The Oakland Michigan Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legal document that outlines the process of ending a partnership upon the death of one of the partners. This agreement is crucial for ensuring a smooth transition and fair distribution of assets and liabilities among the surviving partners and the estate of the deceased partner. Keywords: Oakland Michigan, Agreement to Dissolve, Wind up Partnership, Surviving Partners, Estate of Deceased Partner In Oakland County, Michigan, there are different types of agreements to dissolve and wind up partnerships between surviving partners and the estate of a deceased partner. These types may include: 1. General Partnership Dissolution Agreement: This type of agreement is used when the partnership was formed without any specific business structure, and the partners have equal rights and responsibilities. 2. Limited Partnership Dissolution Agreement: In this case, the partnership consists of both general partners (who actively manage the business) and limited partners (who only invest capital). The agreement will specify how the limited partners are involved in the process of dissolution and winding up. 3. Limited Liability Partnership Dissolution Agreement: This type of partnership usually consists of professionals, such as lawyers or accountants, who want to limit their personal liability. The agreement will address the distribution of assets, liabilities, and any remaining obligations among the surviving partners and the estate. The Oakland Michigan Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner typically includes the following key elements: 1. Identification and Background: The agreement names the partnership, identifies the surviving partners, and provides necessary information about the deceased partner, including their estate representative. 2. Dissolution Process: The agreement outlines the steps to be followed for dissolving the partnership, including notifying relevant parties, closing accounts, and wrapping up business operations. 3. Assets and Liabilities: It addresses how the partnership assets and liabilities will be distributed among the surviving partners and the estate of the deceased partner. This includes the settlement of outstanding debts, selling or transferring assets, and resolving any pending legal matters. 4. Continuation or Termination: The agreement may determine if the partnership will continue with the surviving partners or if it will be terminated following the winding-up process. 5. Buyout Option: In some cases, the surviving partners may have the option to buy out the deceased partner's share in the partnership. The agreement may establish the terms and conditions for such a buyout. 6. Dispute Resolution: If any disputes arise during the dissolution and winding-up process, the agreement may outline a preferred method of resolution, such as mediation or arbitration. It's essential to consult with legal professionals familiar with Oakland Michigan partnership laws to ensure that the Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner complies with all necessary regulations and safeguards the interests of all parties involved.

Oakland Michigan Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Oakland Michigan Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Oakland Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Oakland Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Oakland Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner:

- Examine the content of the page you’re on.

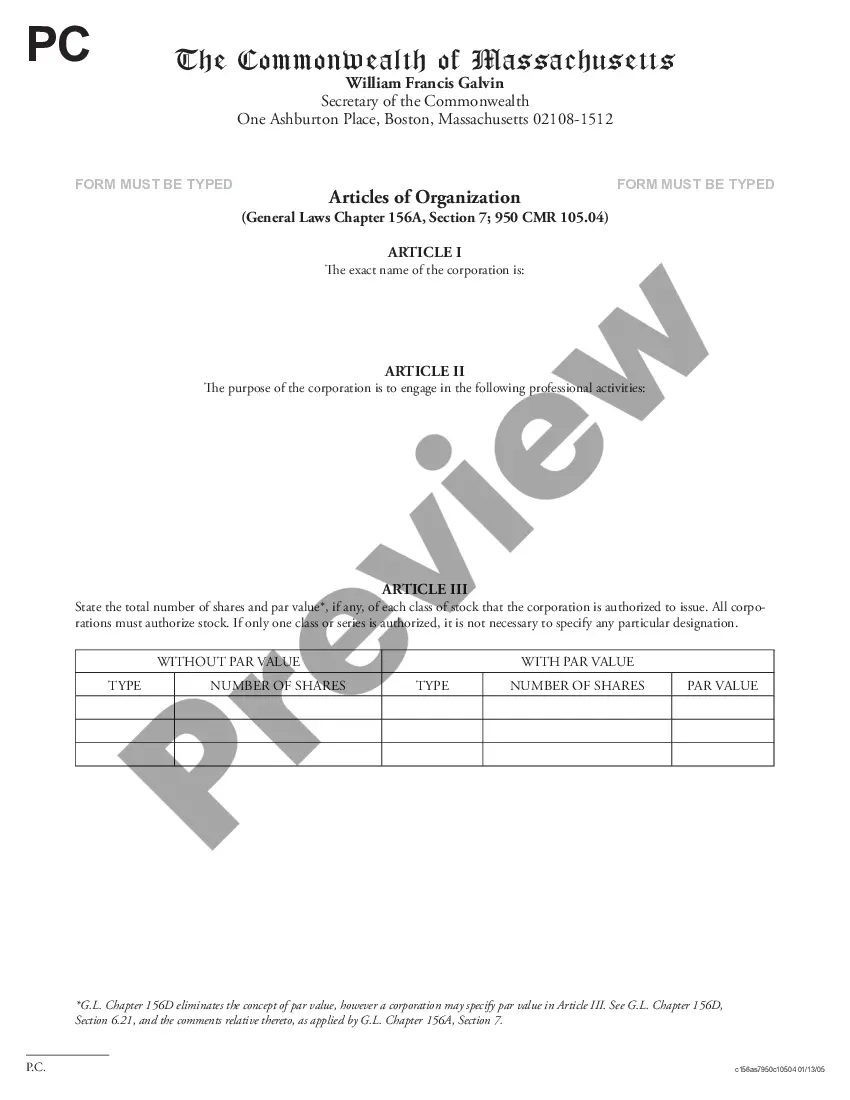

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!