The Harris Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legal document that outlines the terms and conditions for resolving the affairs and distribution of assets in the event of a partner's death in a business or partnership located in Harris County, Texas. This agreement ensures a smooth transition and fair distribution of assets while protecting the rights and interests of both the estate of the deceased partner and the surviving partners. Keywords: Harris Texas, Settlement Agreement, Estate, Deceased Partner, Surviving Partners, assets, business, partnership, Harris County, Texas, transition, distribution, rights, interests. Types of Harris Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners: 1. Asset Distribution Agreement: This type of settlement agreement specifies how the deceased partner's share of assets will be distributed among the surviving partners. It outlines the process for valuing and dividing assets, taking into consideration the contributions and interests of all parties involved. 2. Business Continuation Agreement: In this type of settlement agreement, the surviving partners outline the details of how the business or partnership will continue after the death of a partner. It may include provisions for the transfer of ownership, management responsibilities, and financial arrangements to ensure the smooth operation and future success of the business. 3. Buy-Sell Agreement: This agreement provides a framework for the purchase and sale of the deceased partner's share of the business or partnership. It includes provisions for valuation methods, funding options, and buyout procedures to facilitate the fair transfer of ownership and the financial stability of the business. 4. Non-Compete Agreement: This type of settlement agreement may be included to prevent the deceased partner's estate from engaging in similar business activities that could potentially compete with the surviving partners. It restricts the estate from starting or joining a competing business within a defined geographical area and timeframe. 5. Indemnification Agreement: This agreement protects the surviving partners from any potential liabilities or claims arising from the actions or decisions made by the deceased partner before their death. It ensures that the estate of the deceased partner assumes responsibility for any legal or financial consequences related to their previous activities in the business or partnership. In conclusion, the Harris Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a crucial legal document that establishes the guidelines for resolving the affairs and distributing assets following the death of a partner in Harris County, Texas. Depending on the specific circumstances, different types of settlement agreements may be employed to address asset distribution, business continuation, buy-sell provisions, non-compete conditions, and indemnification.

Harris Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

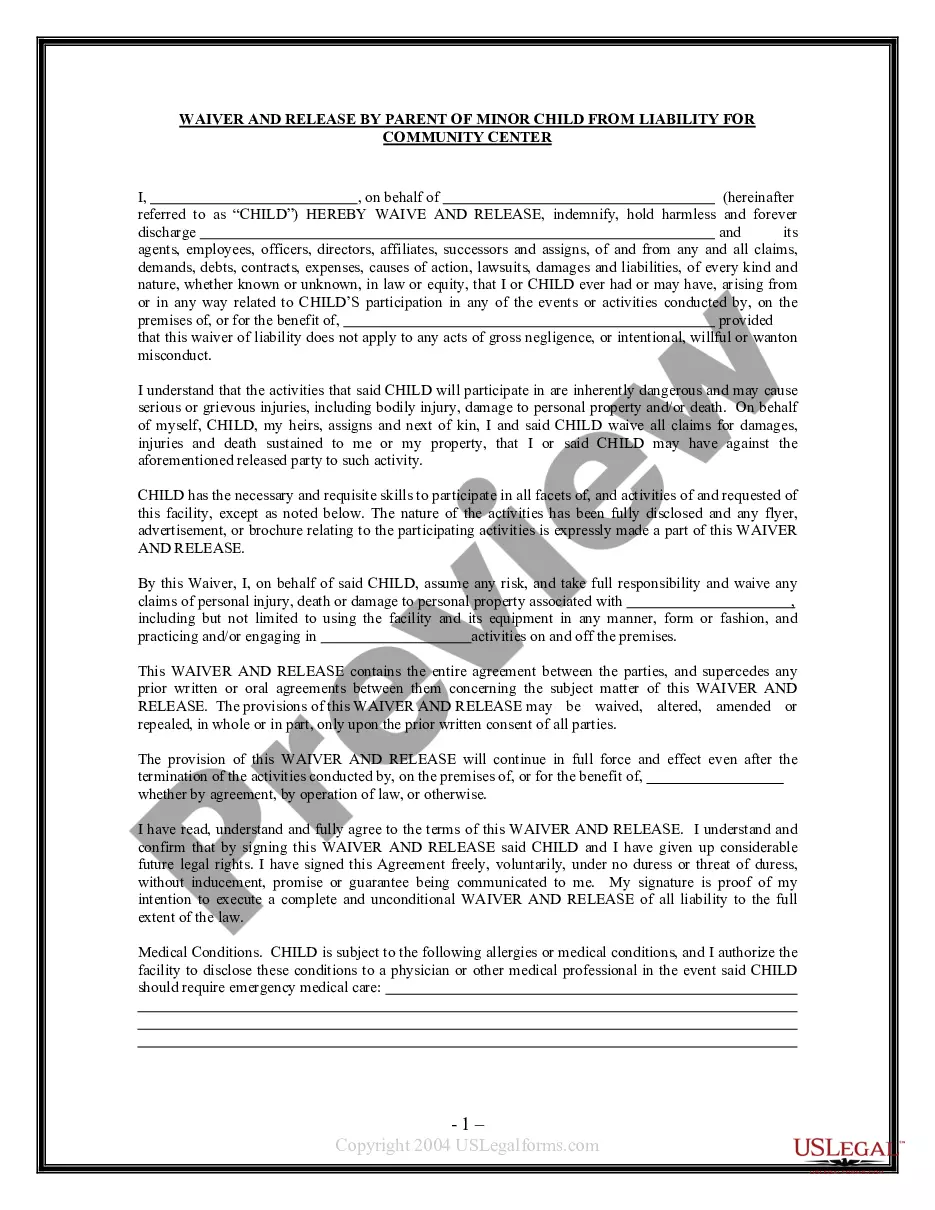

How to fill out Harris Texas Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the current version of the Harris Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Harris Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!