Harris Texas Receipt for Balance of Account is a legal document that serves as proof of payment for any outstanding debts or charges on a particular account. It outlines the details of the transaction and confirms that the account holder has fully settled their financial obligations with the creditor. The receipt is an essential document for record-keeping and can be used as evidence in case of any disputes or discrepancies in the future. Keywords: Harris Texas, receipt, balance of account, payment, outstanding debts, charges, transaction, account holder, financial obligations, creditor, document, record-keeping, disputes, discrepancies. Different types of Harris Texas Receipt for Balance of Account might include: 1. Individual Account Receipt: This type of receipt is issued to an individual account holder who has made a full payment for their outstanding balance. It specifies the account holder's name, account number, payment amount, date, and creditor's details. 2. Corporate Account Receipt: This receipt is issued to a corporate account holder, such as a business or organization, who has settled their remaining balance. It includes the company's name, account number, payment amount, date, and the creditor's information. 3. Installment Payment Receipt: In cases where the account holder has chosen to make payments in installments, an installment payment receipt is issued for each installment made. It lists the account holder's details, installment amount, date, and creditor's information. These receipts collectively document the progress of the account holder in paying off their balance. 4. Partial Payment Receipt: If an account holder has made a partial payment towards their outstanding balance, a partial payment receipt is issued. It indicates the reduced amount paid, date, account holder's name, account number, and creditor's details. This receipt serves as evidence of the partial payment made towards the balance. 5. Final Settlement Receipt: This type of receipt is issued when the account holder has completely paid off their balance and there are no more outstanding debts owed. It confirms the full settlement, mentioning the account holder's name, account number, payment amount, date, and the creditor's information. The final settlement receipt is particularly important as it indicates the closure of the account. These different variations of the Harris Texas Receipt for Balance of Account cater to various scenarios based on the payment status, whether it is an individual or corporate account, the mode of payment, and the payment schedule.

Harris Texas Receipt for Balance of Account

Description

How to fill out Harris Texas Receipt For Balance Of Account?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like Harris Receipt for Balance of Account is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Harris Receipt for Balance of Account. Follow the guide below:

- Make certain the sample meets your individual needs and state law regulations.

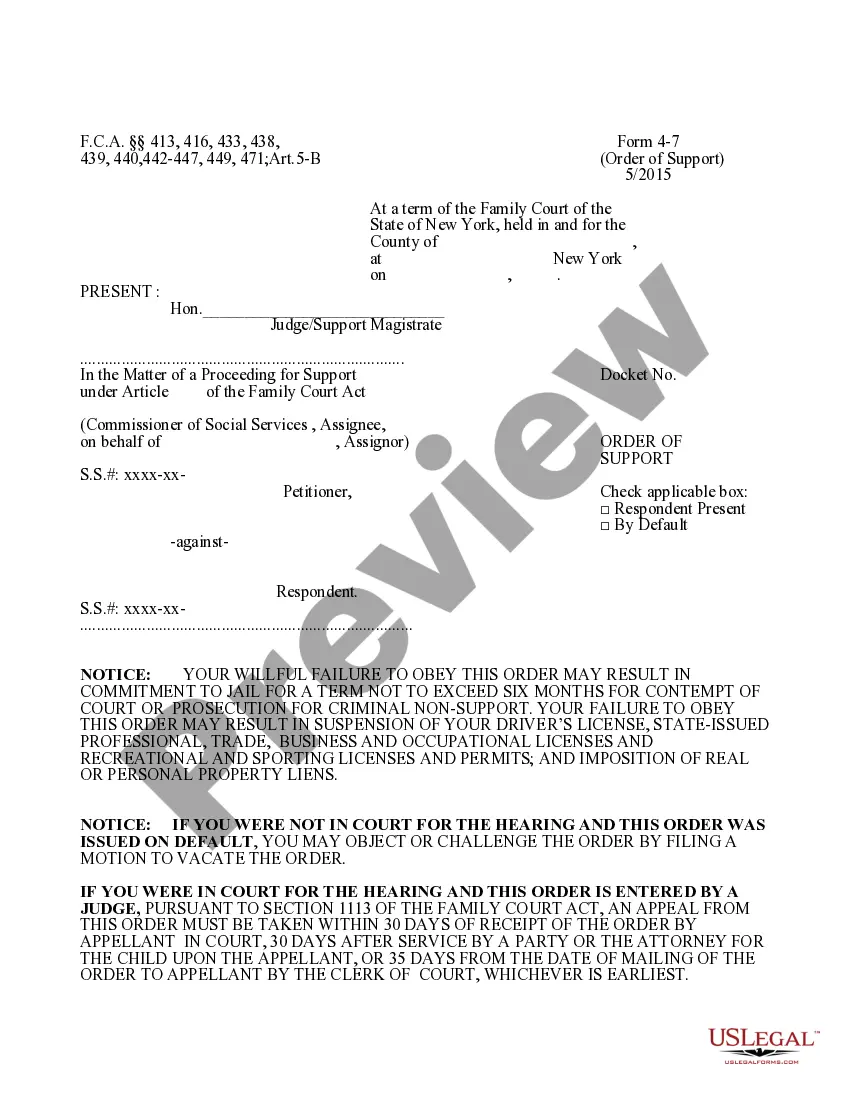

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Receipt for Balance of Account in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!