The Montgomery Maryland Partnership Buy-Sell Agreement is a legally binding document that outlines the terms and conditions for the transfer of ownership in a two-person partnership, where each partner owns an equal share of 50%. In the event of the death of one partner, this agreement ensures a smooth transition of ownership by requiring the estate of the deceased partner to sell their share to the surviving partner at a fixed value. This type of agreement serves as a protective measure for both partners, preserving the stability and continuity of the partnership while also providing financial security for the deceased partner's estate. By fixing the value of the partnership, the agreement eliminates any uncertainties or disputes that may arise regarding the estimation of the deceased partner's share. Furthermore, the requirement for the sale by the estate of the deceased partner to the surviving partner ensures a seamless transfer of ownership without the need for lengthy legal processes or potential conflicts. This provision also safeguards the interests of the surviving partner by granting them the opportunity to maintain control and continue the partnership operations. Different variations of the Montgomery Maryland Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership may include specific clauses addressing the following: 1. Valuation Methodology: The agreement may detail the specific method to be used for determining the fixed value of the partnership, such as the use of appraisals, book value calculations, or other agreed-upon valuation methodologies. This ensures transparency and fairness in the pricing of the deceased partner's share. 2. Payment Terms: The agreement may outline the payment terms for the surviving partner, specifying the timeframe and method of payment for acquiring the deceased partner's share. This could include options for lump-sum payment, installment payments, or utilizing insurance policies to fund the buyout. 3. Contingency Planning: In certain scenarios, additional provisions may be included to address contingencies, such as the incapacity or disability of one partner. These provisions ensure that the agreement remains effective regardless of unforeseen circumstances, providing a comprehensive plan for the partnership's future. 4. Dispute Resolution: The agreement may establish procedures for resolving any disputes that may arise throughout the buy-sell process, including mediation or arbitration. This helps to mitigate potential conflicts and protect the interests of both partners. The Montgomery Maryland Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership is a crucial legal instrument in safeguarding the continuity and stability of partnerships in Montgomery, Maryland. With its provisions for valuation, sale requirements, and other specific clauses, this agreement provides a clear framework for the seamless transition of ownership in the event of a partner's death.

Montgomery Maryland Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

How to fill out Montgomery Maryland Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Montgomery Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Montgomery Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

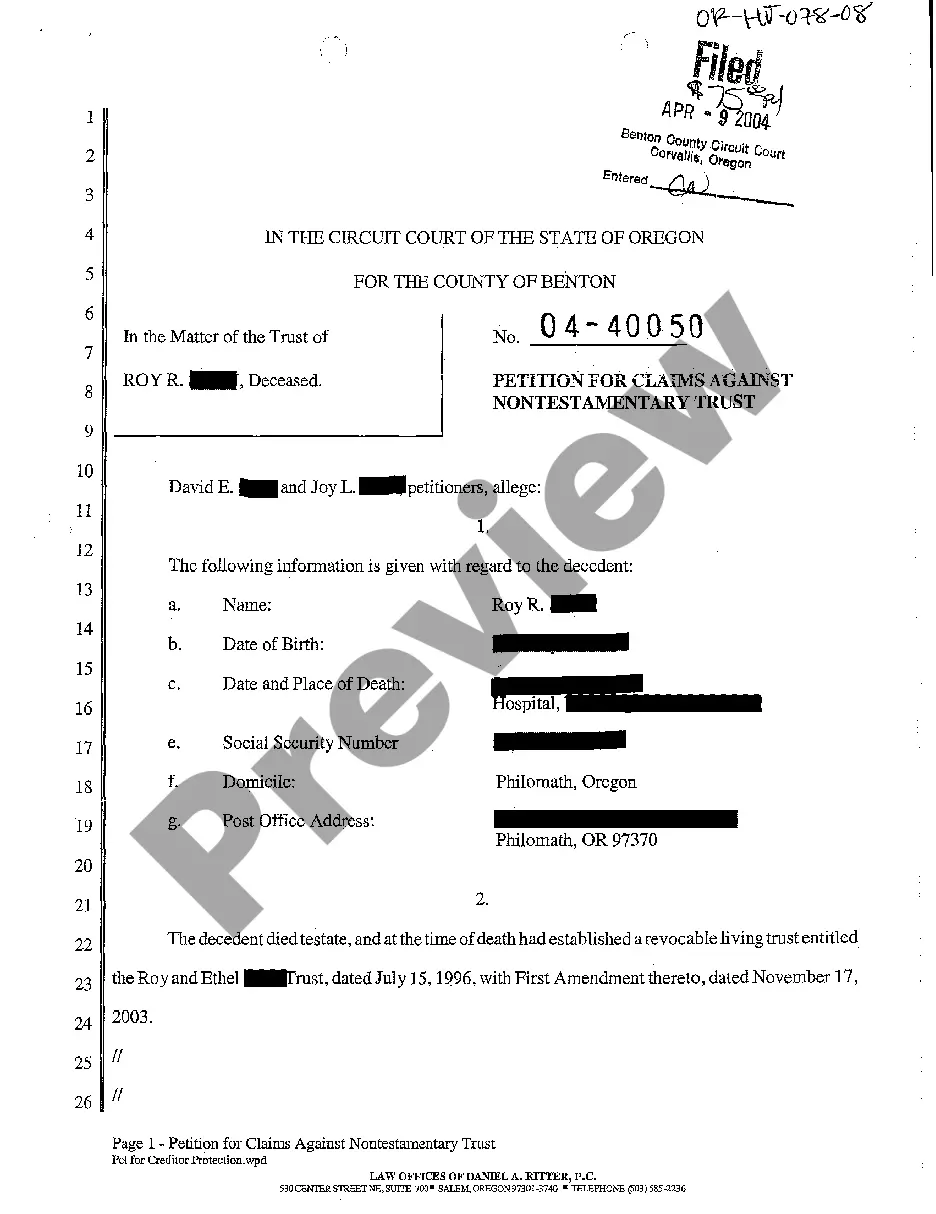

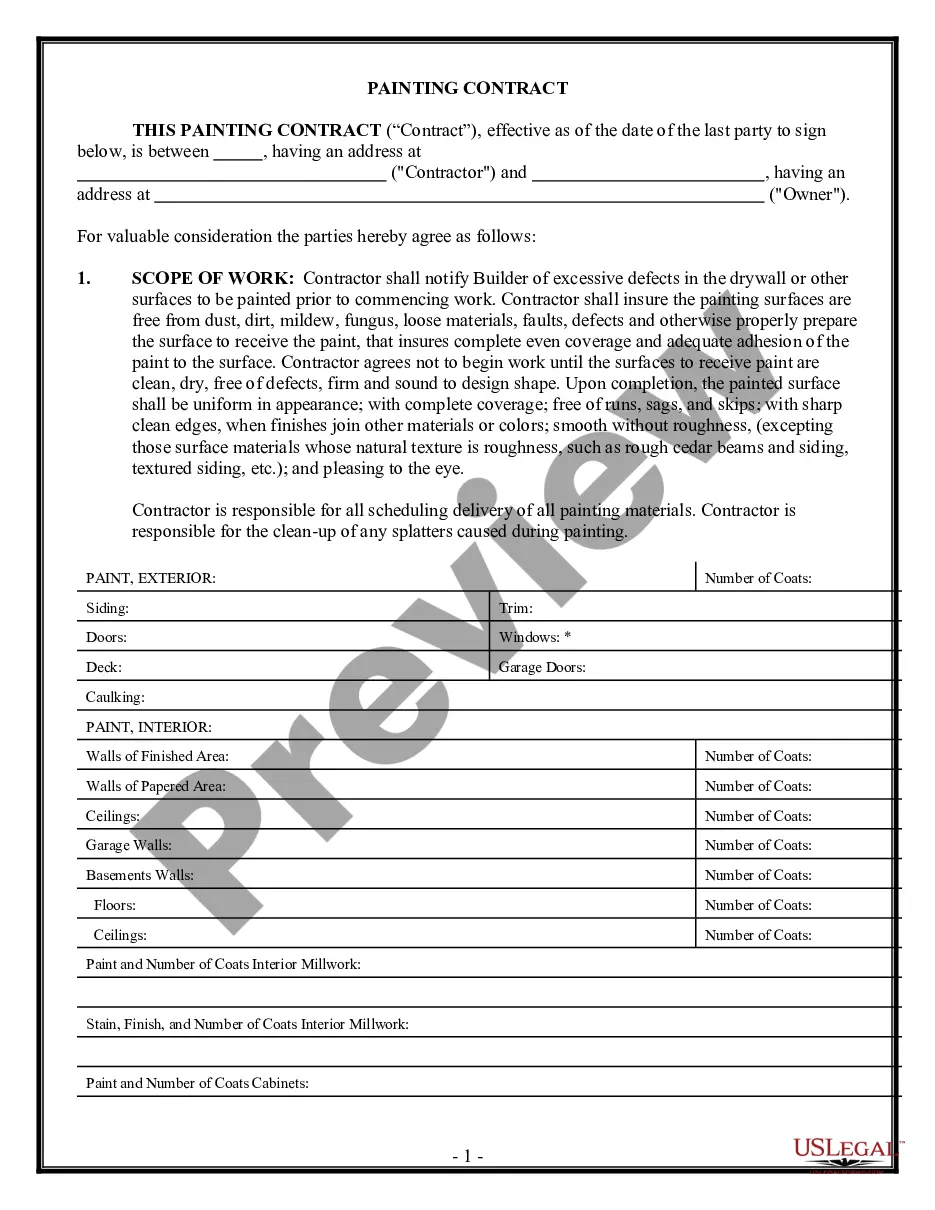

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!