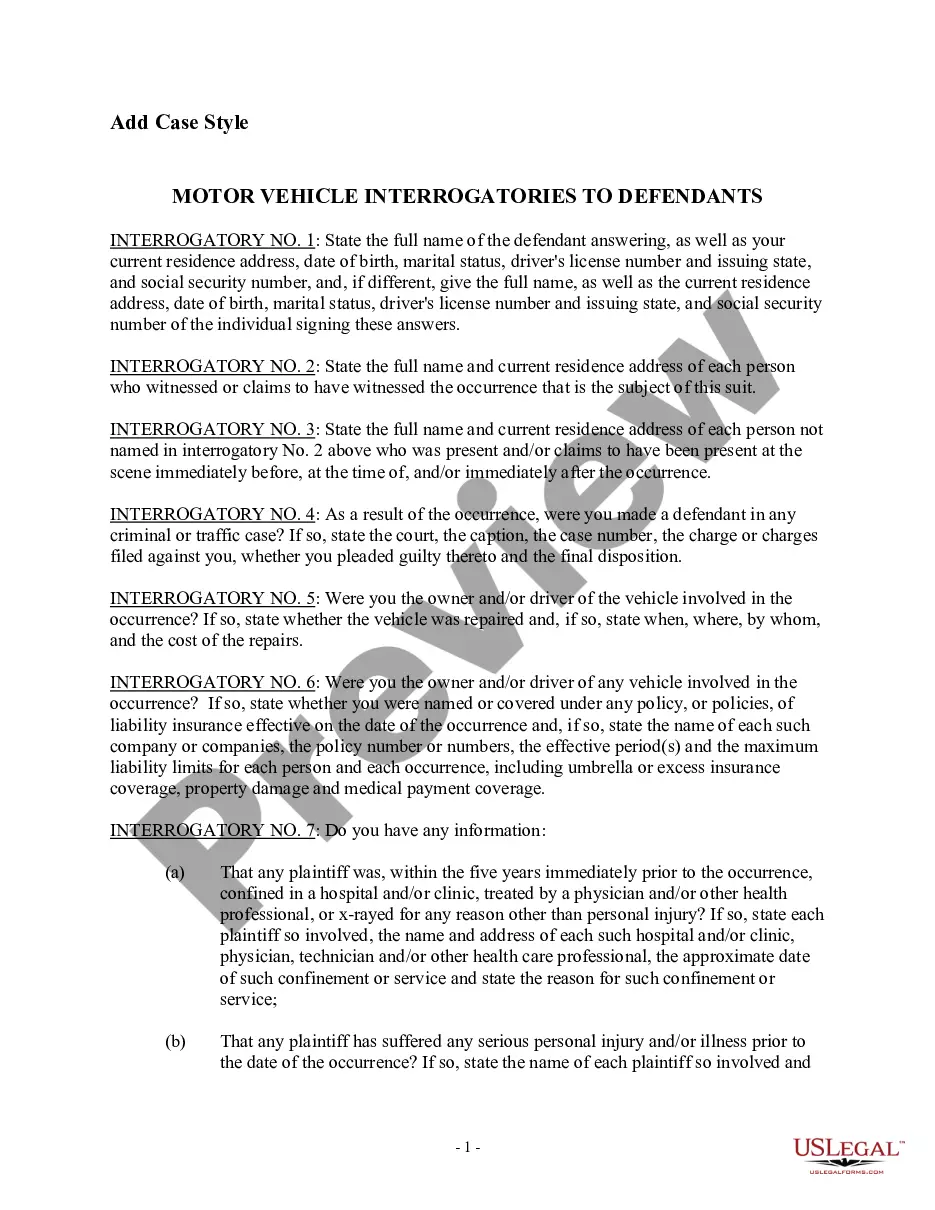

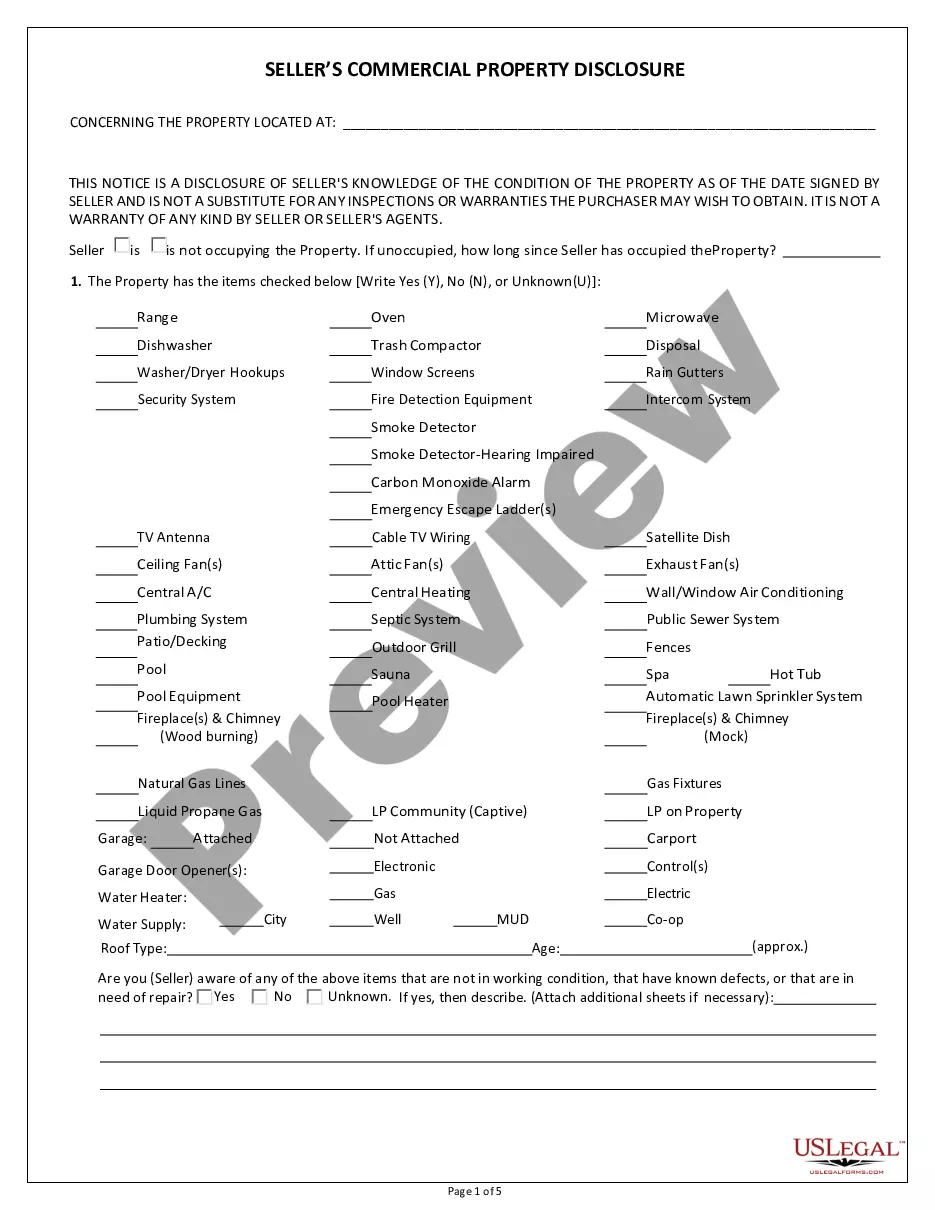

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Dallas Irrevocable Pot Trust Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Dallas Irrevocable Pot Trust Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Dallas Irrevocable Pot Trust Agreement:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Dallas Irrevocable Pot Trust Agreement and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!