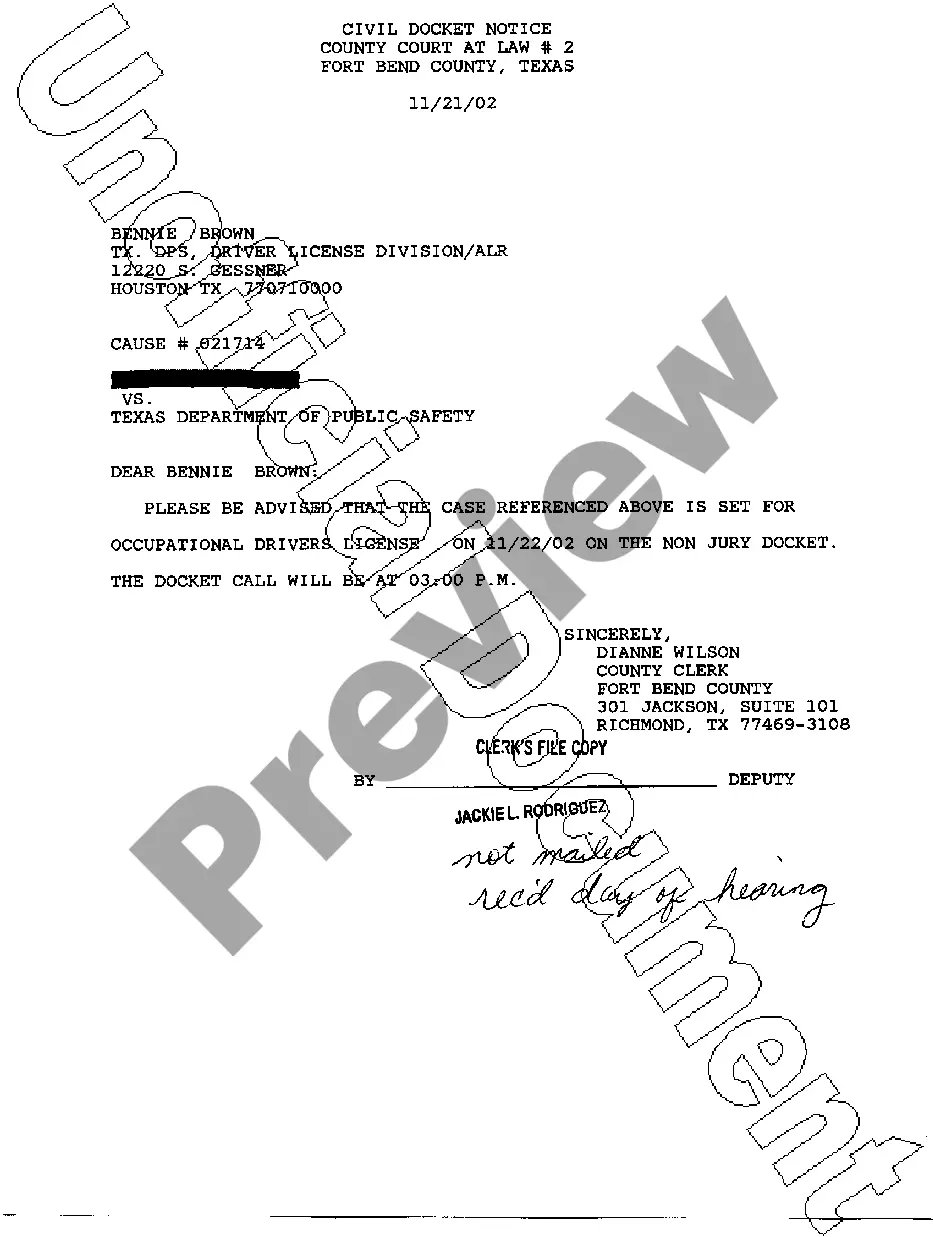

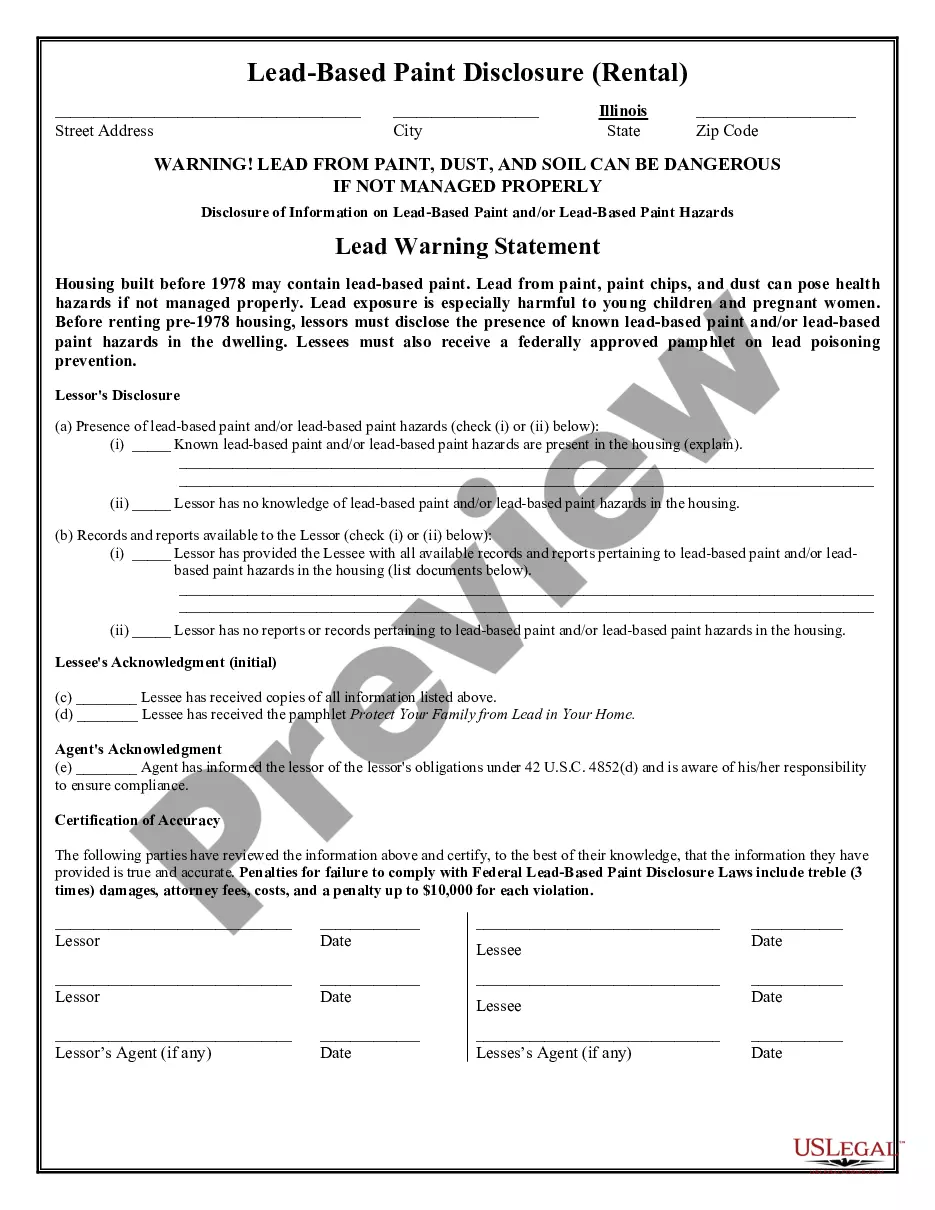

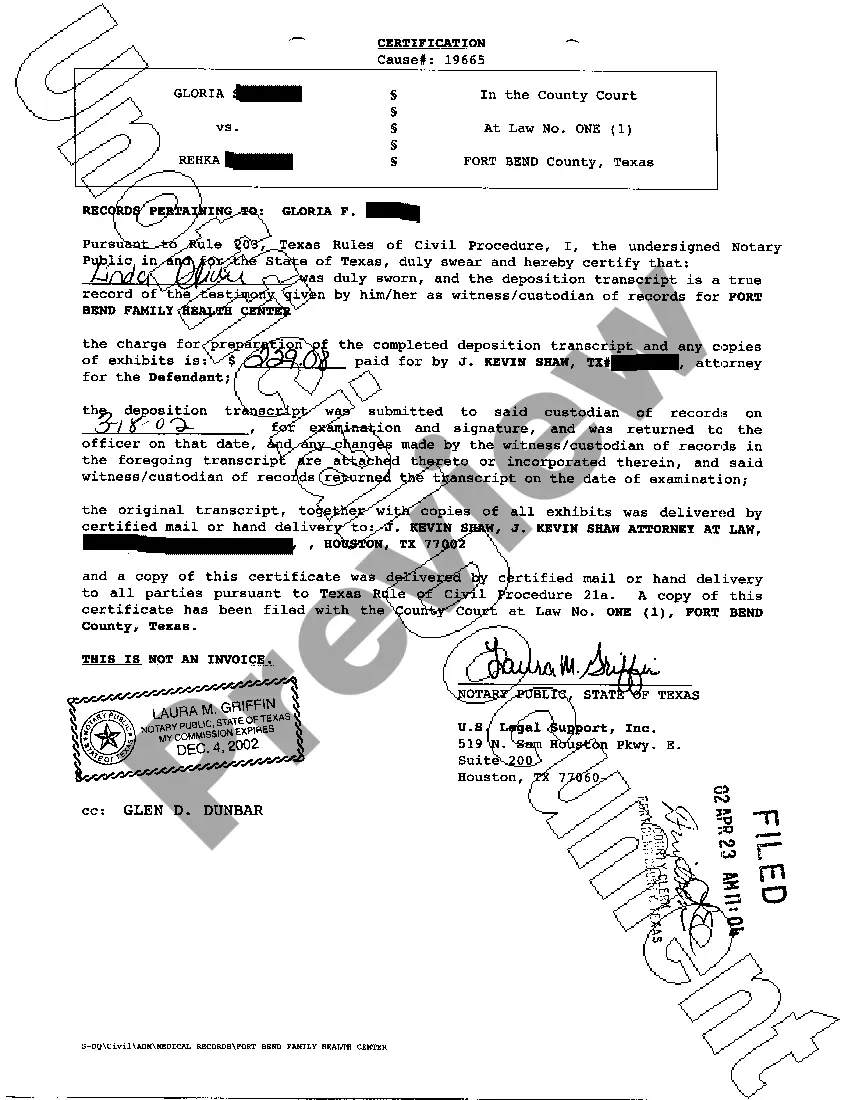

Bronx New York Credit Approval Form is a document used in the Bronx, New York, to assess and approve credit applications or loan requests. It is an essential tool for banks, financial institutions, and lending agencies to gather all necessary information from applicants looking to obtain credit. This form plays a crucial role in determining an individual's creditworthiness and their ability to repay borrowed funds. The Bronx New York Credit Approval Form is divided into several sections to ensure comprehensive evaluation. These sections typically include personal information, employment details, financial history, and references. Keywords used in this context could be: 1. Bronx: Referring to the borough in New York City, where this credit approval form is utilized as a standard procedure for gaining financial assistance. 2. New York: Indicates the specific location of the credit approval form, highlighting that it is tailored to comply with the regulations and requirements of the state of New York. 3. Credit Approval Form: Denotes the document itself, indicating its purpose of evaluating credit applications and making decisions based on the information provided. 4. Credit Application: The form serves as an application for credit, enabling individuals to request loans or lines of credit from financial institutions within the Bronx area. 5. Loan Approval: This form assists in the process of approving loan applications, evaluating the applicant's financial status, credit history, and ability to repay liabilities. 6. Creditworthiness: Implies the measure of an individual's financial reliability and ability to fulfill financial obligations. 7. Financial Institutions: Specifies that the form is designed for use by banks, credit unions, and other lending agencies in the Bronx, New York, ensuring consistency across different entities. There might not be different types of Bronx New York Credit Approval Forms per se, but variations may exist depending on the specific lender or financial institution. Each financial entity might have its own customized version of the form, incorporating certain additional requirements or modifications. It is important for applicants to provide accurate and up-to-date information in the Bronx New York Credit Approval Form as any misrepresentation or omission can affect the approval process. The form acts as a vital link between borrowers and financial institutions, helping to determine creditworthiness and ultimately assisting in the decision-making process for granting loans or lines of credit to individuals in the Bronx, New York.

Bronx New York Credit Approval Form

Description

How to fill out Bronx New York Credit Approval Form?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Bronx Credit Approval Form without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Bronx Credit Approval Form on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Bronx Credit Approval Form:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!