The Wayne Michigan Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legally binding document that governs the distribution of assets and resolution of liabilities after the death of a partner in a business entity based in Wayne, Michigan. This agreement ensures a fair and equitable division of the deceased partner's interests and enables a smooth transition for the business and its surviving partners. The primary purpose of the settlement agreement is to outline the terms and conditions for the distribution and transfer of the deceased partner's share in the partnership. It covers various aspects such as the valuation of the estate, the payment of inheritance tax, and the handling of debts and obligations. It also addresses any real estate, intellectual property, or other assets owned by the partnership. There can be different types of Wayne Michigan Settlement Agreements between the Estate of a Deceased Partner and the Surviving Partners, including: 1. Buy-Sell Agreement: This type of agreement sets forth the terms for the purchase of the deceased partner's share by the surviving partners or the partnership itself. It may include provisions such as a right of first refusal or a predetermined purchase price. 2. Cross-Purchase Agreement: Often utilized in smaller partnerships, this agreement allows the surviving partners to purchase the deceased partner's interest individually rather than the partnership buying it. Each surviving partner acquires a portion of the interest according to the agreement's terms. 3. Partnership Continuation Agreement: In this type of settlement agreement, the partnership as a whole agrees to continue operating after the deceased partner's passing. The surviving partners assume the deceased partner's share and continue running the business together. 4. Dissolution Agreement: If there is an intent to dissolve the partnership upon the death of a partner, a dissolution agreement outlines how the assets and liabilities will be divided among the surviving partners and the estate of the deceased partner. It is crucial to consult with legal professionals experienced in partnership law and estate planning to draft a comprehensive and tailored Wayne Michigan Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners. Adhering to local laws and incorporating relevant clauses that protect the interests of all parties involved is essential for a successful settlement agreement.

Wayne Michigan Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Wayne Michigan Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wayne Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the recent version of the Wayne Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wayne Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners:

- Look through the page and verify there is a sample for your region.

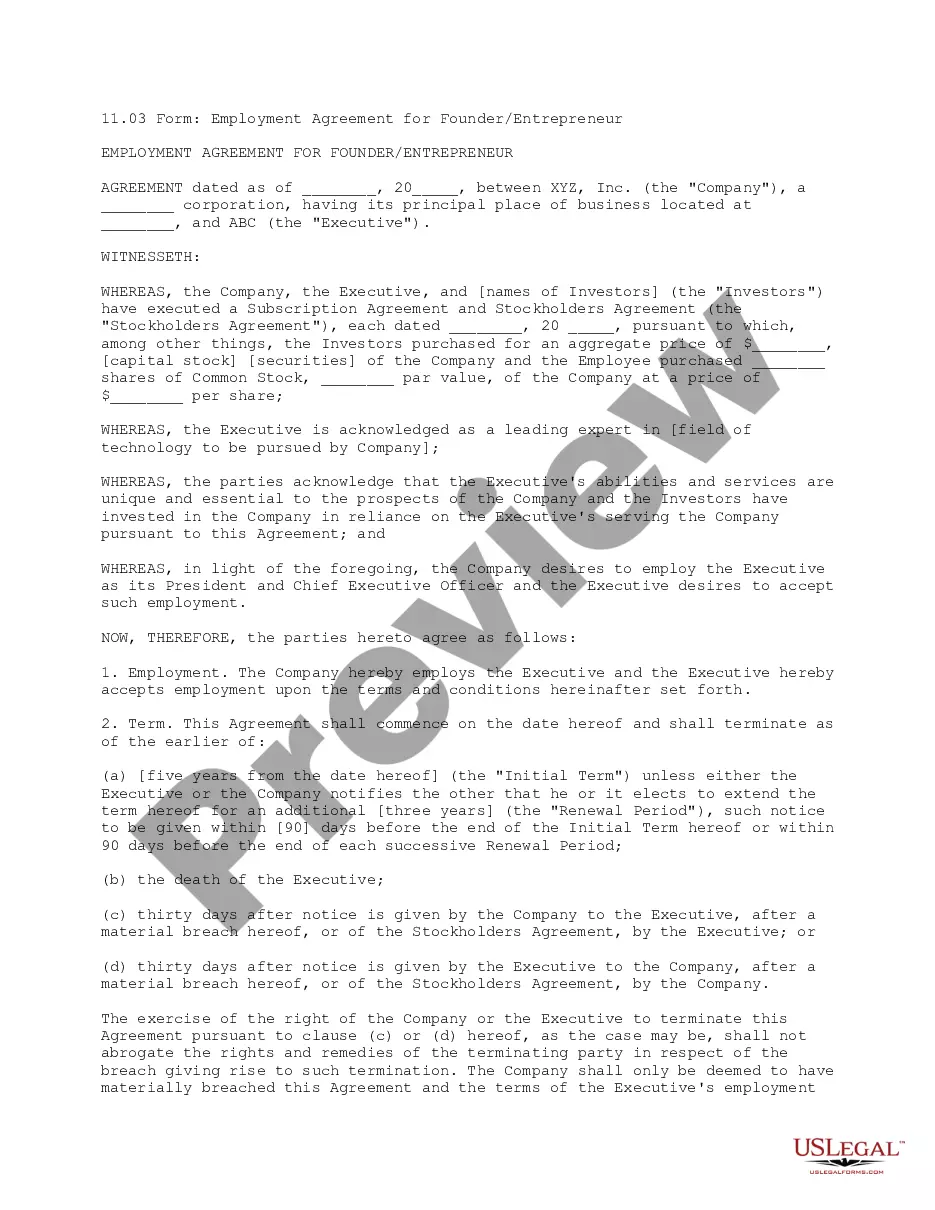

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Wayne Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!