King Washington Investment Management Agreement for Separate Account Clients is a comprehensive investment agreement offered by King Washington, a reputable investment management firm. This agreement outlines the terms and conditions under which King Washington will manage the investments of its separate account clients. Under this agreement, King Washington acts as the investment advisor and is responsible for making investment decisions on behalf of the client. The agreement specifies the investment objectives, risk tolerance, and any specific investment restrictions or preferences of the client. The agreement also includes details about the fee structure, which may vary depending on the services provided and the assets under management. Clients can expect transparent and competitive fees for the professional investment management services offered by King Washington. Clients can choose from different types of King Washington Investment Management Agreement for Separate Account Clients, tailored to meet their unique needs and preferences. Some types include: 1. Growth-focused Agreement: Designed for clients seeking capital appreciation, this agreement focuses on investing in companies with strong growth potential. 2. Income-focused Agreement: Suitable for clients who prioritize generating regular income from their investments, this agreement aims to provide a steady stream of income through carefully selected dividend and interest-paying securities. 3. Balanced Agreement: This agreement offers a balanced approach, seeking to generate a combination of income and capital appreciation. It combines elements of growth-focused and income-focused strategies to meet the client's objectives. 4. Customized Agreement: For clients with specific investment requirements or preferences, King Washington offers a customized agreement that can be tailored to their unique needs and preferences. This allows clients to have more control over their investments and align them with their individual circumstances. The King Washington Investment Management Agreement for Separate Account Clients is designed to ensure that clients' investments are managed professionally and in line with their specific objectives. It provides clients with peace of mind, knowing that their investments are being actively monitored and managed by a team of experienced investment professionals.

King Washington Investment Management Agreement for Separate Account Clients

Description

How to fill out King Washington Investment Management Agreement For Separate Account Clients?

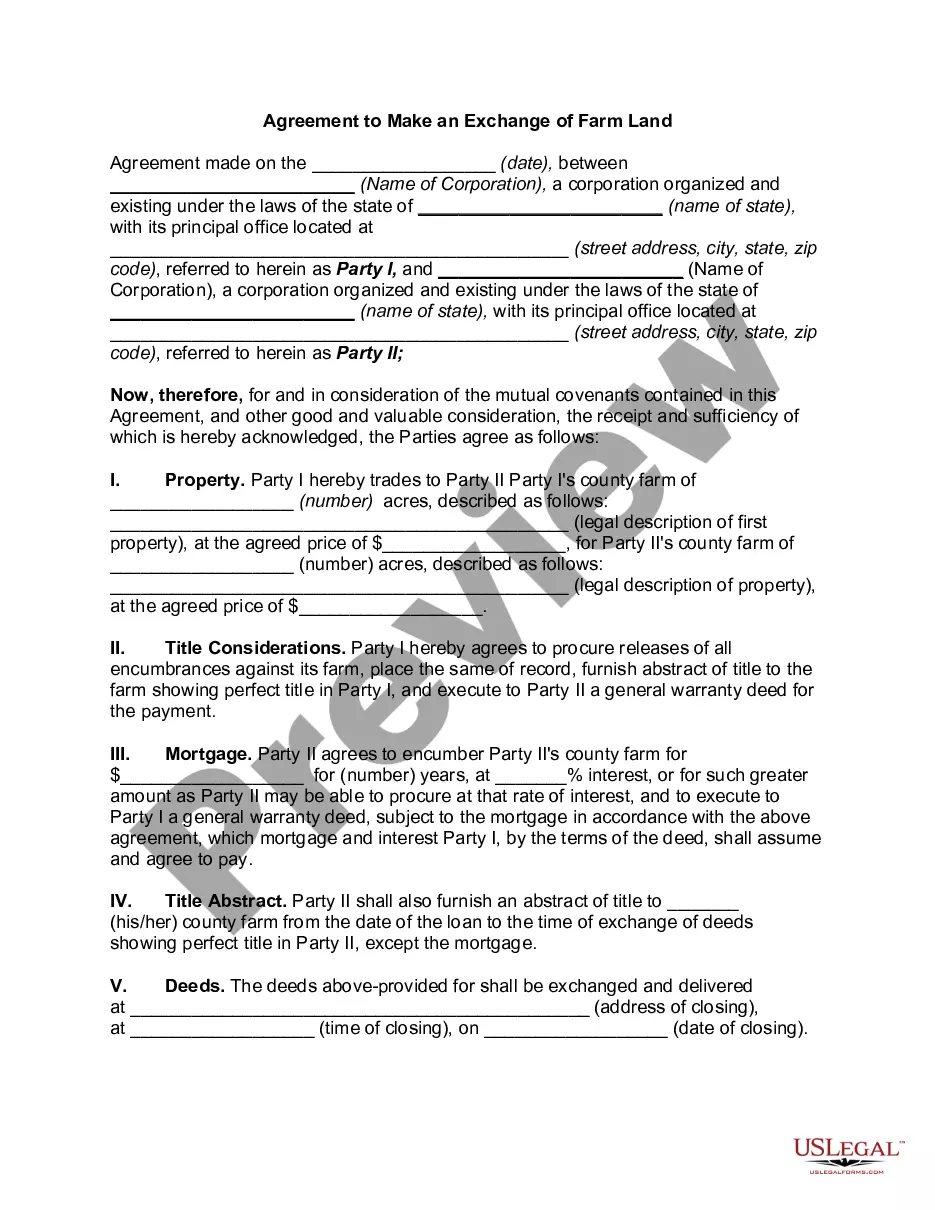

Preparing paperwork for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create King Investment Management Agreement for Separate Account Clients without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid King Investment Management Agreement for Separate Account Clients on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to get the King Investment Management Agreement for Separate Account Clients:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

An Investment Management Account (IMA) is a flexible fund management arrangement that allows you to diversify your portfolio by gaining access to a wide range of financial instruments that span various asset types.

IMA means an investment management agreement, typically entered into between a client and an Advisor that governs the provision of advisory services to a client by Medley Capital and the fees to be paid to the applicable Advisor for such advisory services.

Investment Term Definition The timeframe the life cycle of an investment has. For example, in a debt investment, this would be the amount of time it takes to pay the lender back.

Investment management refers to the handling of financial assets and other investmentsnot only buying and selling them. Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax services and duties, as well.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Discretionary Portfolio Management (DPM)

Portfolio Managers build and maintain investment portfolios, while investment advisors sell a specific product. 1 Investment advisors play an important role in the financial markets, but are not in a position to support the needs of a client's long-range financial objectives. That's the job of the Portfolio Manager.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.

Investment management refers to the handling of financial assets and other investmentsnot only buying and selling them. Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax services and duties, as well.

Interesting Questions

More info

Our global team also provides the following solutions to our fund advisory customers: online trading platform; investment adviser service; portfolio manager; and tax compliance tool set. Online Trading for Advisers: Trade a range of instruments including shares, options and futures using the U.S. Bank's global online trading platform. We are currently offering a broad swath of instruments, including shares, options and futures, for use on our platform. Trading on a global market platform can save you time and money. We can help you find great trading opportunities from stocks to options to mutual funds and ETFs. Global Platform: Our company provides its clients with access to a global market which is used by an increasing number of financial institutions for financial trading purposes. We offer a wide range of instruments which can be traded around the world. Our financial products are available in more than 100 currencies and can be traded in the U.S.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.