Allegheny Pennsylvania Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

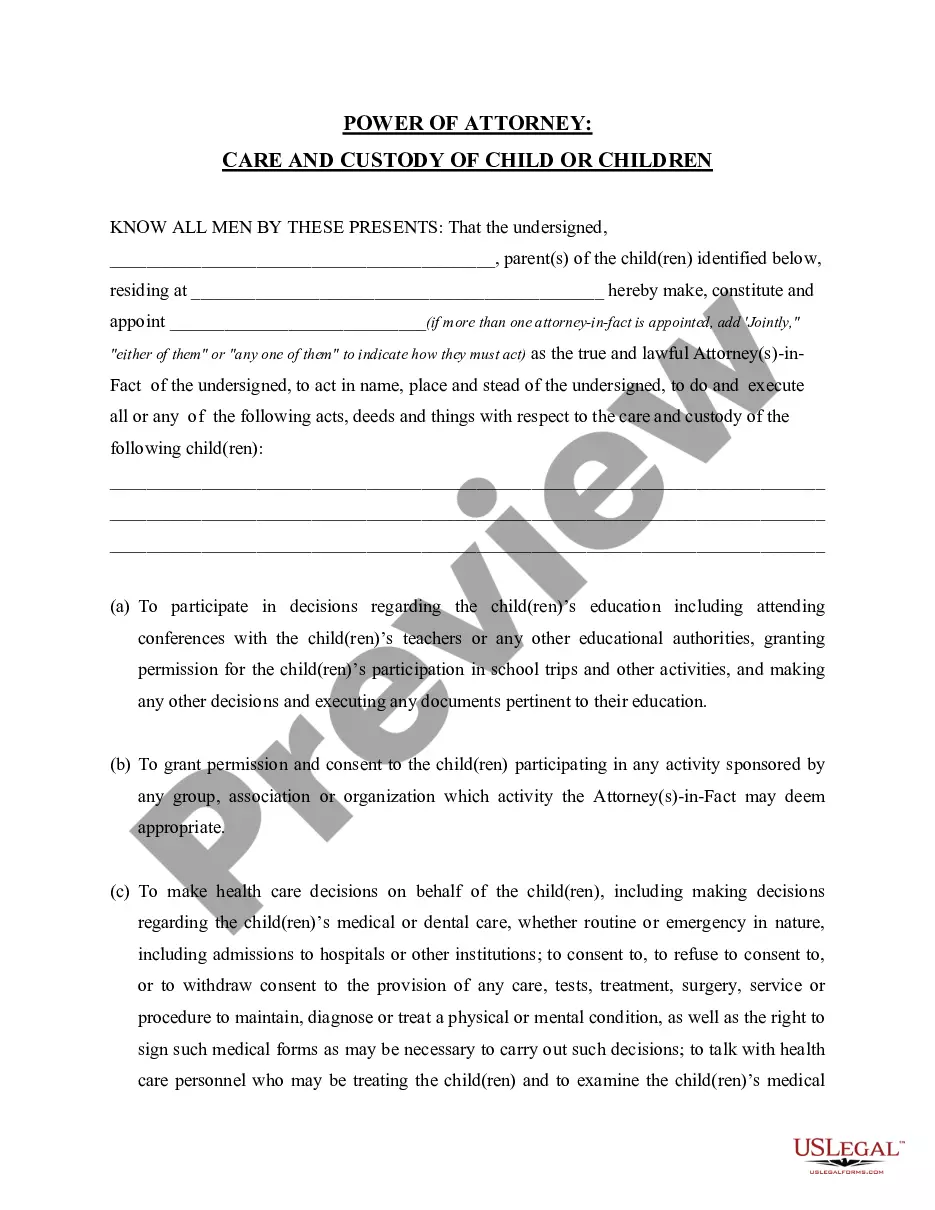

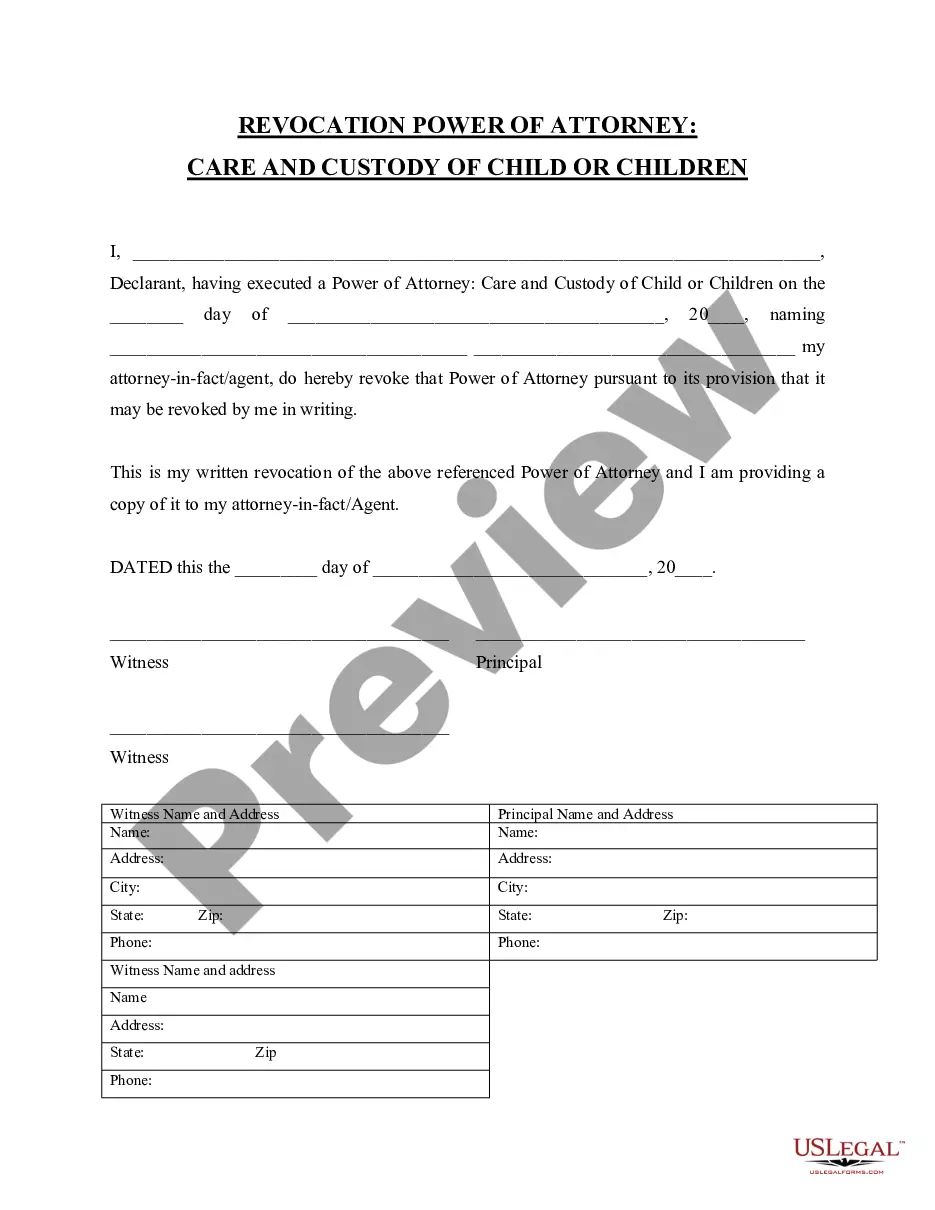

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

Whether you plan to launch your business, engage in a contract, seek your ID renewal, or address family-related legal matters, you must prepare specific documentation according to your local laws and regulations.

Finding the correct documents may require considerable time and effort, unless you utilize the US Legal Forms library.

The platform offers users over 85,000 skillfully drafted and verified legal templates for any personal or commercial situation. All documents are categorized by state and purpose, making it quick and simple to choose a copy like the Allegheny Agreement to Sell Real Property Owned by Partnership to One of the Partners.

Documents provided by our library are reusable. With an active subscription, you can access all of your previously obtained paperwork at any time in the My documents section of your account. Stop wasting time on an ongoing search for updated official documentation. Register for the US Legal Forms platform and organize your paperwork using the most extensive online form collection!

- Ensure the sample meets your personal needs and complies with state law.

- Examine the form description and review the Preview if available on the page.

- Use the search box to specify your state above and find another template.

- Click Buy Now to acquire the document when you identify the suitable one.

- Select the subscription plan that fits you best to proceed.

- Log in to your account and process the payment using a credit card or PayPal.

- Download the Allegheny Agreement to Sell Real Property Owned by Partnership to One of the Partners in your preferred file format.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

The exit strategy for your real estate partnership should address how to handle the business if it grows, either through merging or selling. Buy-out. A good exit strategy includes the possibility of one partner wanting to buy the other partner out.

Real estate limited partnerships must register with the state where they operate. File a certificate of dissolution with the state to dissolve this type of partnership.

How to sell your share of a partnership? Step 1: Review the partnership agreement which outlines how partners would address certain business situations, such as selling.Step 2: Meet with your partner(s) in order to take a vote on how to dissolve the partnership and sell your assets.

Typically, partnerships are categorized as either active, where all parties are equally responsible for day-to-day management, or passive, as a means to raise capital from investors who are not as involved. Real estate partnerships are one of the most common types of pass-through entities.

How to Dissolve a Partnership Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

Below are seven benefits of a partnership agreement. Avoiding the state's default rules on partnership.Clarifying management duties.Establishing decision-making processes and voting rights.Reducing money-related disputes.Controlling ownership through an entry plan.Establishing an exit plan.

At its core, a real estate partnership agreement shows a commitment between two business partners. It will typically outline shared goals and a mission for the business; the purpose is to ensure both partners are consistently working towards the same thing.

Termination when only one partner remains The partnership form also ceases to exist if a transfer of partnership interests occurs and only one partner remains. For example, a partnership terminates when a 60% partner acquires the interests of two other partners who each have a 20% interest in the partnership (Regs.