Travis Texas Credit Approval Form is a crucial document used by Travis Texas financial institutions or lenders to evaluate and assess the creditworthiness of individuals or businesses applying for credit. The credit approval form is an official paperwork that gathers comprehensive information about the applicant's financial background, credit history, income, assets, and liabilities. It helps lenders determine the level of risk associated with extending credit to the applicant and ultimately decides whether to approve or deny the credit request. The Travis Texas Credit Approval Form typically requests essential applicant information, including personal details such as name, contact information, social security number, and employment information. Moreover, the form dives into a detailed analysis of the applicant's financial standing. It requires specifics on the applicant's sources of income, such as employment salary, rental income, investments, or any other revenue streams. One crucial aspect of the Travis Texas Credit Approval Form is the evaluation of the individual's credit history. This involves gathering details on any existing loans, debts, or lines of credit, along with payment history and credit scores. Lenders often analyze an applicant's credit report from major credit bureaus to assess their creditworthiness accurately. The form also requires detailed information about the collateral or assets an applicant possesses. Collateral serves as security for the loan, reassuring lenders of their ability to recover the owed amount in case of default. Thus, the form may include sections that inquire about properties, vehicles, investments, or any other valuable assets owned by the applicant. Additionally, the Travis Texas Credit Approval Form may include sections dedicated to collecting references, such as personal or professional contacts who can provide further insight into the applicant's character, reliability, and financial responsibility. While the Travis Texas Credit Approval Form generally covers all the necessary aspects of evaluating creditworthiness, there may be variations or specific types of credit approval forms based on the type of credit being sought. Some examples of specialized forms may include Mortgage Credit Approval Forms, Auto Loan Credit Approval Forms, Small Business Loan Credit Approval Forms, or Personal Loan Credit Approval Forms. These specialized forms may require additional information or have specific sections tailored to the unique considerations of these credit types. In conclusion, the Travis Texas Credit Approval Form is a comprehensive document used by lenders to thoroughly assess the financial stability and creditworthiness of individuals or businesses seeking credit. By providing detailed information about an applicant's financial background, credit history, income, and collateral/assets, the form allows lenders to determine the level of risk associated with extending credit and make informed decisions regarding credit approval.

Travis Texas Credit Approval Form

Description

How to fill out Travis Texas Credit Approval Form?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Credit Approval Form, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Travis Credit Approval Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Travis Credit Approval Form:

- Glance through the page and verify there is a sample for your area.

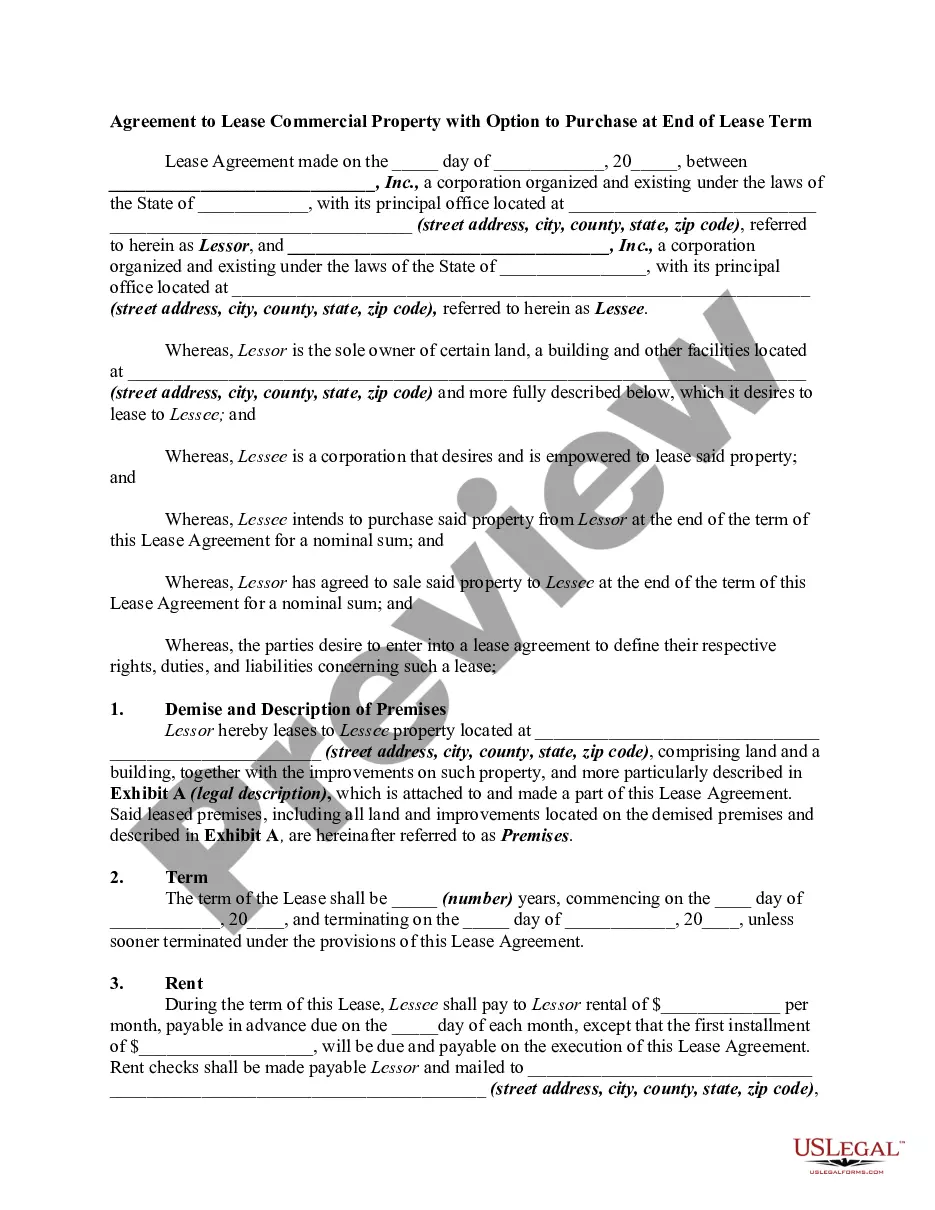

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Travis Credit Approval Form and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!