Clark Nevada Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation is a legal agreement that outlines the terms and conditions of a partnership where profits and losses are distributed among the partners based on their respective units of participation. This agreement is commonly used in the field of law and is designed to ensure fair and equitable distribution of financial outcomes among partners. The Clark Nevada Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation serves as a binding contract between all parties involved and establishes crucial aspects of the partnership, including the allocation of profits and losses based on the units of participation. These units are typically determined by each partner's contribution to the partnership, which can include capital investment, expertise, or other valuable contributions. One type of Clark Nevada Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation is the Limited Partnership Agreement. This agreement involves two types of partners: general partners and limited partners. General partners have active roles in managing the partnership and are accountable for its debts and liabilities. Limited partners, on the other hand, have limited liability and are typically passive investors who contribute capital without actively participating in the partnership's operations. Another variation is the Professional Partnership Agreement. This type of partnership agreement is focused on professionals within the legal field, such as lawyers, attorneys, or solicitors, who come together to form a partnership. These partnerships often operate based on the units of participation, as each partner's expertise, client base, and caseload can differ. The partnership agreement regulates the division of profits and losses based on the units of participation, reflecting the individual contribution and value of each partner within the firm. In summary, the Clark Nevada Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation is a legally binding contract used in law firms, which outlines the division of profits and losses among partners based on their respective units of participation. Different types of this agreement include the Limited Partnership Agreement and the Professional Partnership Agreement, each tailored to specific partnership structures and requirements within the legal profession.

Clark Nevada Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation

Description

How to fill out Clark Nevada Law Partnership Agreement With Profits And Losses Shared On Basis Of Units Of Participation?

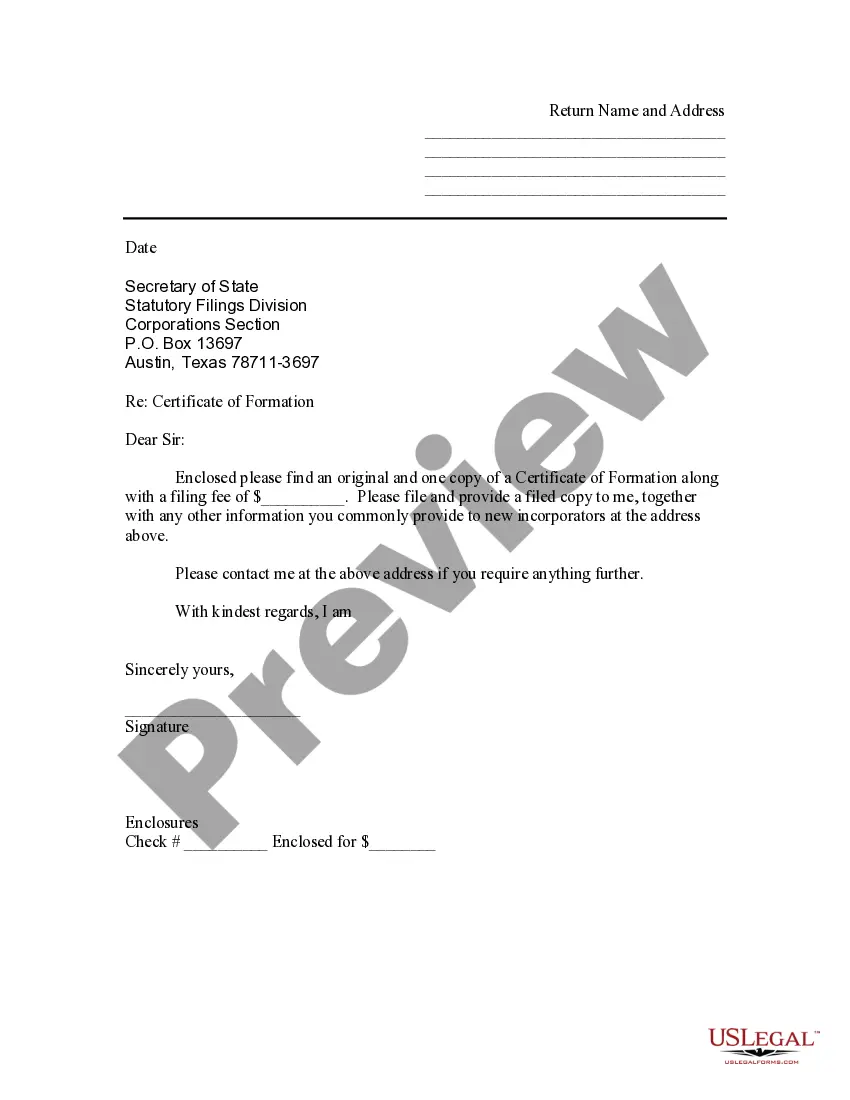

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a Clark Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Clark Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Clark Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!