Orange California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legally binding contract between business partners in Orange, California. It outlines the terms and conditions for the sale or transfer of a partner's share in the event of death, retirement, or voluntary withdrawal. This type of partnership agreement is specifically designed to address the potential financial implications and uncertainties that may arise when a partner passes away, retires, or decides to leave the partnership voluntarily. It ensures a smooth transition of ownership and protects the interests of all partners involved. The agreement entails the inclusion of life insurance policies on each partner. In the case of death, the life insurance proceeds are then utilized to fund the purchase of the deceased partner's share by the surviving partners or the partnership itself. This ensures adequate funds are available to make a timely and fair buyout offer to the deceased partner's estate or designated beneficiaries, without putting unnecessary financial strain on the remaining partners or the business. There are various types of Orange California Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, including: 1. Cross-Purchase Agreement: In this agreement, each partner purchases a life insurance policy on the other partners, and in case of death, the surviving partners use the proceeds to buy the deceased partner's share proportionally. 2. Entity Redemption Agreement: Also known as stock redemption agreement, this type involves the partnership itself purchasing life insurance policies on each partner. If a partner dies, the partnership uses the life insurance proceeds to repurchase the deceased partner's share. 3. Wait-and-See Agreement: This agreement allows partners to choose between a cross-purchase or entity redemption agreement when a triggering event occurs. The decision is made at the time of the event, based on the prevailing circumstances and most favorable tax implications. It is crucial for business partners to consult with legal and financial professionals familiar with partnership agreements, life insurance policies, and the specific laws governing partnerships in Orange, California. They can tailor the agreement to fit the partners' unique circumstances and provide guidance on selecting the most suitable type of buy-sell agreement with life insurance.

Orange California Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

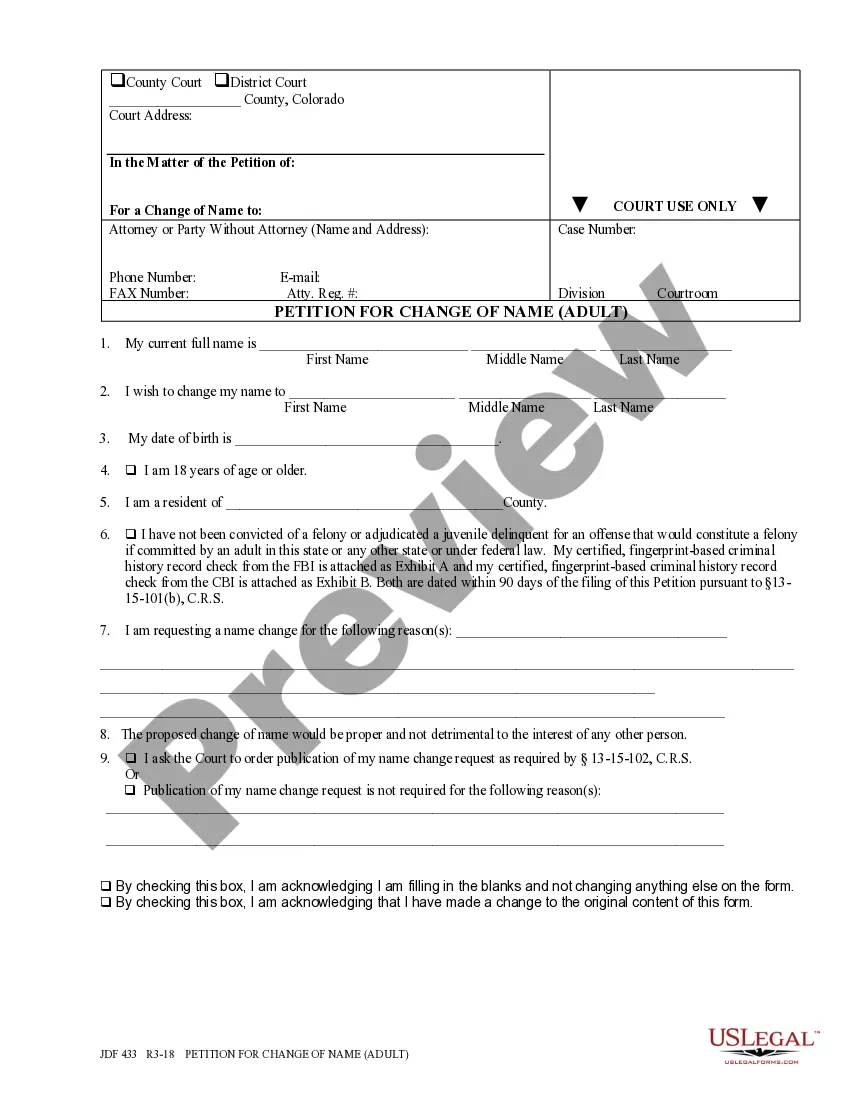

How to fill out Orange California Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

If you need to find a trustworthy legal document supplier to get the Orange Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Orange Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Orange Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Orange Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death - all from the convenience of your home.

Sign up for US Legal Forms now!