Santa Clara California Agreement Acquiring Share of Retiring Law Partner is a legal contract that outlines the terms and conditions of acquiring a portion of a retiring law partner's share in a law firm based in Santa Clara, California. This agreement serves to protect the rights and interests of all parties involved in the transaction and ensures a smooth transition of ownership. In such an agreement, several key elements are typically included. Firstly, the agreement outlines the specific percentage of the law partner's share that will be acquired by the remaining partners or the new partner(s). It also states the purchase price or valuation method utilized to determine the value of the retiring partner's share. The agreement further establishes the payment terms and conditions, including the timeframe for making the payment or installment plans if applicable. It may also address any potential adjustments to the purchase price based on the firm's financial performance or other agreed-upon factors. Additionally, the agreement may stipulate the retiring partner's obligations and responsibilities during the transition period, such as completing pending cases or assisting with the client transition process. It can also address non-competition or non-solicitation clauses to protect the firm's interests. Types of Santa Clara California Agreement Acquiring Share of Retiring Law Partner may include: 1. Stock Purchase Agreement: This type of agreement involves the purchase of the retiring partner's share in the law firm as corporate stock or shares, reflecting the proportionate ownership in the firm. 2. Partnership or Membership Interest Purchase Agreement: If the law firm operates as a partnership or limited liability company, this type of agreement is utilized to acquire the retiring partner's partnership or membership interest. 3. Asset Purchase Agreement: In some cases, the acquiring partners may opt to purchase specific assets of the retiring partner, such as client lists, goodwill, or intellectual property, rather than acquiring their share in the firm directly. 4. Buy-Sell Agreement: This agreement is typically created well in advance to address the future retirement or departure of partners. It establishes a mechanism and terms for the acquisition of a retiring partner's share by the remaining partners or the firm itself. In summary, a Santa Clara California Agreement Acquiring Share of Retiring Law Partner facilitates a smooth transition of ownership within a law firm. It defines the specifics of the share acquisition, payment terms, and the retiring partner's obligations, ensuring a fair and well-structured transaction for all parties involved.

Santa Clara California Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Santa Clara California Agreement Acquiring Share Of Retiring Law Partner?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Santa Clara Agreement Acquiring Share of Retiring Law Partner, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Agreement Acquiring Share of Retiring Law Partner from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Santa Clara Agreement Acquiring Share of Retiring Law Partner:

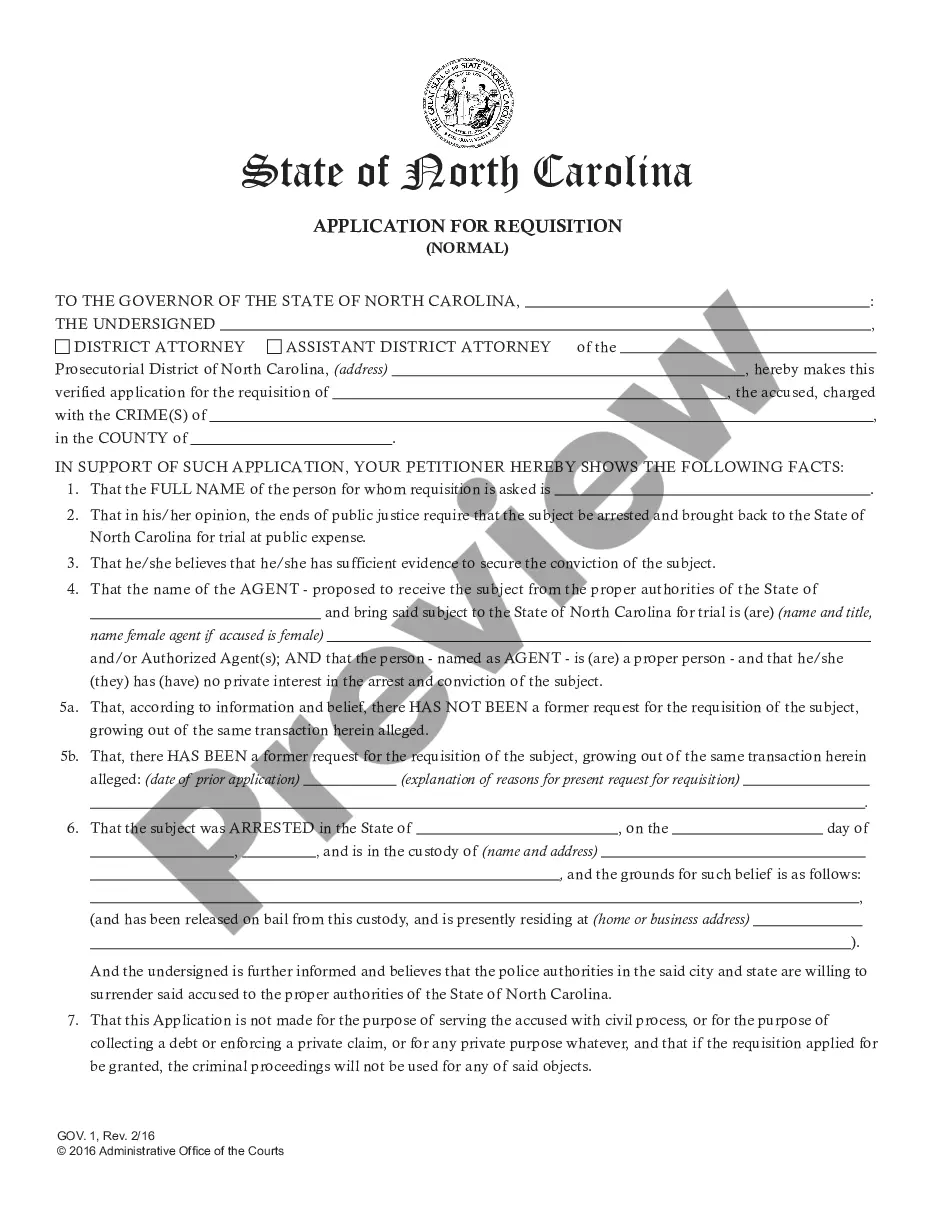

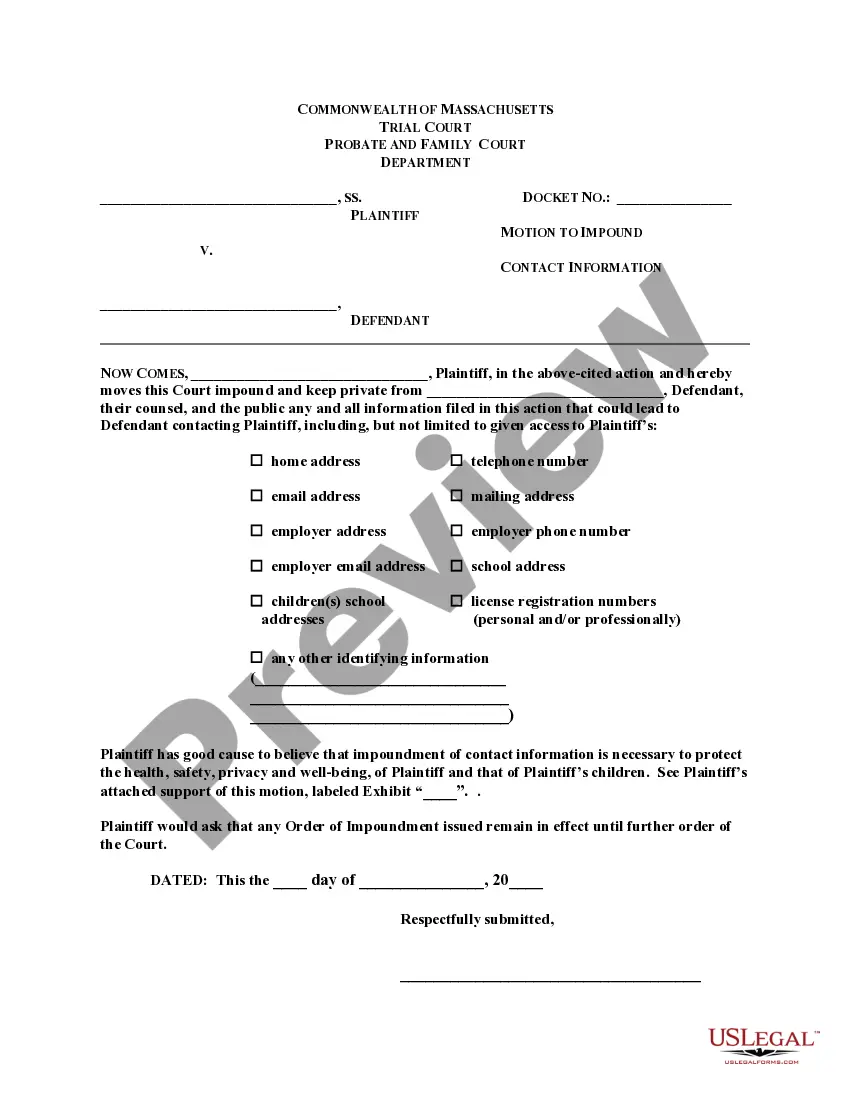

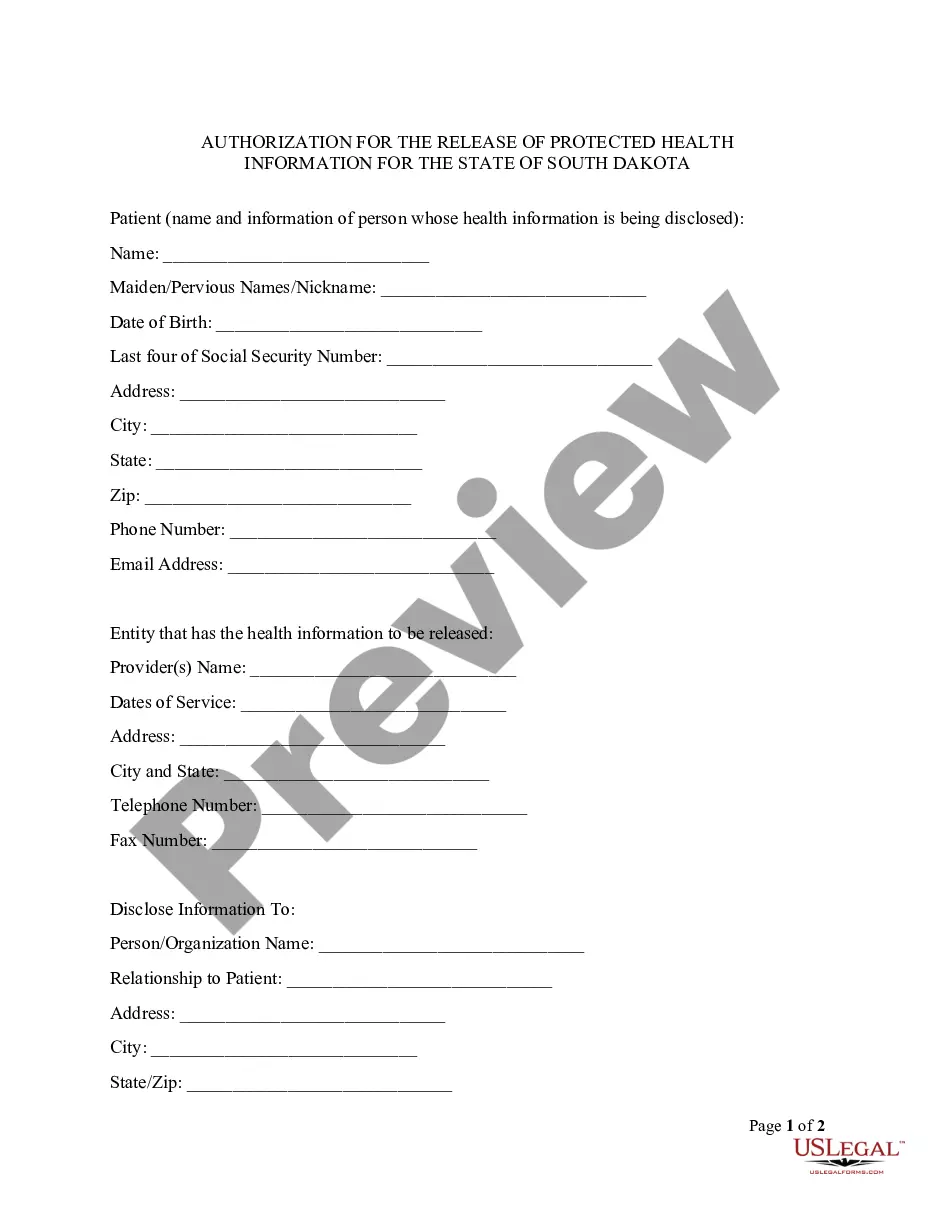

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!