A Contra Costa California Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legal document that outlines the terms and conditions for the transfer of ownership in a partnership in the event of death, retirement, or withdrawal of a partner. This agreement ensures a smooth transition of ownership while also protecting the financial interests of remaining partners and their families. Keywords: Contra Costa California, Partnership Buy-Sell Agreement, Purchase on Death, Retirement, Withdrawal of Partner, Life Insurance, Fund Purchase, Death. There are different types of Contra Costa California Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. Some common variations include: 1. Contra Costa California Cross-Purchase Agreement: In this type of agreement, each partner purchases a life insurance policy on the lives of all other partners. If a partner dies, the remaining partners use the insurance proceeds to buy the deceased partner's interest in the partnership. 2. Contra Costa California Entity-Purchase Agreement: In this arrangement, the partnership itself purchases life insurance policies on the lives of each partner. If a partner passes away, the partnership uses the insurance proceeds to buy the deceased partner's interest in the business. 3. Contra Costa California Wait-and-See Agreement: This type of agreement allows the remaining partners the flexibility to decide whether to buy the deceased partner's interest in the business or allow the deceased partner's estate to sell it to a third party. The life insurance policies are held in place until the decision is made. 4. Contra Costa California Term Life Insurance Agreement: In this agreement, the partners take out term life insurance policies on each other's lives. The benefit is paid out if a partner dies within the specified term. This type of agreement is suitable for partnerships with a limited lifespan or specific time period until retirement. 5. Contra Costa California Whole Life Insurance Agreement: This type of agreement involves partners purchasing whole life insurance policies on each other's lives. The policies provide coverage for the partner's entire lifetime and build cash value over time. Upon the death of a partner, the cash value and death benefit are used to fund the purchase of the deceased partner's interest. These various types of Contra Costa California Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death give partners flexibility in structuring the agreement based on their specific needs, preferences, and financial situations. It is always advisable to consult with an attorney or financial advisor to determine the most appropriate agreement for a partnership.

Contra Costa California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Contra Costa California Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Contra Costa Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Contra Costa Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

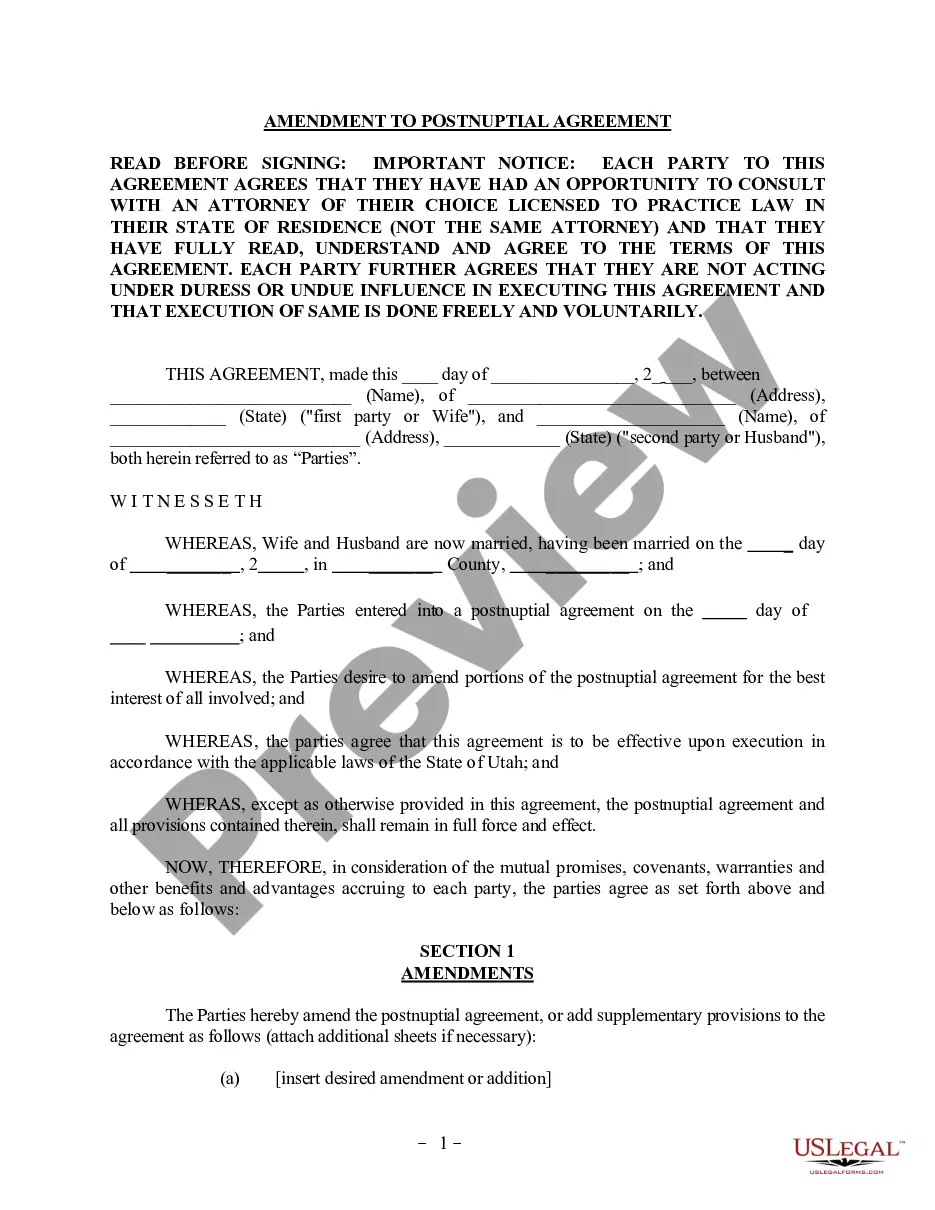

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!