The Harris Texas Investment Management Agreement for Separate Account Clients is a comprehensive contract that outlines the terms and conditions between Harris Texas (a reputable financial management company) and its separate account clients. This agreement is tailored to meet the unique investment needs and objectives of each client, ensuring a personalized approach to wealth management. The main purpose of this agreement is to establish a clear understanding between Harris Texas and its separate account clients regarding the management of their investment portfolios. It sets forth the responsibilities, rights, and obligations of both parties, providing a transparent framework for a successful and fruitful investment partnership. The agreement goes into detail about the investment objectives and risk tolerance of the separate account client. Harris Texas conducts an in-depth assessment of the client's goals, financial situation, and preferences to create a tailored investment strategy. This ensures that the client's specific needs are met, and their investments align with their long-term goals. Furthermore, the agreement outlines the investment authority granted to Harris Texas. It defines the permissible investments, asset allocation, and investment guidelines that the firm will adhere to while managing the client's funds. By providing clarity on these aspects, the client can have confidence in the management of their assets. Risk management is another crucial aspect addressed in the agreement. Harris Texas delineates its risk management policies and procedures, including the monitoring and assessment of investment risks. Clients can have peace of mind knowing that their portfolios are constantly evaluated to mitigate any potential risks. The Harris Texas Investment Management Agreement for Separate Account Clients also covers fee structures and compensation. It clearly outlines the fees charged by Harris Texas for its investment management services, ensuring transparency and full disclosure. This allows clients to have a clear understanding of the costs associated with their investment management. Additionally, the agreement may include provisions for reporting and communication. Harris Texas commits to providing regular reports and updates on the performance of the client's portfolio. Open lines of communication are established, enabling clients to discuss their investments, ask questions, and seek clarification whenever necessary. Different types of Harris Texas Investment Management Agreements may exist, depending on the specific needs and requirements of the separate account clients. These variations could include agreements tailored for individual clients, institutional clients, or high-net-worth individuals. Each type of agreement may have distinct provisions and considerations, reflecting the unique circumstances of the clients being served. In conclusion, the Harris Texas Investment Management Agreement for Separate Account Clients is a comprehensive and customized contract that ensures a mutually beneficial relationship between Harris Texas and its separate account clients. It covers all aspects related to investment management, risk management, fees, and communication, providing a solid framework for successful wealth management.

Harris Texas Investment Management Agreement for Separate Account Clients

Description

How to fill out Harris Texas Investment Management Agreement For Separate Account Clients?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Harris Investment Management Agreement for Separate Account Clients.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Harris Investment Management Agreement for Separate Account Clients will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Harris Investment Management Agreement for Separate Account Clients:

- Ensure you have opened the proper page with your localised form.

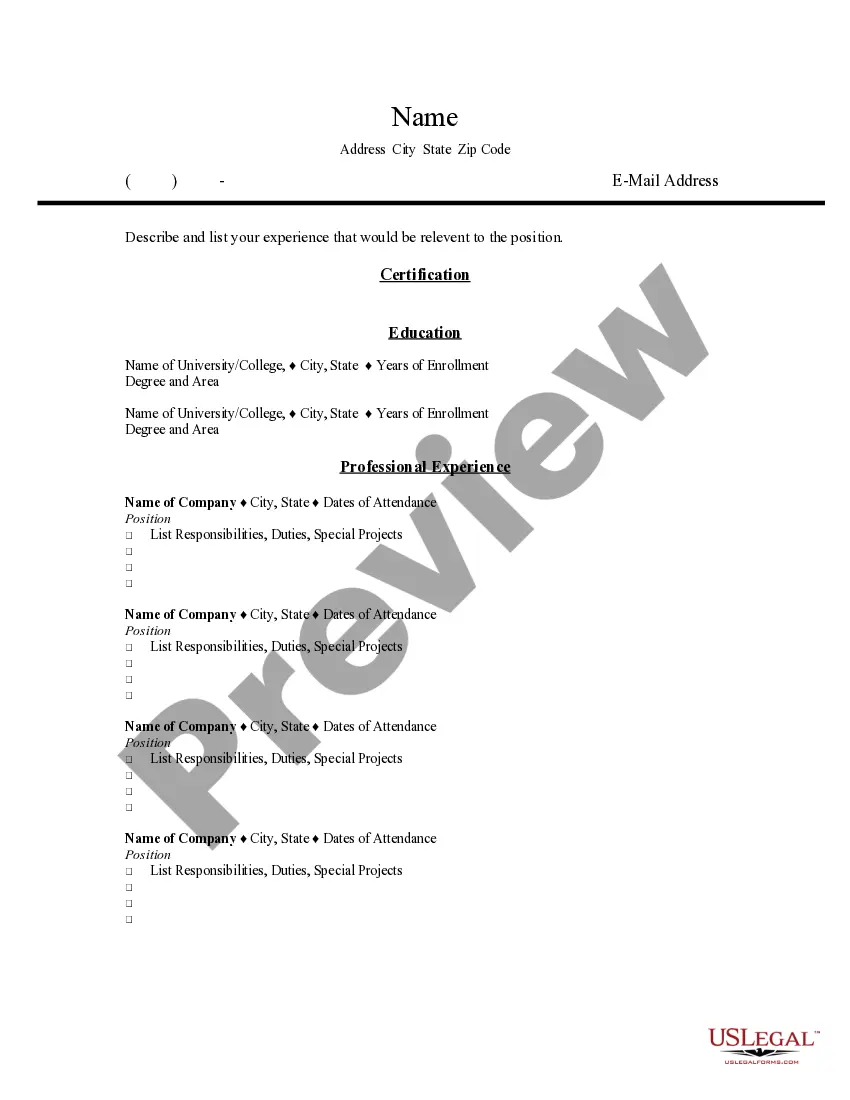

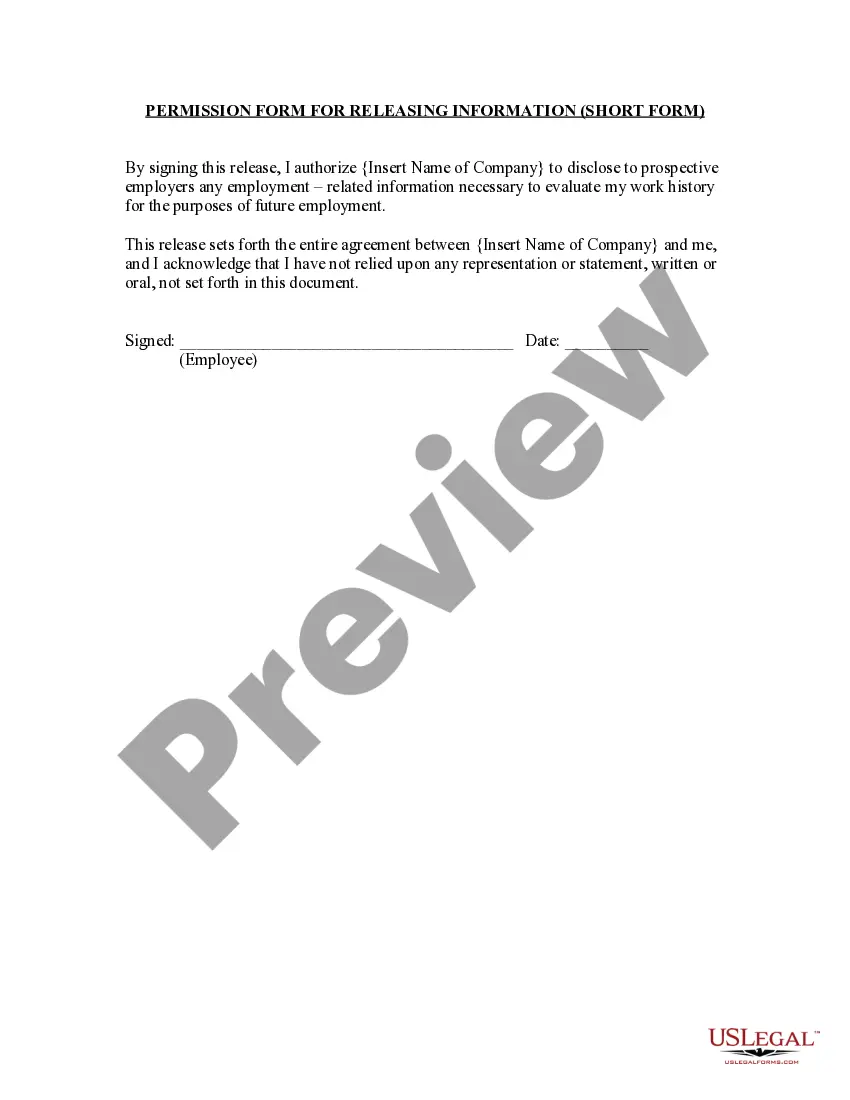

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Harris Investment Management Agreement for Separate Account Clients on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!