Pima Arizona Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

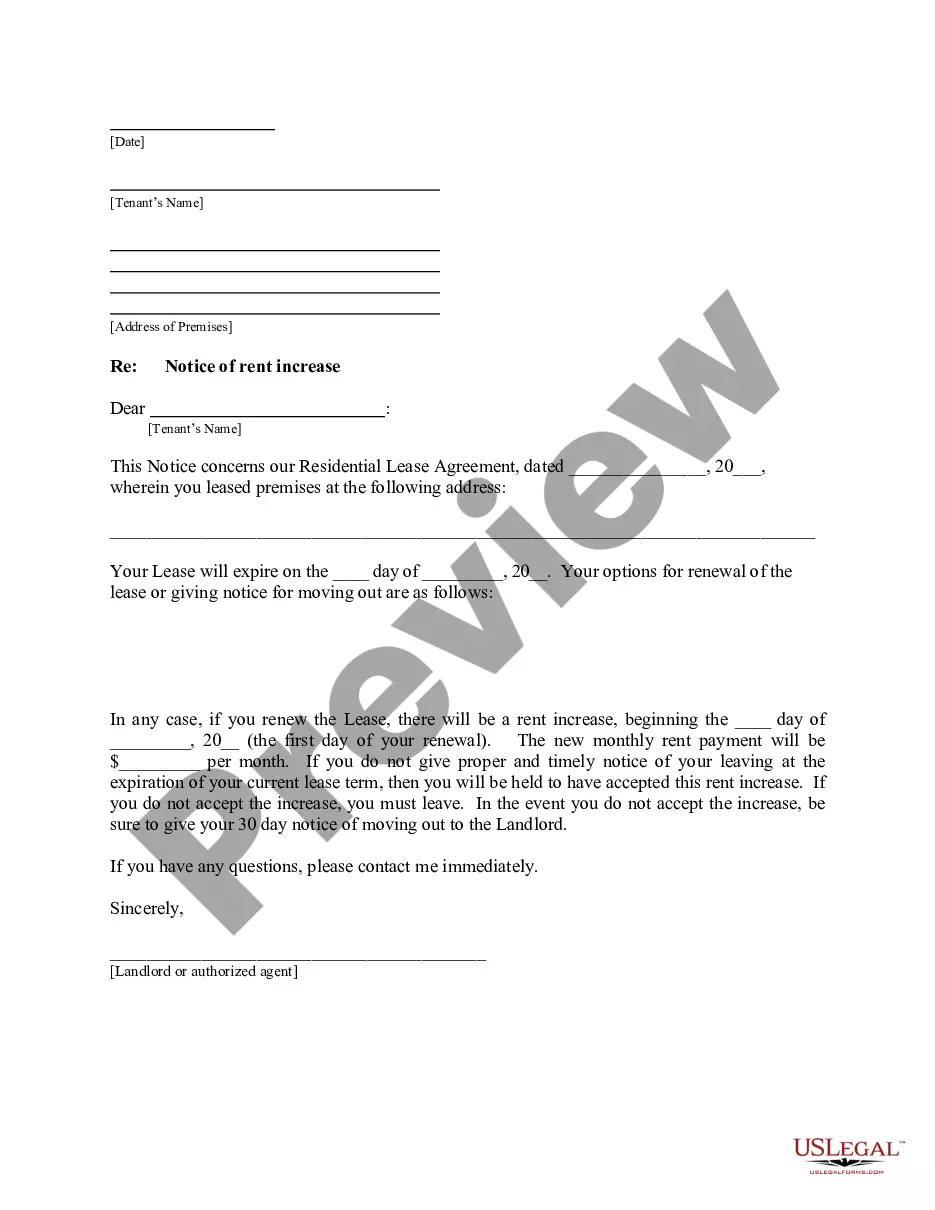

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Preparing documents for professional or personal requirements is always a significant obligation.

When formulating a contract, a public service petition, or a power of attorney, it's crucial to consider all federal and state laws pertinent to the specific area.

Nonetheless, small counties and even towns also possess legislative regulations that you must take into account.

The remarkable aspect of the US Legal Forms library is that all the documents you've ever acquired remain accessible - you can retrieve them in your profile under the My documents tab at any time.

- All these factors make it challenging and time-intensive to compose a Pima Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment without professional assistance.

- It's feasible to avoid incurring costs for attorneys drafting your documents and create a legally binding Pima Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment independently, utilizing the US Legal Forms online library.

- It is the largest online collection of state-specific legal templates that are expertly verified, ensuring their validity when selecting a template for your county.

- Previously registered users need only to Log In to their accounts to retrieve the required document.

- If you have not yet subscribed, follow the step-by-step guide below to acquire the Pima Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment.

- Browse the page you've accessed and check if it contains the document you need.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Ending a business partnership can be as challenging and emotionally difficult as ending a marriage. The best outcomes are possible when both parties to a partnership can negotiate toward an amicable separation. Unfortunately, it's not always possible.

Divide the partnership assets equitably. Upon dissolution, divide any assets and liabilities evenly among the former member partners. If you cannot come to an agreement with your partner, hire a mediator or file a civil lawsuit, and let the court divide the assets and liabilities.

Secured credits first in line regarding lien claim take highest priority. Secured Claims (2nd Lien): An asset can theoretically have dozens of lien claims against it. After assessing the priority order, each secured claim still receives top priority to receive liquidation proceeds.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Payment of the debts of the firm to the third parties. Payment of advances and loans given by the partners. Payment of capital contributed by the partners. The surplus, if any, will be divided among the partners in their profit-sharing ratio.

There are 5 main ways to dissolve a partnership legally : Dissolution of Partnership by agreement.Dissolution by notice.Termination of Partnership by expiration.Death or bankruptcy.Dissolution of a Partnership by court order.

First of all the external liabilities and expenses are to be paid. Then, all loans and advances forwarded by the partners should be paid. Then, the capital of each partner should be paid off.

How are accounts settled. Losses of the firm will be paid out of the profits, next out of the capital of the partners, and even then if losses aren't paid off, losses will be divided among the partners in profit sharing ratios. Third party debts will be paid first.

Just keep in mind these five key steps when dissolving a partnership: Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

The firm shall apply its assets including any contribution to make up the deficiency firstly, for paying the third party debts, secondly for paying any loan or advance by any partner and lastly for paying back their capitals. Any surplus left after all the above payments is shared by partners in profit sharing ratio.