Hillsborough Florida Liquidation of Partnership with Authority, Rights and Obligations during Liquidation The Hillsborough Florida Liquidation of Partnership with Authority, Rights and Obligations during Liquidation refers to the process of winding up a partnership in Hillsborough, Florida, whereby the partners dissolve their business operations and distribute the assets among themselves or their creditors. This process is guided by certain rights and obligations that must be adhered to in order to ensure a smooth and lawful liquidation. Let us explore the various aspects and types of Hillsborough Florida Liquidation of Partnership with Authority, Rights and Obligations during Liquidation. 1. Authority and Process of Liquidation: In Hillsborough, Florida, a partnership can be liquidated voluntarily by the mutual agreement of the partners or involuntarily by order of the court. The partners have the authority to decide upon the method and manner of liquidation, whether it's by selling off assets, settling liabilities, or any other suitable means. They may also appoint a liquidator or trustee to oversee the liquidation process, ensuring compliance with legal requirements. 2. Rights and Obligations: During the liquidation process, each partner holds certain rights and obligations. These include the right to participate in the distribution of assets proportionate to their capital contribution unless otherwise agreed upon in the partnership agreement. Partners also have the right to separate and distribute their personal property, which was used in the partnership business. However, partners are obligated to settle all liabilities and pay off the partnership's debts, which may require selling assets or using partnership funds. 3. Types of Hillsborough Florida Liquidation of Partnership: a. Voluntary Liquidation: This type of liquidation occurs when all partners mutually agree to dissolve the partnership. It is usually a smoother process as partners have an opportunity to plan the liquidation and resolve any pending matters before distribution of assets. b. Involuntary Liquidation: In certain circumstances, a partnership may be forced into liquidation by court order. These situations typically arise when a partner files a petition to dissolve the partnership due to misconduct, fraud, or impracticable operations. The court then evaluates the claims and determines whether liquidation is necessary. c. Administrative Dissolution: If a partnership fails to comply with statutory obligations, such as filing required documents or paying fees, the state may initiate an administrative dissolution. In such cases, the partnership's authority to carry on business is terminated, and liquidation becomes necessary to settle affairs. d. Judicial Dissolution: A partnership can also be dissolved by court order if the court finds that the partnership's continued functioning is not feasible or that its dissolution is in the best interest of the partners. This often occurs when irreconcilable disputes arise between partners or when the partnership is unable to achieve its intended purpose. In conclusion, the Hillsborough Florida Liquidation of Partnership with Authority, Rights and Obligations during Liquidation encompasses various processes and types of partnerships. Understanding the different rights and obligations of partners involved in the liquidation is crucial for a fair and orderly winding-up process. Whether the liquidation is voluntary, involuntary, administrative, or judicial, partners must adhere to legal requirements and prioritize settling liabilities before distributing the remaining assets among themselves or creditors.

Hillsborough Florida Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Hillsborough Florida Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

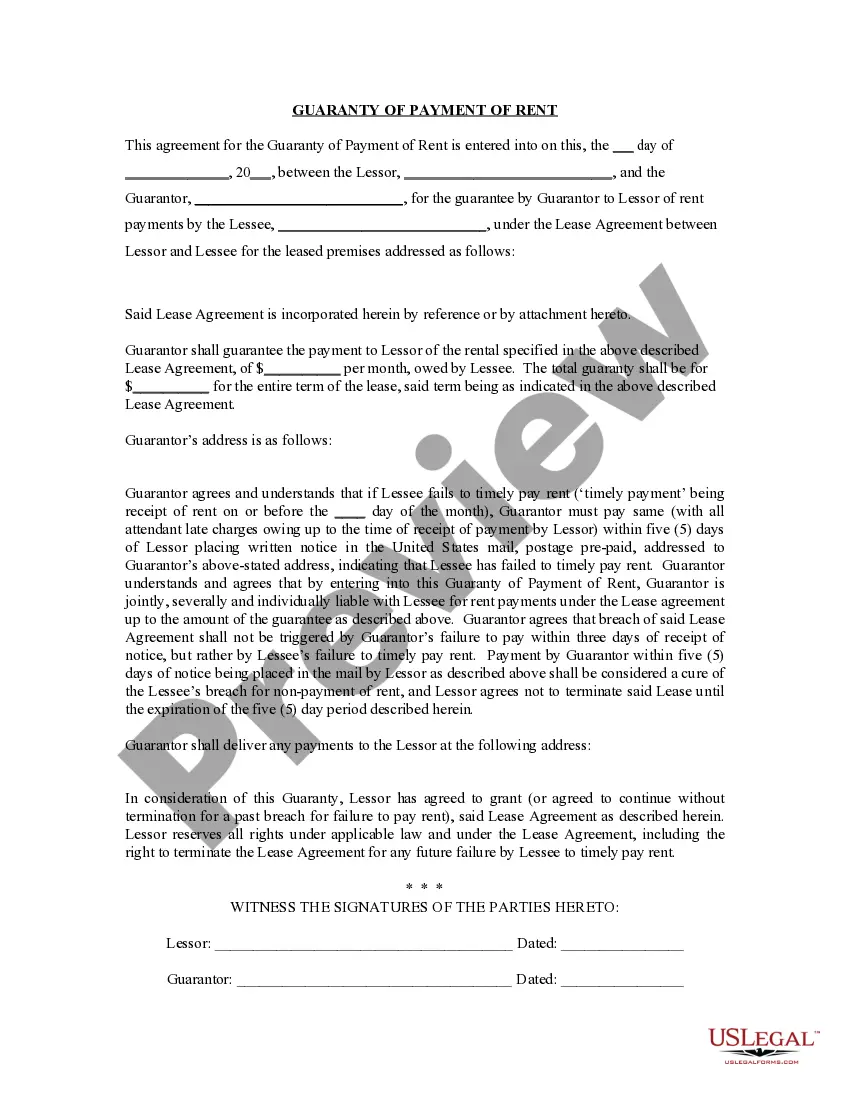

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Hillsborough Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities related to document execution straightforward.

Here's how to find and download Hillsborough Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Hillsborough Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Hillsborough Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to deal with an extremely complicated case, we recommend getting an attorney to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific documents with ease!