The San Antonio Texas Investment Management Agreement for Separate Account Clients is a comprehensive contract between an investment manager and their clients in the San Antonio area. This agreement outlines the terms and conditions under which the investment manager will provide investment advisory services to clients and manage their separate account(s) based on their specific investment goals and objectives. In this agreement, various key elements are covered to ensure a transparent and mutually beneficial relationship between the investment manager and the separate account clients. The agreement clarifies the investment manager's responsibilities, including the overall investment strategy, asset allocation, risk management, and performance monitoring. It also sets forth the client's responsibilities, such as providing accurate and complete information regarding their financial situation, investment preferences, and objectives. The San Antonio Texas Investment Management Agreement for Separate Account Clients helps establish a clear understanding of the fee structure associated with the investment management services provided. The agreement specifies the fees, commissions, and any other compensation arrangements for the investment manager. This ensures that both parties are aware of the cost structure and helps prevent any potential conflicts of interest. Additionally, the agreement covers topics such as custody of assets, reporting requirements, and termination conditions. It outlines how the investment manager will safeguard the client's assets, including the use of a qualified custodian to hold the securities. The reporting requirements section specifies the frequency and format of performance reports that the investment manager will provide to the client. Furthermore, it establishes the conditions under which either party can terminate the agreement, ensuring that both parties have a clear understanding of their rights and obligations. There might be different types of San Antonio Texas Investment Management Agreements for Separate Account Clients, each tailored to specific investment strategies or client needs. For instance, some may focus on long-term growth and capital appreciation, while others may emphasize income generation or risk mitigation. These different types of agreements may vary in terms of investment objectives, asset classes, risk tolerance, and other factors. In conclusion, the San Antonio Texas Investment Management Agreement for Separate Account Clients is a crucial document that establishes the guidelines and expectations for the investment manager and their clients. It helps ensure transparency, trust, and a clear understanding of the investment management process, ultimately working towards the client's financial goals.

San Antonio Texas Investment Management Agreement for Separate Account Clients

Description

How to fill out San Antonio Texas Investment Management Agreement For Separate Account Clients?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Antonio Investment Management Agreement for Separate Account Clients, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the latest version of the San Antonio Investment Management Agreement for Separate Account Clients, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Investment Management Agreement for Separate Account Clients:

- Glance through the page and verify there is a sample for your region.

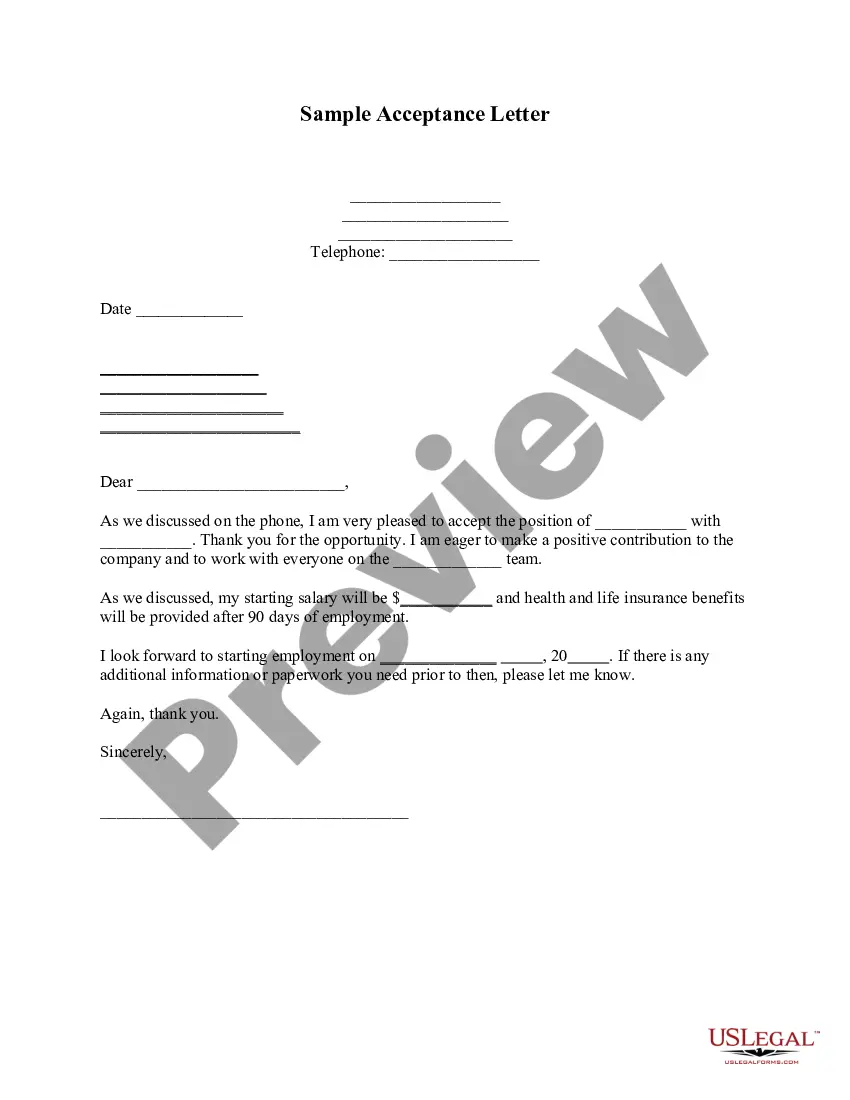

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your San Antonio Investment Management Agreement for Separate Account Clients and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!