Dallas Texas Agreement Acquiring Share of Retiring Law Partner is a legal document that outlines the terms and conditions surrounding the acquisition of a retiring law partner's share in a law firm based in Dallas, Texas. This agreement is crucial in maintaining the smooth transition of ownership and ensuring the fair distribution of assets and liabilities. In Dallas, Texas, law firms often have various types of agreements for acquiring the share of a retiring law partner. Some commonly seen types include: 1. Buyout Agreement: This type of agreement outlines the terms and conditions for the purchasing law firm to buy the retiring law partner's share. It specifies the purchase price, payment terms, and how the funds will be allocated. 2. Partnership Agreement Amendment: Sometimes, existing partnership agreements have provisions for acquiring a retiring law partner's share. In such cases, an amendment is made to the partnership agreement, clearly stating the details of the acquisition, including financial arrangements and the new ownership structure. 3. Succession Plan Agreement: A law firm may have a pre-established succession plan in place to smoothly transition the retiring law partner's share to other partners or key associates within the firm. This agreement will define the succession plan and the terms under which the share will be redistributed. 4. Asset Purchase Agreement: In certain situations, the acquisition may involve the outright purchase of the retiring law partner's share, including the assets associated with it. This agreement will outline the assets being transferred, the purchase price, and any warranties or representations made by the retiring partner. Regardless of the specific type, a Dallas Texas Agreement Acquiring Share of Retiring Law Partner generally includes the following key elements: 1. Identification of the parties: This section identifies the law firm, retiring law partner, and any other relevant parties involved in the acquisition. 2. Purchase details: The agreement specifies the share being acquired, the purchase price, and the payment terms, including any lump sums, installments, or contingent payments. 3. Allocation of assets and liabilities: It outlines how the assets and liabilities associated with the retiring partner's share will be distributed among the remaining partners or the purchasing law firm. 4. Termination of partnership: If the acquisition results in the retirement or withdrawal of the partner from the firm, the agreement will include provisions related to the termination of the retired partner's partnership interest. 5. Non-compete and confidentiality clauses: To protect the interests of the acquiring law firm, the retiring partner will often be required to agree to non-compete and confidentiality clauses, preventing them from competing directly with the firm or disclosing sensitive information. 6. Dispute resolution and governing law: This section specifies the mechanism for resolving any disputes arising from the agreement and designates the jurisdiction whose laws will govern the agreement. These agreements play a pivotal role in the succession planning and preserving the stability of the law firm in Dallas, Texas, by providing a clear framework for the transfer of a retiring law partner's share. Consulting with legal professionals experienced in partnership agreements is highly recommended ensuring that the agreement accurately captures the intentions of all parties involved.

Dallas Texas Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Dallas Texas Agreement Acquiring Share Of Retiring Law Partner?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Dallas Agreement Acquiring Share of Retiring Law Partner, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Dallas Agreement Acquiring Share of Retiring Law Partner.

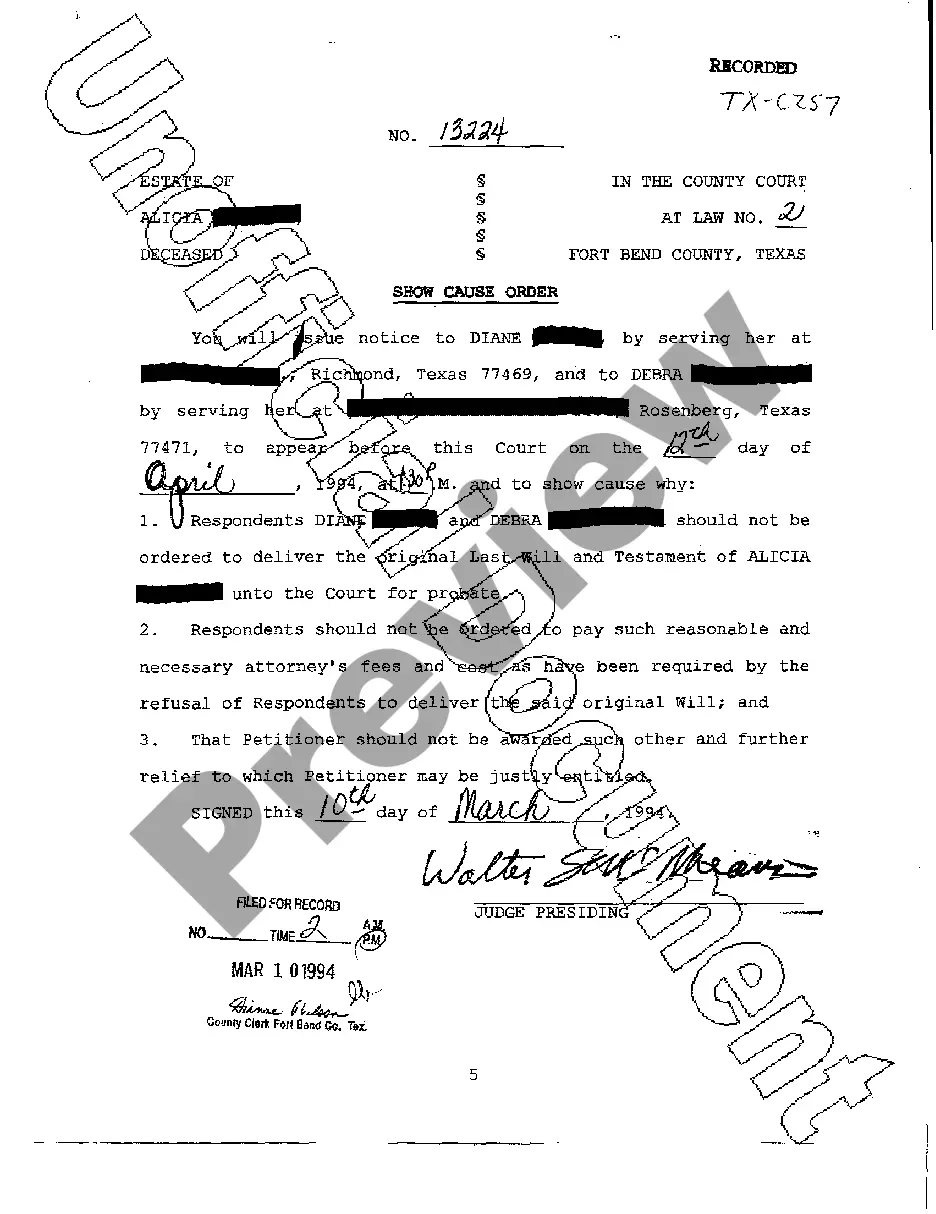

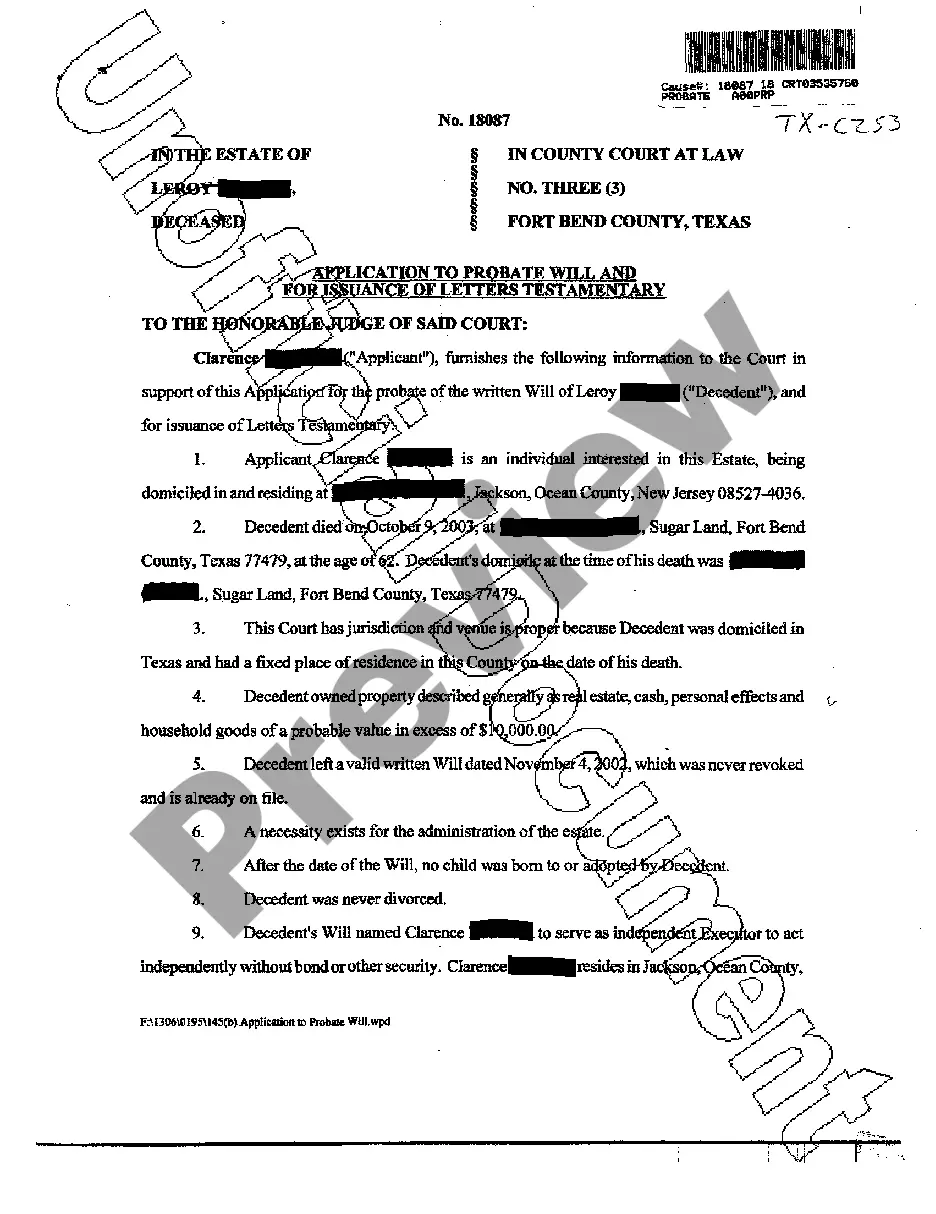

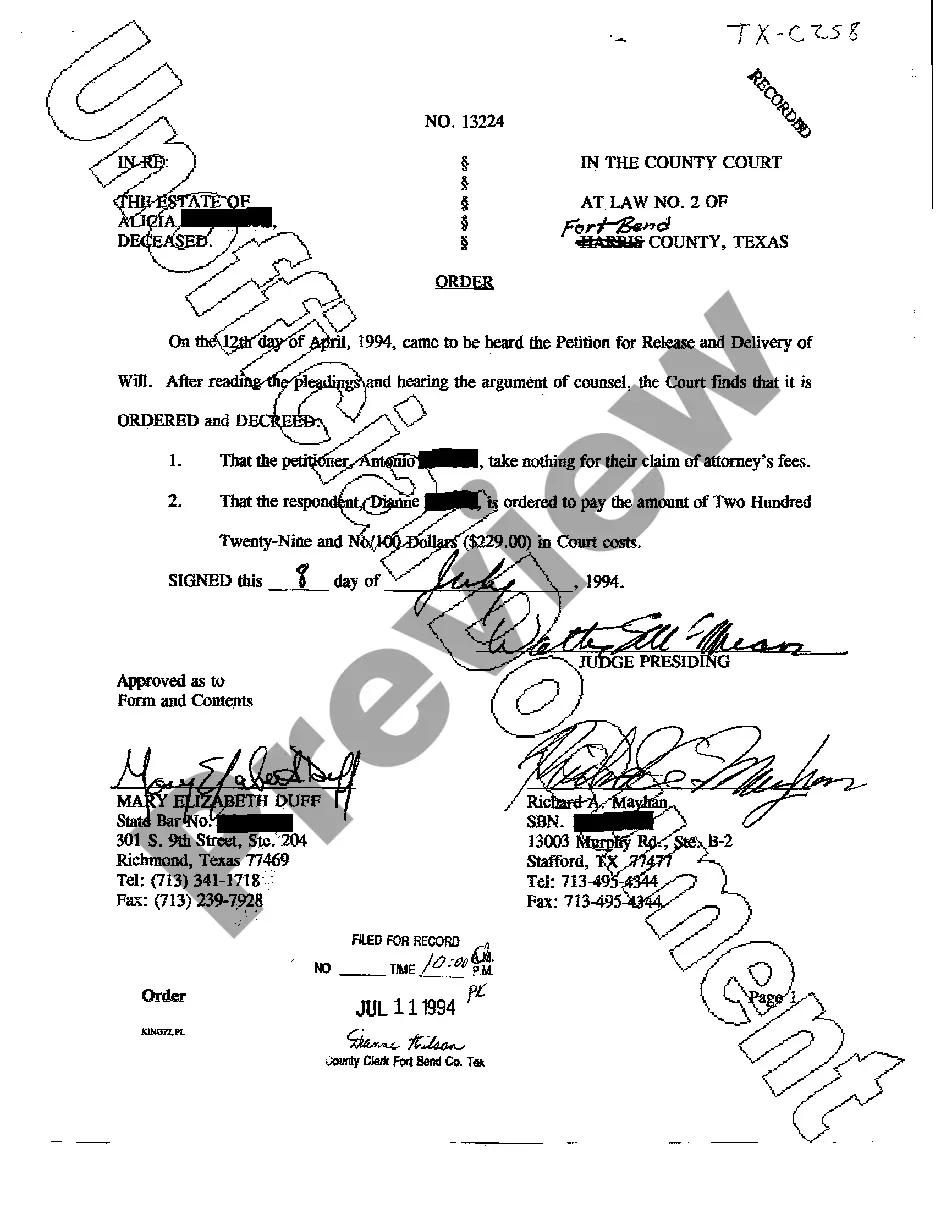

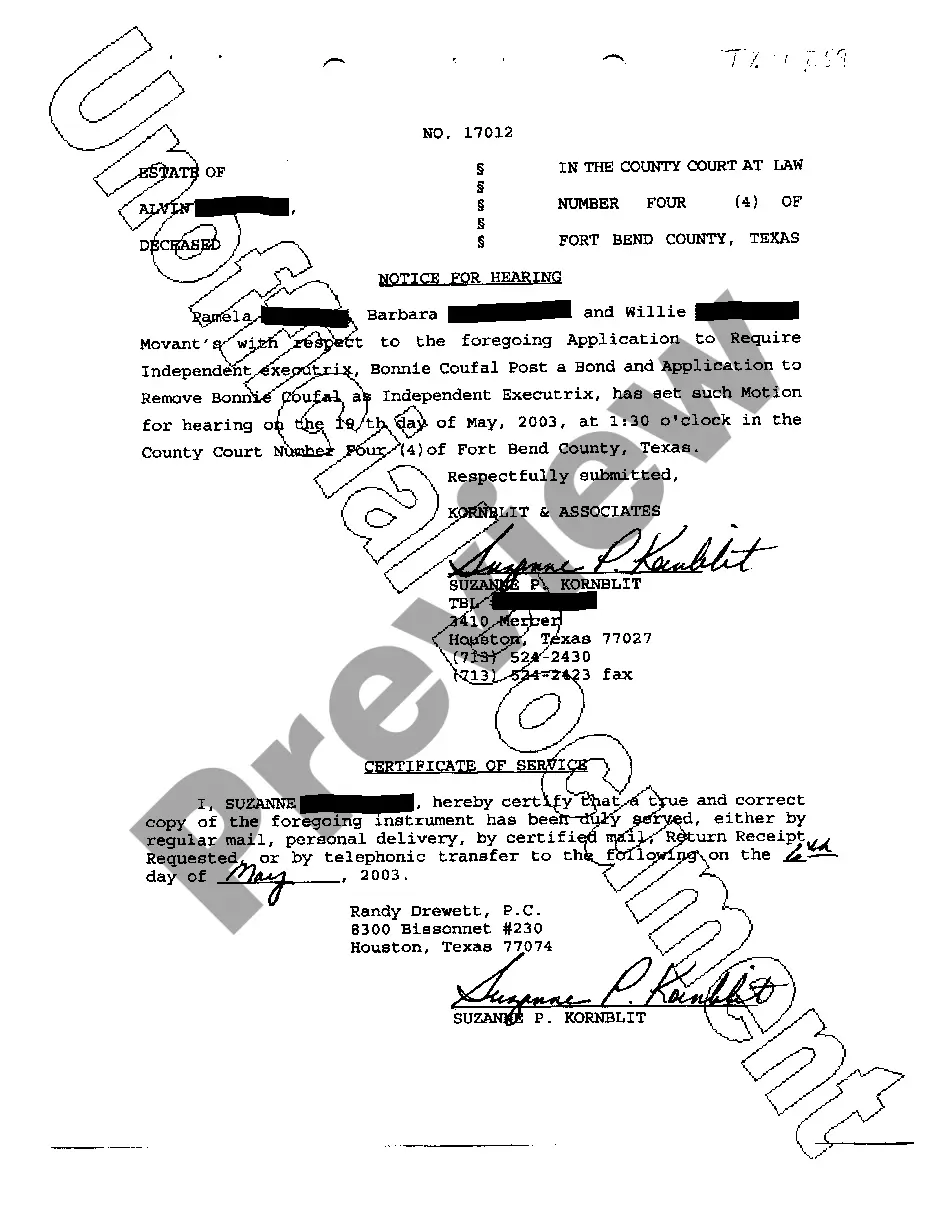

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Dallas Agreement Acquiring Share of Retiring Law Partner.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Dallas Agreement Acquiring Share of Retiring Law Partner, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you need to deal with an extremely challenging case, we advise getting a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork effortlessly!