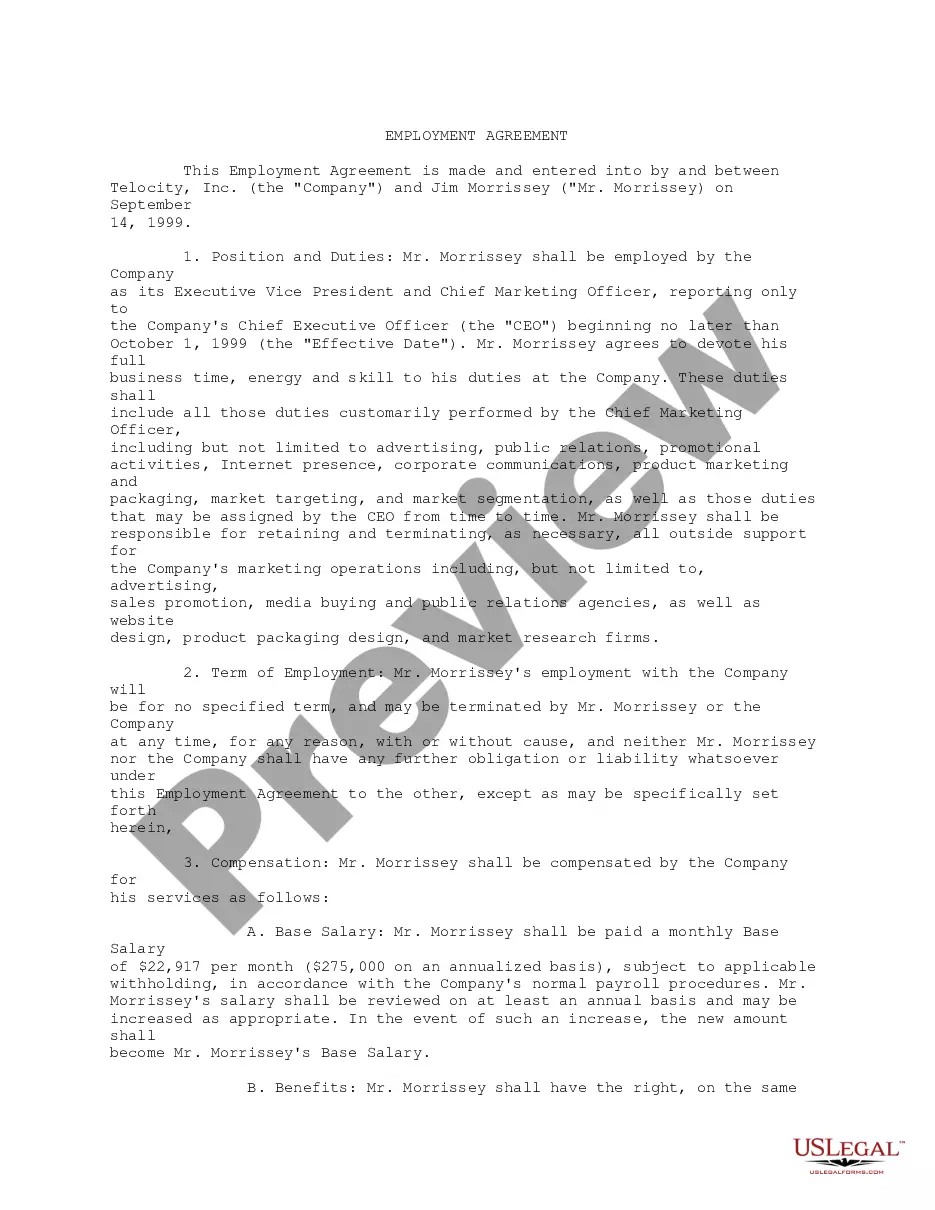

Nassau New York Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legally binding document commonly used by business partners in Nassau, New York. It serves to outline the terms and conditions regarding the exchange of ownership interest in a partnership, ensuring a smooth transition in the event of predetermined events such as death, retirement, or withdrawal of a partner. This agreement also incorporates the use of life insurance policies to finance the buyout process. When it comes to the different types of Nassau New York Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, there may be various variations depending on the specific needs and preferences of the partners. Some common types include: 1. Traditional Cross-Purchase Agreement: In this type of agreement, each partner is responsible for obtaining and owning a life insurance policy on the lives of the other partners. In the event of a partner's death, the surviving partners utilize the life insurance proceeds to purchase the deceased partner's interests. 2. Entity Redemption Agreement: In this arrangement, the partnership itself obtains and owns life insurance policies on the lives of each partner. If a partner dies, the partnership receives the life insurance proceeds and uses them to buy the deceased partner's interests. The remaining partners then divide the ownership. 3. Wait-and-See Agreement: This type of agreement allows partners to choose between a cross-purchase or entity redemption arrangement at a future date. Initially, partners agree to acquire life insurance policies on each other's lives. Upon the occurrence of a specified event, they can then decide whether to proceed with a cross-purchase or entity redemption scenario based on the circumstances at that time. 4. One-Way Buy-Sell Agreement: Unlike the previous types, this agreement involves only one partner purchasing another partner's interests upon their death, retirement, or withdrawal. The remaining partners do not participate in the buyout and may have negotiated different terms in the agreement, such as reduced purchase price or different payment options. 5. Hybrid Agreements: There may also be hybrid agreements that combine elements from different types mentioned above to meet the unique requirements of the business or the partners involved. These are just a few examples of the potential variations in Nassau New York Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. It is crucial for partners to consult with legal professionals who specialize in business law and partnerships to tailor the agreement to their specific circumstances.

Nassau New York Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Nassau New York Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

If you need to get a reliable legal document supplier to find the Nassau Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support team make it easy to locate and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Nassau Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Nassau Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less expensive and more affordable. Create your first business, organize your advance care planning, create a real estate contract, or complete the Nassau Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death - all from the convenience of your sofa.

Sign up for US Legal Forms now!