Santa Clara, California Investment Management Agreement for Separate Account Clients The Santa Clara, California Investment Management Agreement for Separate Account Clients is a legal document that outlines the terms and conditions agreed upon between an investment management firm and their separate account clients. This agreement governs the professional relationship between the investment management firm, also known as the investment advisor or portfolio manager, and the separate account client. The purpose of the agreement is to establish clear guidelines regarding the investment management services provided by the firm and the responsibilities of both parties involved. It aims to ensure transparency, trust, and accountability in managing the client's investments. Key provisions typically included in the Santa Clara, California Investment Management Agreement for Separate Account Clients may include: 1. Objectives: This section defines the client's investment objectives, goals, risk tolerance, and any specific restrictions or preferences they may have. 2. Investment Strategies: The agreement outlines the investment strategies that the investment management firm will employ to achieve the client's objectives. This may include details about asset allocation, diversification, and any specific investment styles or approaches used. 3. Performance Measurement: The agreement may include guidelines on how the investment management firm will measure and report the performance of the client's portfolio. It may specify the benchmark(s) used for comparison and the frequency of reporting. 4. Fees: The structure and amount of fees charged for the investment management services provided by the firm are stated in this section. It may outline management fees, advisory fees, performance-based fees, and any additional expenses that the client may be responsible for. 5. Termination: This section highlights the conditions and procedures for terminating the agreement by either party. It may include notice periods, penalties, and any applicable fees upon termination. 6. Duties and Responsibilities: The agreement clearly defines the roles, duties, and responsibilities of both the investment management firm and the client. It ensures that the firm acts in the best interest of the client and provides ongoing monitoring and reporting of the client's portfolio. Different types of Santa Clara, California Investment Management Agreements for Separate Account Clients may include: 1. Equity Investment Management Agreement: This type of agreement focuses on managing the client's investments in equity securities, such as stocks and shares. 2. Fixed Income Investment Management Agreement: This agreement is tailored towards managing the client's investments in fixed-income securities, including bonds, treasury bills, and other debt instruments. 3. Balanced Investment Management Agreement: A balanced investment management agreement aims to create a diversified investment portfolio across multiple asset classes, including equity and fixed income securities. It seeks to strike a balance between risk and return. 4. Specialized Investment Management Agreement: This type of agreement caters to clients with specific investment needs, such as socially responsible investing (SRI), impact investing, or alternative investment strategies. In conclusion, the Santa Clara, California Investment Management Agreement for Separate Account Clients is a comprehensive legal document that governs the relationship between an investment management firm and their separate account clients. It addresses investment objectives, strategies, performance measurement, fees, termination, and the duties and responsibilities of both parties. Various types of agreements exist to cater to different investment preferences and objectives.

Santa Clara California Investment Management Agreement for Separate Account Clients

Description

How to fill out Santa Clara California Investment Management Agreement For Separate Account Clients?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a Santa Clara Investment Management Agreement for Separate Account Clients suiting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Santa Clara Investment Management Agreement for Separate Account Clients, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Santa Clara Investment Management Agreement for Separate Account Clients:

- Examine the content of the page you’re on.

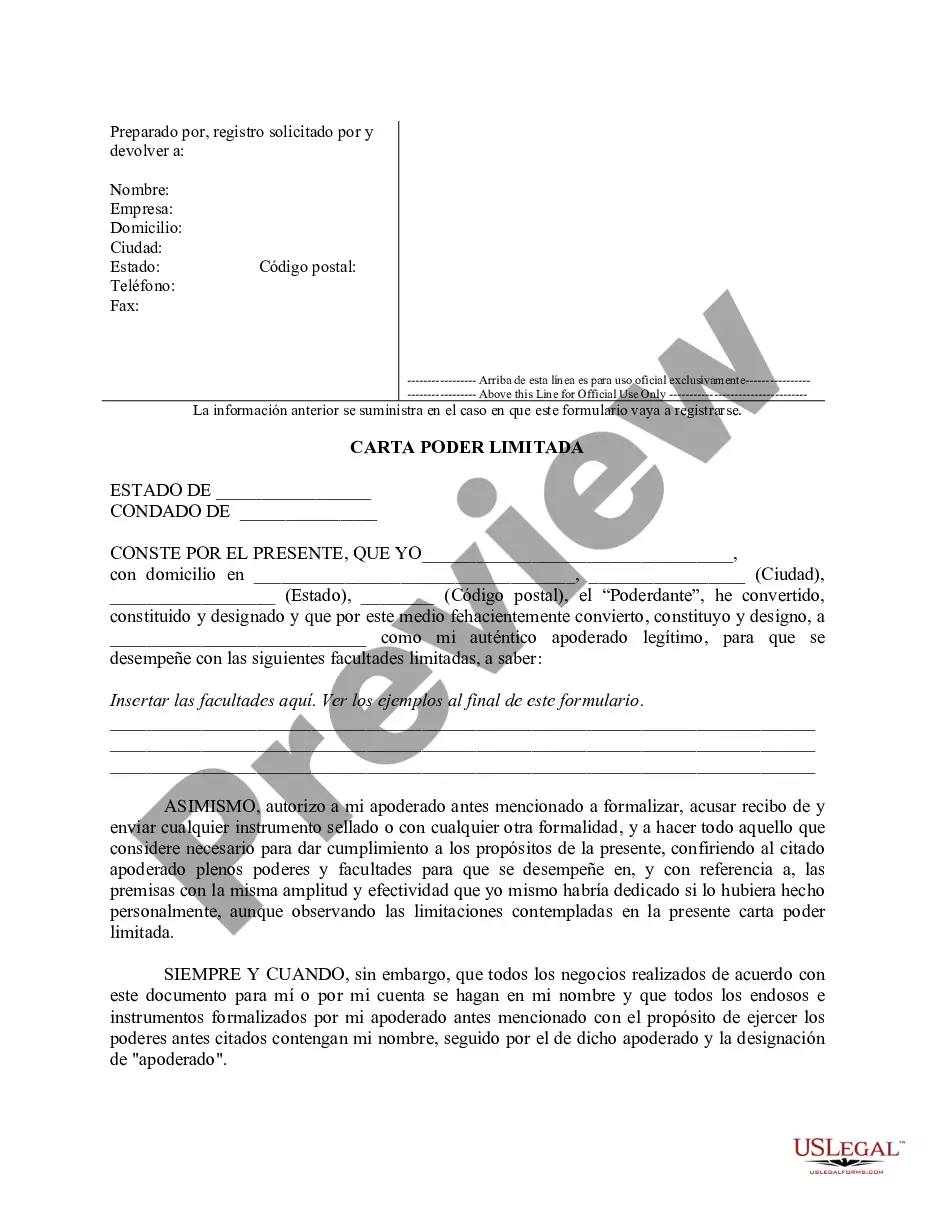

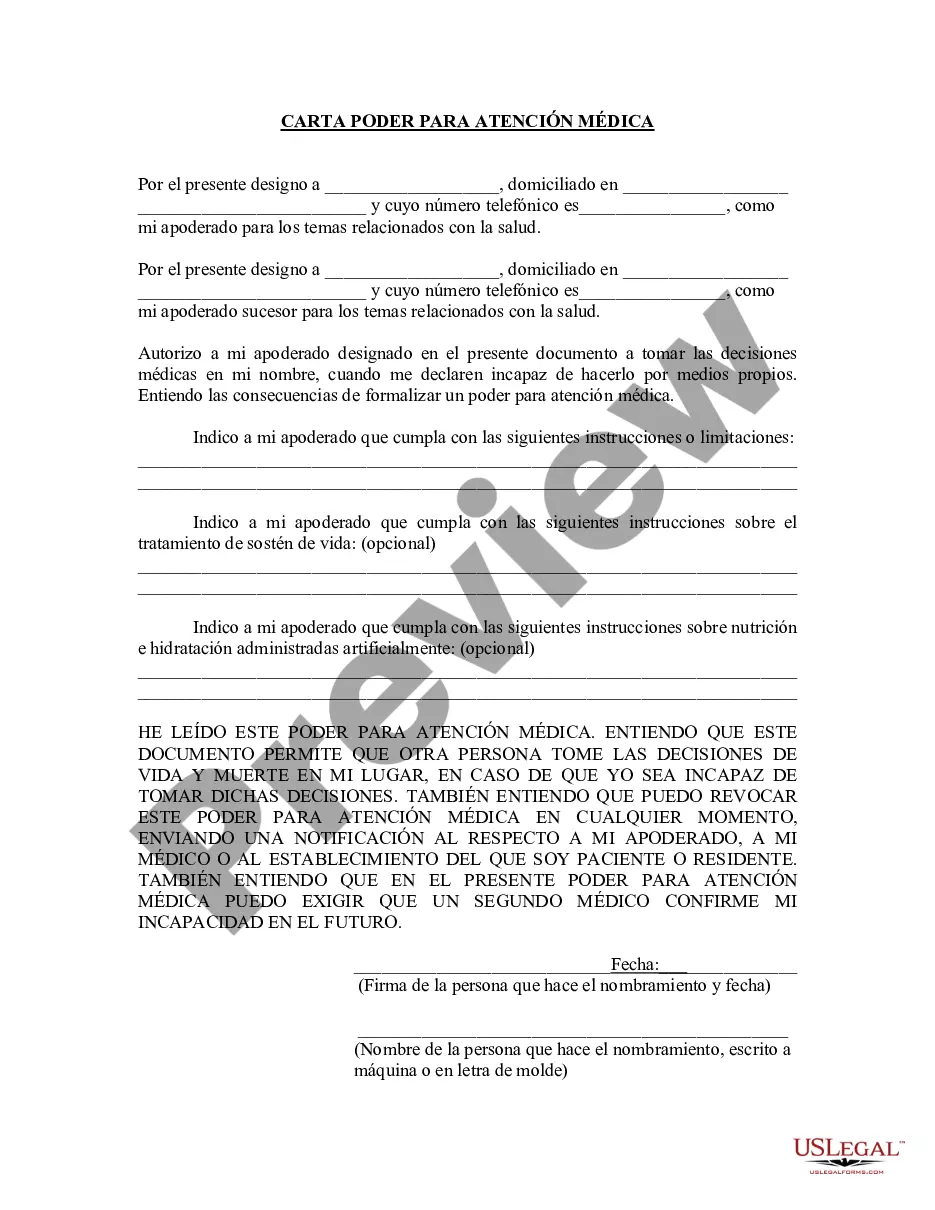

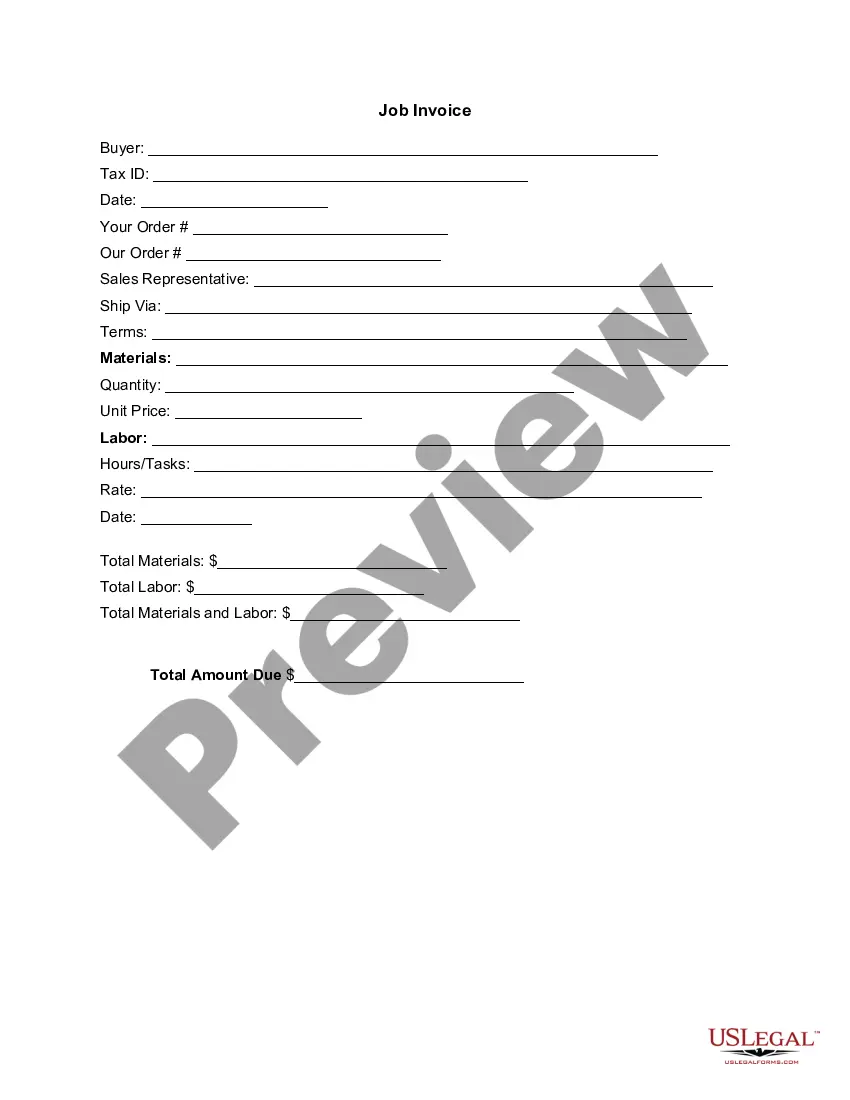

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Santa Clara Investment Management Agreement for Separate Account Clients.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!