The Cuyahoga Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a legal document that outlines the process and terms for ending a partnership in Cuyahoga County, Ohio. This agreement is crucial when partners wish to dissolve their business relationship and divide the assets, liabilities, and profits fairly. The agreement begins by clearly stating the intent of the partners to dissolve the partnership and outlines the effective date of termination. It includes the names of the parties involved, the name of the partnership, and any relevant identification numbers. The terms of the settlement are outlined in detail, addressing key aspects such as the division of assets and liabilities, including property, accounts, and debts. The agreement ensures that both parties receive their fair share in the partnership's assets, while also addressing any outstanding financial obligations. Furthermore, the agreement includes a provision for a lump sum payment, which represents a one-time, predetermined amount that is given to one or both parties as part of the settlement. This payment can be used to settle any outstanding debts or obligations, compensate for personal investments, or provide fair compensation for the contributions made during the partnership. It is important to note that there may be variations of the Cuyahoga Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, depending on the specific circumstances of the partnership. Some variations may include additional terms or provisions tailored to address unique situations, such as dissolution due to retirement, death of a partner, or buyout agreements. In summary, the Cuyahoga Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a legal document that ensures a smooth dissolution of a partnership within Cuyahoga County, Ohio. It clarifies the division of assets and liabilities and provides for a lump sum payment to settle any outstanding financial obligations. Each agreement is unique and may be customized to suit the specific needs and circumstances of the partners involved.

Cuyahoga Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Cuyahoga Ohio Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Cuyahoga Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the Cuyahoga Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment. Follow the guide below:

- Make certain the sample meets your personal needs and state law regulations.

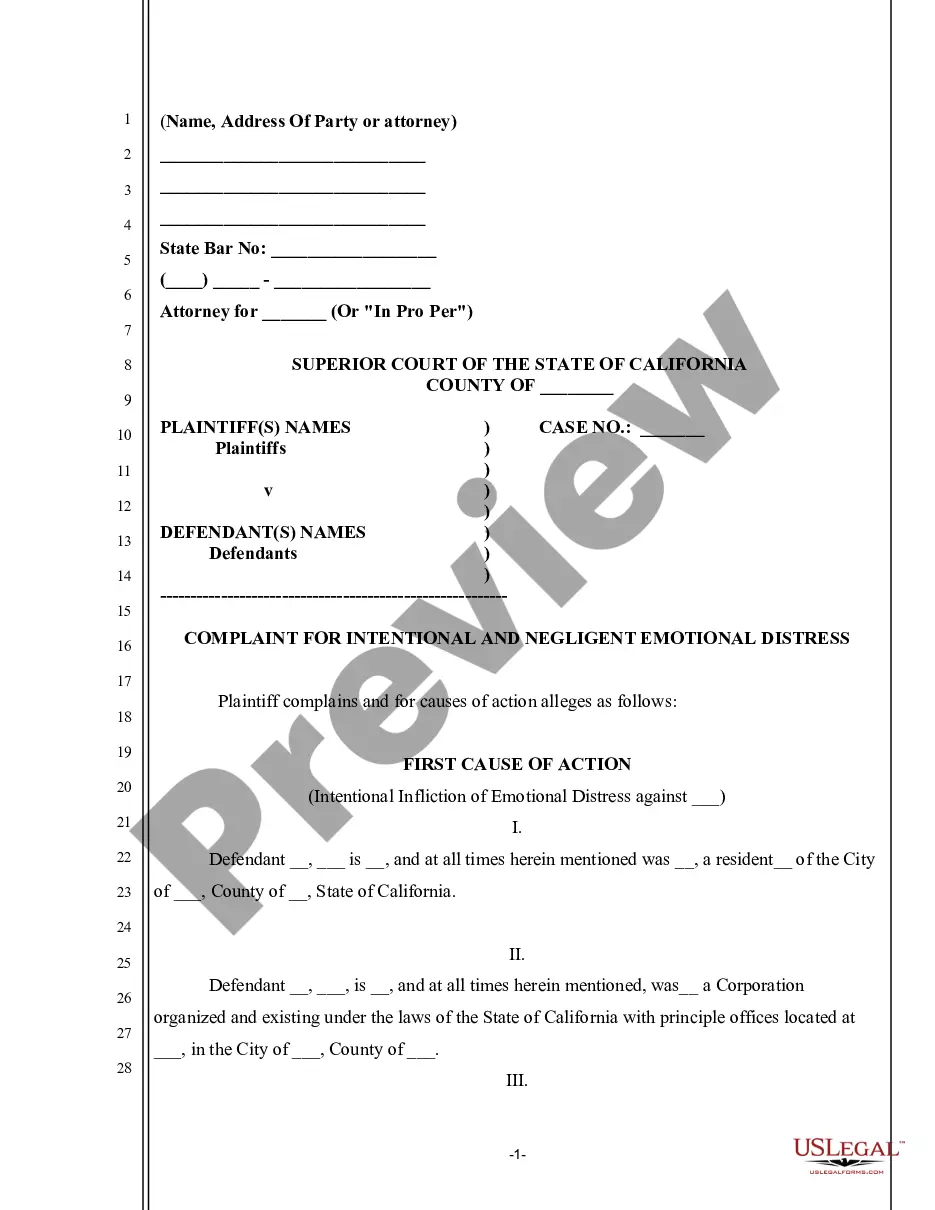

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Dissolution occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship. The second step is known as winding up. This is when partnership accounts are settled and assets are liquidated.

First, you make minimum payments to all your debts. Second, you put the extra money into the debt with the lowest balance. And lastly, once the debt with the lowest balance is paid off, take the extra money you were using to pay it off the debt with the next smallest balance from the first one.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

First of all the external liabilities and expenses are to be paid. Then, all loans and advances forwarded by the partners should be paid. Then, the capital of each partner should be paid off.

The firm shall apply its assets including any contribution to make up the deficiency firstly, for paying the third party debts, secondly for paying any loan or advance by any partner and lastly for paying back their capitals. Any surplus left after all the above payments is shared by partners in profit sharing ratio.

On dissolution of firm, when assets are distributed, liabilities are disposed in a proper order wherein payment to third party debt is on priority, followed by amount due to partners and in the end the residual amount is divided amongst the partners in profit sharing ratio.

(B) The liabilities of the partnership shall rank in order of payment, as follows: (1) Those owing to creditors other than partners; (2) Those owing to partners other than for capital and profits; (3) Those owing to partners in respect of capital; (4) Those owing to partners in respect of profits.

Termination when only one partner remains The partnership form also ceases to exist if a transfer of partnership interests occurs and only one partner remains. For example, a partnership terminates when a 60% partner acquires the interests of two other partners who each have a 20% interest in the partnership (Regs.

Secured credits first in line regarding lien claim take highest priority. Secured Claims (2nd Lien): An asset can theoretically have dozens of lien claims against it. After assessing the priority order, each secured claim still receives top priority to receive liquidation proceeds.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.