Allegheny Pennsylvania Liquidation of Partnership: Authority, Rights, and Obligations during Liquidation When a partnership in Allegheny, Pennsylvania, goes through the process of liquidation, it involves the dissolution of the partnership and the distribution of its assets to settle any outstanding obligations. The liquidation may be voluntary or involuntary, and the partners' authority, rights, and obligations during this process are governed by applicable laws and the terms of the partnership agreement. During the liquidation of a partnership in Allegheny, Pennsylvania, several key aspects should be considered: 1. Voluntary Liquidation: — Partners may agree to dissolve the partnership voluntarily by mutual consent, often due to various reasons such as retirement, financial difficulties, or changes in business goals. — In cases of voluntary liquidation, partners have more control over the process as they determine the timeline and methods for selling assets and paying off debts. 2. Involuntary Liquidation: — Involuntary liquidation occurs when a court orders the dissolution of the partnership due to misconduct, fraud, or serious breaches of the partnership agreement. — In such cases, a court-appointed trustee may oversee the liquidation process to ensure fairness and compliance with legal requirements. 3. Authority during Liquidation: — Unless otherwise specified in the partnership agreement, partners have shared authority and decision-making power during the liquidation process. — Major decisions, such as selling assets, paying creditors, or making distributions, usually require the unanimous consent of all partners. 4. Assets and Liabilities: — When a partnership in Allegheny, Pennsylvania, liquidates, its assets, including cash, inventory, accounts receivable, and real estate, are sold or distributed to pay off debts and obligations. — Partners must account for and value all assets accurately, ensuring transparency and fairness throughout the process. 5. Claim Prioritization: — During liquidation, partners must follow a specific order for debt repayment as outlined by Pennsylvania state laws. — Priority is typically given to secured creditors, such as banks holding collateral, followed by unsecured creditors such as suppliers, employees, and other outstanding obligations. 6. Obligations to Partners: — Partners must fulfill their obligations to one another, including settling outstanding loan accounts, reimbursing capital contributions, or distributing remaining profits or losses. — The partnership agreement will typically outline the specific rights and obligations each partner has during liquidation. Throughout the liquidation process in Allegheny, Pennsylvania, partners must exercise diligence, transparency, and fair dealing. It is wise to consult with legal professionals experienced in partnership law to ensure compliance with all legal requirements and protect the rights and interests of each partner.

Allegheny Pennsylvania Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

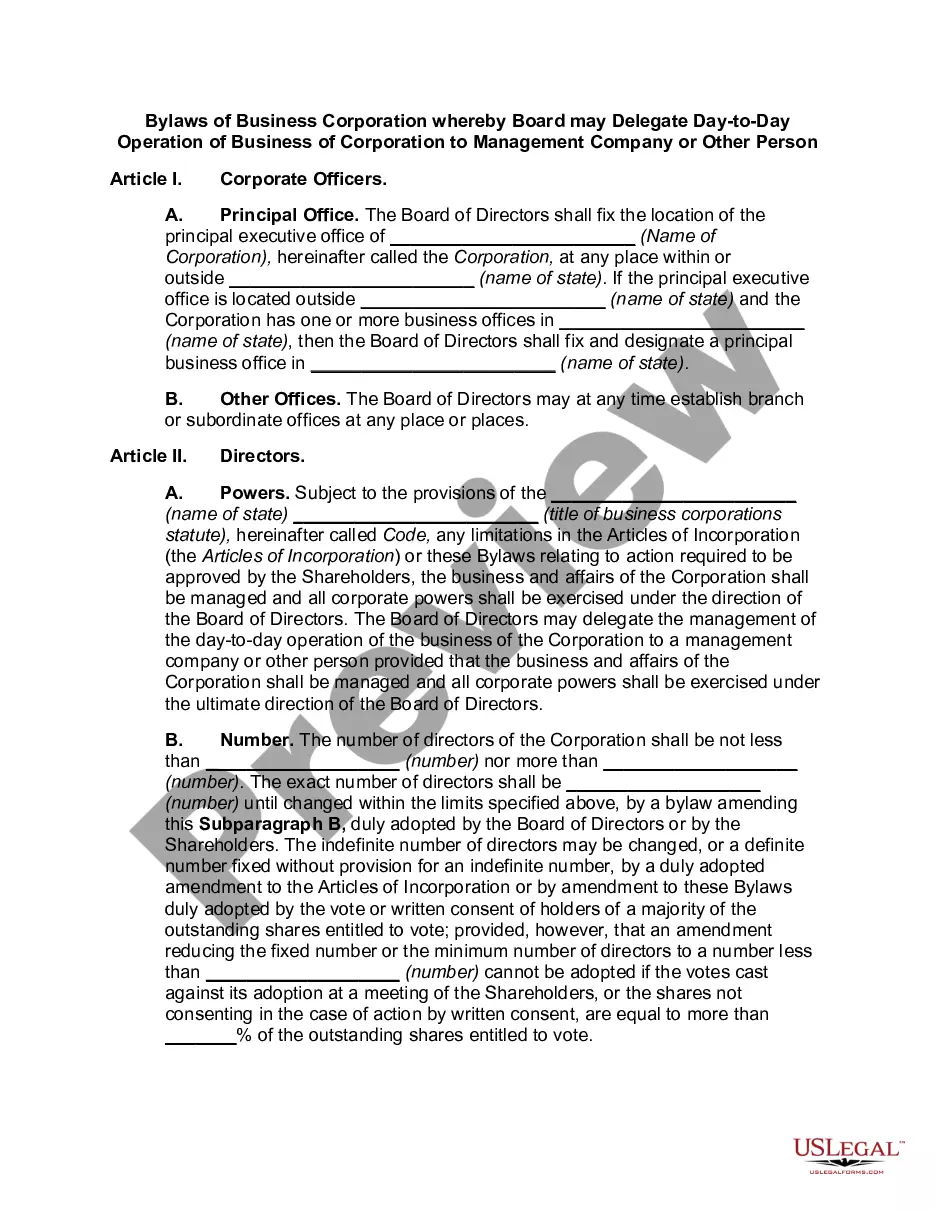

Description

How to fill out Allegheny Pennsylvania Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Allegheny Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Allegheny Liquidation of Partnership with Authority, Rights and Obligations during Liquidation will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Allegheny Liquidation of Partnership with Authority, Rights and Obligations during Liquidation:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Allegheny Liquidation of Partnership with Authority, Rights and Obligations during Liquidation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!