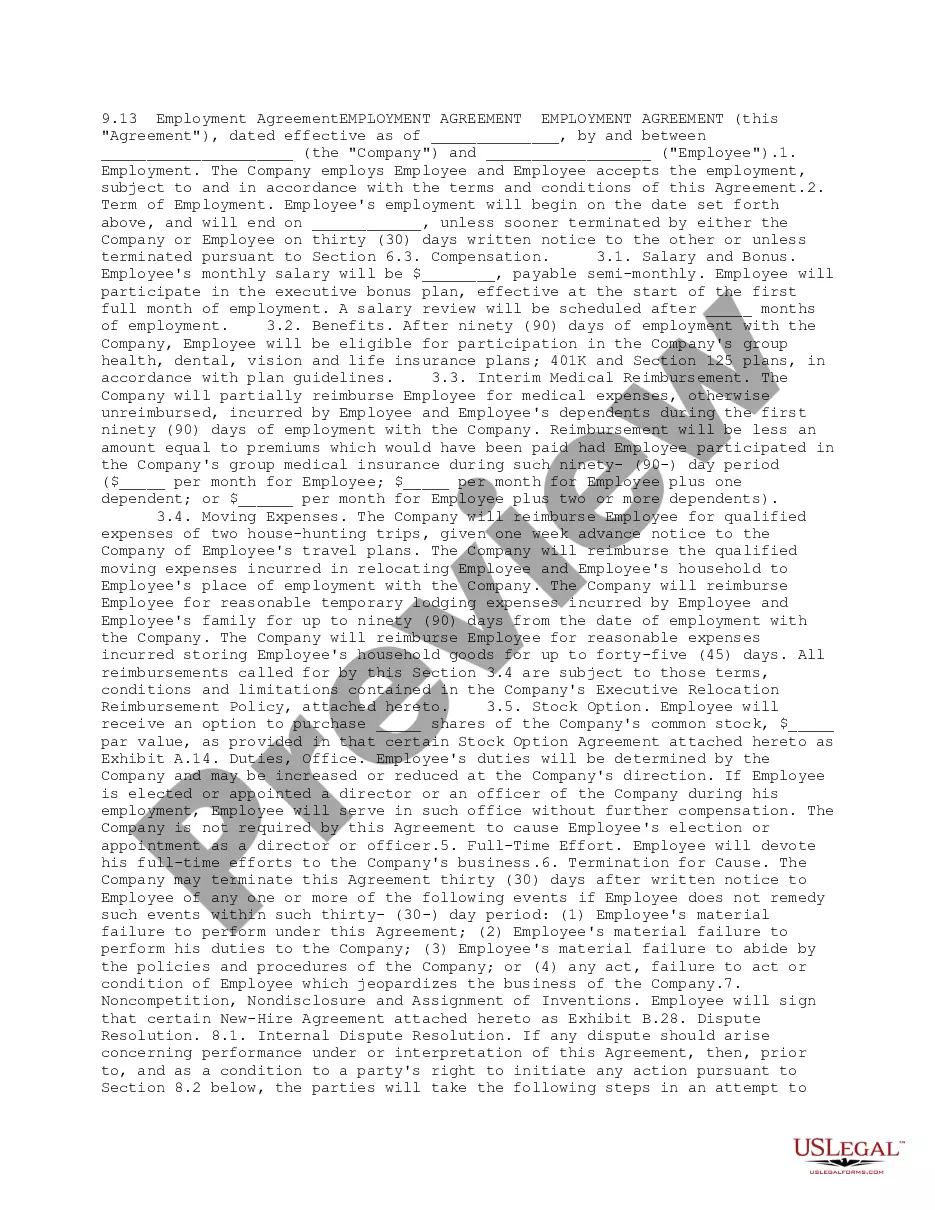

The Alameda California Credit Approval Form is a document required by financial institutions, lenders, or credit providers to assess an individual or business's creditworthiness for various financial services, such as loans, credit cards, or mortgages. This form aims to gather crucial information about an applicant's financial history, income, debt obligations, and other relevant details needed for evaluating their creditworthiness and determining the approval decision. Keywords: Alameda California, credit approval form, financial institutions, lenders, credit providers, creditworthiness, loans, credit cards, mortgages, applicant, financial history, income, debt obligations, evaluation, approval decision. Different types of Alameda California Credit Approval Forms may include: 1. Personal Credit Approval Form: This form is used when an individual is applying for personal financial services, such as personal loans or credit cards. It will typically require personal information, employment details, income sources, outstanding debts, and credit history. 2. Business Credit Approval Form: This form is designed for businesses seeking credit or financing options, such as business loans, lines of credit, or trade credit. It will require information about the business's financials, including revenue, expenses, assets, liabilities, and business credit history. 3. Mortgage Credit Approval Form: This form is specific to individuals applying for a mortgage to purchase a property. It will include sections for the applicant's personal information, income, employment history, assets and liabilities, as well as details about the property being financed. 4. Credit Card Approval Form: This form is used when applying for a credit card, allowing the credit card company to assess an individual's creditworthiness and determine their credit limit. It will require personal information, income sources, employment details, outstanding debts, and credit history. 5. Auto Loan Credit Approval Form: This form is utilized by individuals seeking financing for purchasing an automobile. It will include sections for personal information, employment details, income, existing debts, and credit history, along with specific details about the vehicle being financed. Keywords: personal credit approval form, business credit approval form, mortgage credit approval form, credit card approval form, auto loan credit approval form.

Alameda California Credit Approval Form

Description

How to fill out Alameda California Credit Approval Form?

Drafting documents for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Alameda Credit Approval Form without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Alameda Credit Approval Form by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Alameda Credit Approval Form:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!