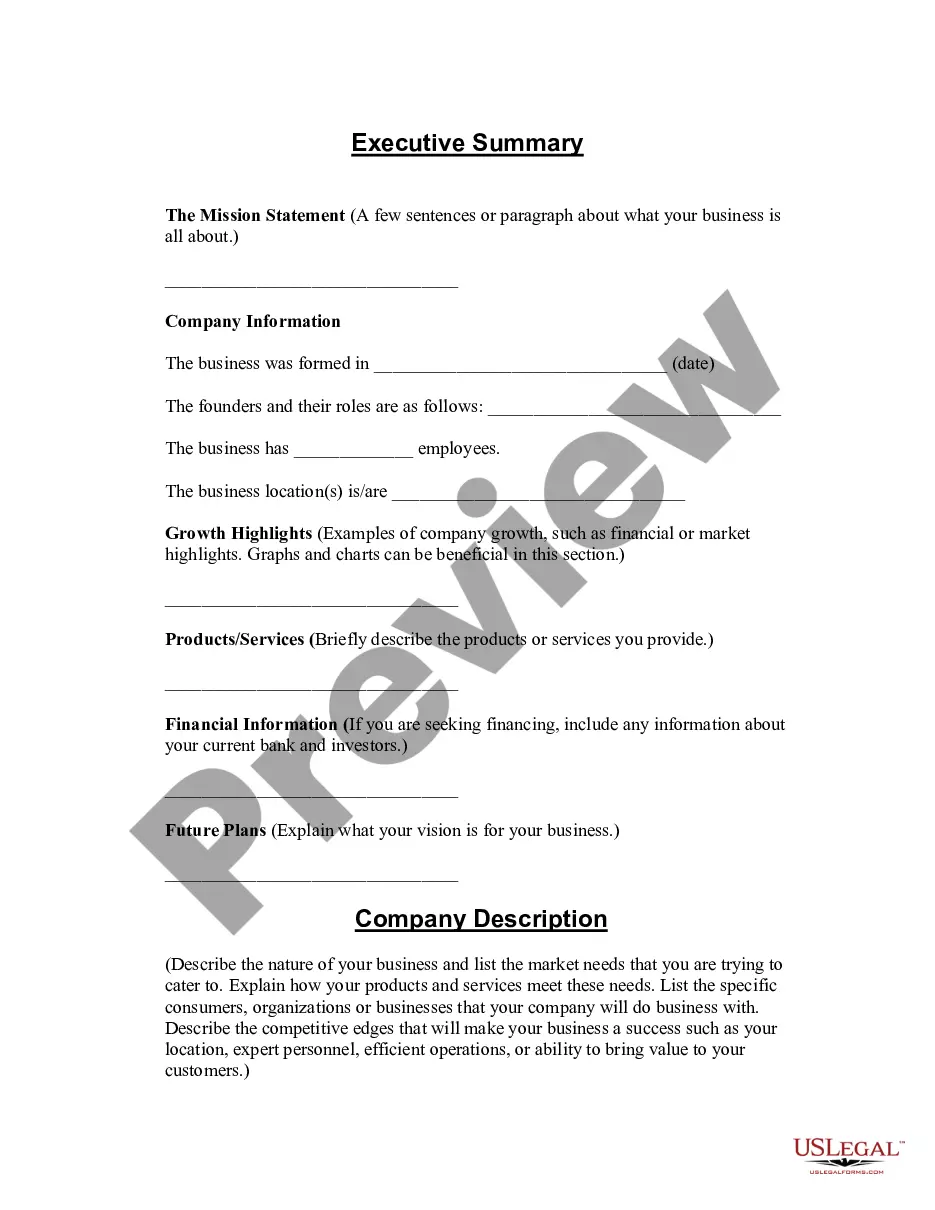

Fulton Georgia Investment Management Agreement for Separate Account Clients is a comprehensive contract between Fulton Georgia Investment Management and its clients who opt for separate account management services. This agreement outlines the terms and conditions governing the investment management services offered to clients and ensures a transparent and mutually beneficial relationship between the parties involved. The agreement caters to different types of clients, including individuals, families, institutional investors, and corporations seeking customized investment strategies. Fulton Georgia Investment Management recognizes that each client has unique financial goals, risk tolerance, and investment preferences. Therefore, the agreement stipulates that the investment management services provided will be tailored to suit the specific needs of the separate account client. The Investment Management Agreement covers various crucial aspects, including the scope and duration of the engagement, fee structure, investment objectives, and guidelines. This document delineates the responsibilities of both Fulton Georgia Investment Management and the client, ensuring clarity and aligning expectations. Key components of the agreement include: 1. Investment Objectives: The agreement identifies the client's investment objectives and risk tolerance. Fulton Georgia Investment Management utilizes this information to develop a personalized investment strategy that suits the client's needs while considering market conditions, asset allocation, and other relevant factors. 2. Account Guidelines: The document outlines the investment guidelines for the separate account. This includes asset classes, investment styles, concentration limits, and any specific exclusions or preferences requested by the client. 3. Fee Structure: The agreement specifies the fee structure for the investment management services provided by Fulton Georgia Investment Management. It outlines the management fee, performance fee (if applicable), and any other charges associated with the account. 4. Reporting and Communication: The agreement stipulates the frequency and format of performance reporting, as well as the channels of communication between Fulton Georgia Investment Management and the client. This ensures that the client receives regular updates on their portfolio's performance and can communicate their concerns or queries effectively. 5. Termination and Transition: The agreement covers termination clauses, including notice periods, early termination fees (if applicable), and the procedure for the transition of the separate account to another investment manager if desired by the client. Fulton Georgia Investment Management offers various types of investment management agreements within their separate account client offering. These may include conservatively-managed portfolios aimed at preserving capital, growth-oriented portfolios targeting substantial long-term capital appreciation, income-focused portfolios emphasizing regular income generation, and balanced portfolios seeking a combination of growth and income. The specific type of management agreement is determined based on the client's investment goals and risk tolerance. In conclusion, the Fulton Georgia Investment Management Agreement for Separate Account Clients establishes a legal and operational framework to ensure a fruitful client-manager relationship. It caters to a diverse range of clients and provides customized investment solutions to help clients achieve their financial objectives.

Fulton Georgia Investment Management Agreement for Separate Account Clients

Description

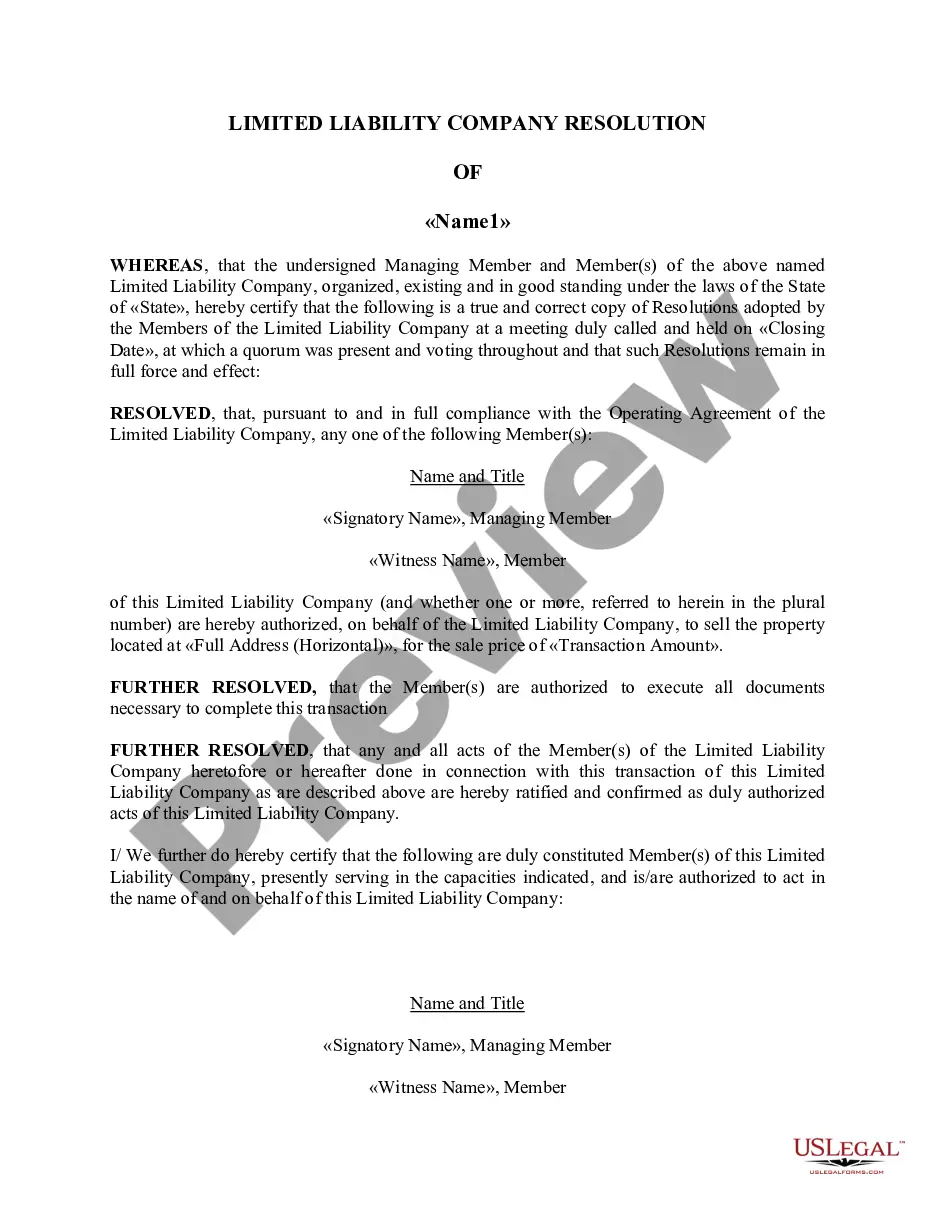

How to fill out Fulton Georgia Investment Management Agreement For Separate Account Clients?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Fulton Investment Management Agreement for Separate Account Clients is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Fulton Investment Management Agreement for Separate Account Clients. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Fulton Investment Management Agreement for Separate Account Clients in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!