The Clark Nevada Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legally binding document that outlines the process of dissolving and winding up a partnership in the state of Nevada after the death of a partner. This agreement is specifically designed to provide a clear and comprehensive framework for resolving any remaining business matters and distributing assets between the surviving partners and the estate of the deceased partner. Keywords: Clark Nevada Agreement, Dissolve Partnership, Wind up Partnership, Surviving Partners, Estate of Deceased Partner, Nevada, Legal Document, Partnership Dissolution, Business Matters, Asset Distribution. There can be different types of Clark Nevada Agreements to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner depending on the specific circumstances and preferences of the partners involved. Some possible variations include: 1. Clark Nevada Agreement with Pre-determined Asset Distribution: This type of agreement specifies in advance how the partnership's assets will be divided between the surviving partners and the estate of the deceased partner. It may include details such as the valuation methods for the assets, the order of priority for distribution, and any specific allocations or restrictions. 2. Clark Nevada Agreement with Buyout Option: In this type of agreement, the surviving partners have the option to buy out the deceased partner's share of the partnership. The agreement may outline the conditions and terms of the buyout, including the valuation of the partner's share and the payment terms. 3. Clark Nevada Agreement with Dissolution and Liquidation: If the partners decide to dissolve the partnership entirely after the death of a partner, this type of agreement outlines the process of liquidating the partnership's assets, paying off any debts, and distributing the remaining funds between the surviving partners and the estate of the deceased partner. It may also include provisions for terminating any existing contracts or agreements. 4. Clark Nevada Agreement with Succession Plan: In situations where the partnership has a predefined succession plan, this type of agreement outlines the steps to be taken for transferring the deceased partner's share to the designated successor. It may involve legal formalities, such as updating partnership agreements or registering new partners with the relevant authorities. 5. Clark Nevada Agreement with Mediation or Arbitration Clause: Partnerships often include dispute resolution mechanisms to handle any disagreements that may arise during the dissolution and winding up process. This type of agreement may include provisions for mediation or arbitration to resolve disputes amicably and avoid litigation. It is important to consult with legal professionals familiar with Nevada partnership law to tailor the Clark Nevada Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner to fit the specific needs and circumstances of the partnership.

Clark Nevada Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Clark Nevada Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

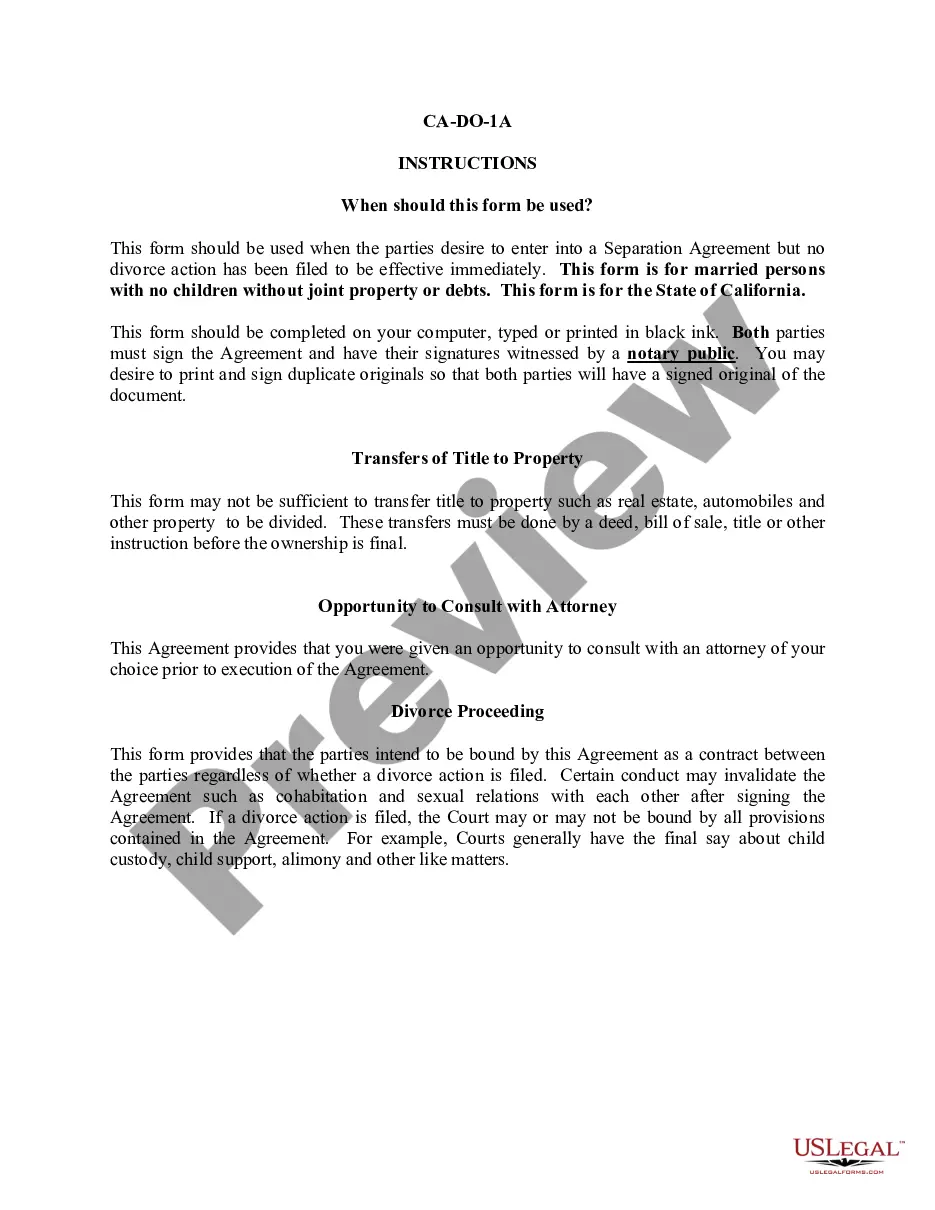

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Clark Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Clark Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner from the My Forms tab.

For new users, it's necessary to make some more steps to get the Clark Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

In a landmark judgment, in Mohd Laiquiddin v Kamala Devi Misra (deceased) by LRs,(1) the Supreme Court has ruled that on the death of a partner of a firm comprised of only two partners, the firm is dissolved automatically; this is notwithstanding any clause to the contrary in the partnership deed.

1 General principles. When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

Firm, stands dissolved automatically on death of one partner. Continuance of business after such death would not tantamount to continuance of earlier partnership. In the absence of a contract to the contrary, the insolvency of any of the partner may dissolve the firm.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Aggregate Theory Therefore, unless you and the other partners have made an agreement that the partnership will continue intact after a partner dies, the general partnership dissolves after the death of a partner.

The partners who have not wrongfully dissociated may participate in winding up the partnership business. On application of any partner, a court may for good cause judicially supervise the winding up. UPA, Section 37; RUPA, Section 803(a).

By Operation of Law Or a partner may die or one or more partners or the entire partnership may become bankrupt. Dissolution under these circumstances is said to be by operation of law.