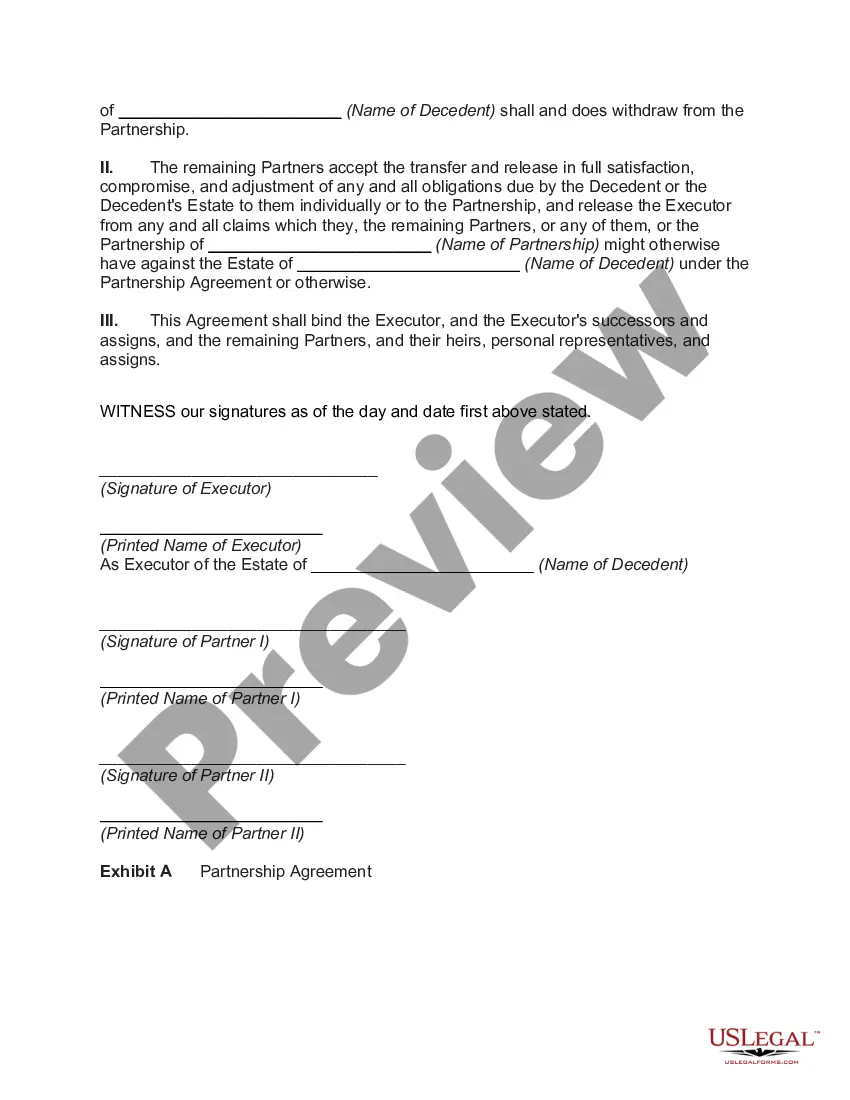

A Collin Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners refers to a legally binding agreement that specifies the terms and conditions of resolving disputes, distributing assets, and managing the affairs of a partnership following the death of one of its partners in Collin County, Texas. This agreement helps ensure a smooth transition of the deceased partner's interests and responsibilities to the surviving partners. It is crucial to understand the various types of settlement agreements that can be involved in this context: 1. Buy-Sell Agreement: This type of settlement agreement outlines the terms for the surviving partners to purchase the deceased partner's share of the partnership. It typically includes provisions for valuation methods, payment terms, and funding mechanisms, such as life insurance policies or installment payments. 2. Succession Agreement: A succession agreement defines the process by which the surviving partners will take on the rights and responsibilities of the deceased partner. It includes details of how the partnership will continue its operations and may involve the selection of a new partner or the redistribution of duties among the remaining partners. 3. Dissolution Agreement: In some cases, the death of a partner may lead to the dissolution of the partnership. A dissolution agreement specifies the steps that need to be taken to wind up the partnership's affairs, settle any outstanding debts, distribute assets, and terminate the partnership. 4. Release and Waiver Agreement: This agreement is signed by the estate of the deceased partner, releasing the surviving partners from any liability or claims related to the partnership. It ensures that the estate cannot hold the surviving partners personally responsible for any partnership obligations or debts. 5. Non-Compete Agreement: Occasionally, a settlement agreement may include a non-compete clause, restricting the deceased partner's estate from engaging in similar business activities or joining a competitive partnership within a certain geographic area and time frame. This protects the surviving partners' interests and helps maintain the value of the partnership. Overall, a Collin Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a critical legal document that establishes guidelines and resolves any disputes arising from the death of a partner. By providing clarity and addressing crucial aspects such as asset distribution, partnership succession, and liabilities, these agreements enable the smooth continuation or dissolution of the partnership while protecting the interests of all parties involved in Collin County, Texas.

Collin Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Collin Texas Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Collin Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the Collin Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners. Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!