San Jose California Liquidation of Partnership: The liquidation of a partnership refers to the process of winding up and ending the affairs of a partnership business. In San Jose, California, this process follows specific guidelines and regulations to ensure a smooth transition and fair treatment of all involved parties. During the liquidation of a partnership in San Jose, several key elements come into play, including the authority, rights, and obligations of the partners. It is essential to understand these aspects to navigate the liquidation process effectively. Authority during Liquidation: In San Jose, the partners of a liquidating partnership typically have the authority to manage and oversee the liquidation process. They are responsible for making decisions about selling assets, paying off debts, and distributing remaining proceeds among the partners. However, any major decisions may require the consent of all partners or a specific agreement stated in the partnership agreement. Rights during Liquidation: Partners in San Jose have certain rights during the liquidation of a partnership. These rights include receiving their share of the partnership's assets after all debts and obligations are settled. Partners also have the right to participate in decision-making processes and vote on matters that affect the liquidation proceedings. It is crucial for partners to understand their rights to ensure they receive fair treatment throughout the process. Obligations during Liquidation: Partners in San Jose have specific obligations they must fulfill during the liquidation process. These obligations primarily revolve around the settlement of debts, obligations to creditors, and the proper distribution of remaining assets. Partners must act in good faith and work towards satisfying all outstanding liabilities to ensure a successful liquidation. Types of San Jose California Liquidation of Partnership: Although there are no specific types of liquidation unique to San Jose, California, the liquidation of a partnership can occur through either voluntary liquidation or compulsory liquidation. 1. Voluntary Liquidation: In a voluntary liquidation, partners mutually agree to wind up the partnership and distribute its assets. Partners make this decision when they believe it is in their best interest to dissolve the partnership voluntarily. Voluntary liquidation typically occurs when partners reach an agreement due to retirement, disagreement about operations, or pursuing other business opportunities. 2. Compulsory Liquidation: Compulsory liquidation occurs when a court orders the liquidation of a partnership due to various reasons, such as insolvency or failure to meet legal requirements. In these cases, partners lose control over the liquidation process, as a court-appointed liquidator takes charge and oversees the proceedings. Compulsory liquidation usually happens as a last resort when a partnership's financial situation becomes unsustainable. Understanding the authority, rights, and obligations during the liquidation of a partnership in San Jose, California, is crucial for partners to ensure an orderly and legally compliant process. Whether it is a voluntary or compulsory liquidation, partners must follow the appropriate procedures and seek legal advice if necessary to protect their interests throughout the liquidation journey.

San Jose California Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out San Jose California Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

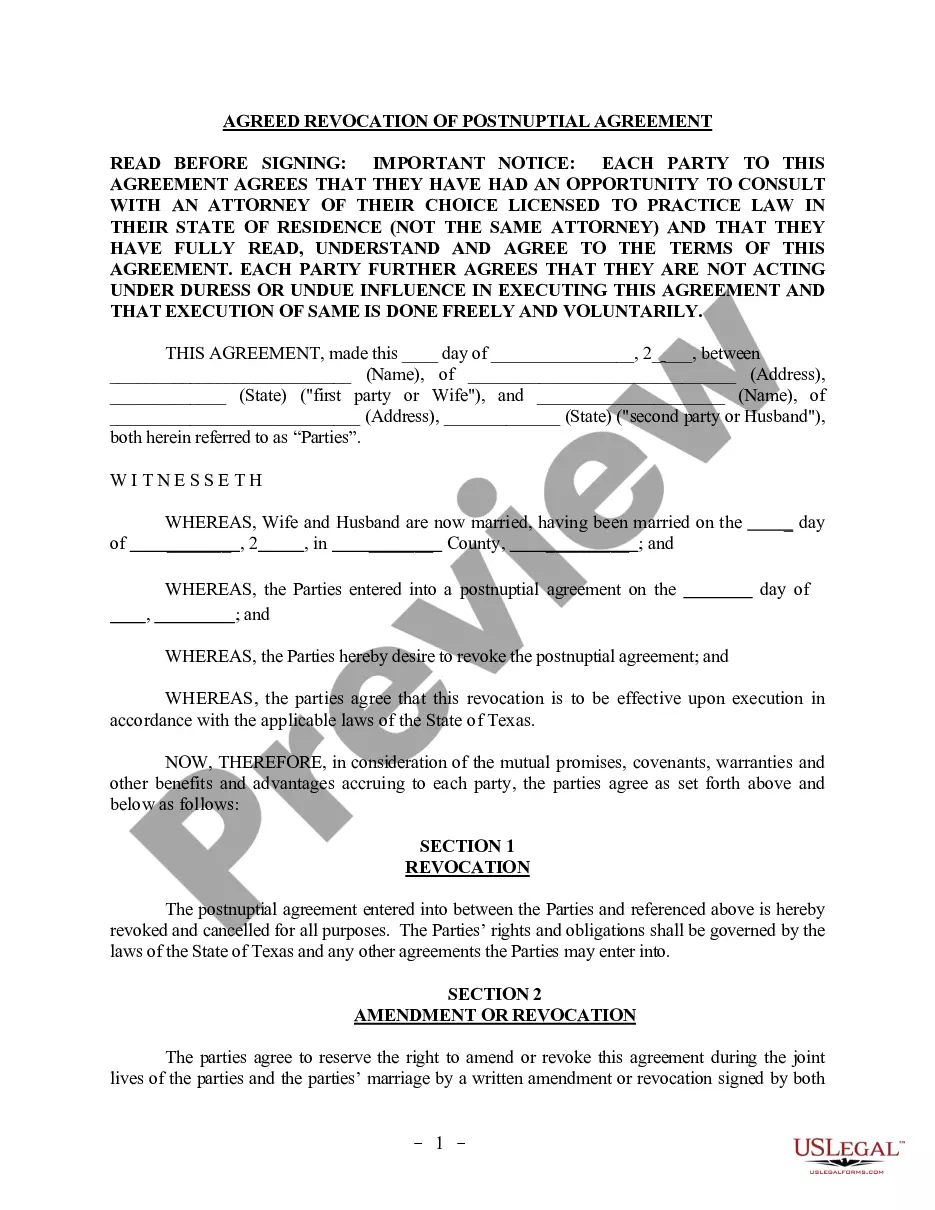

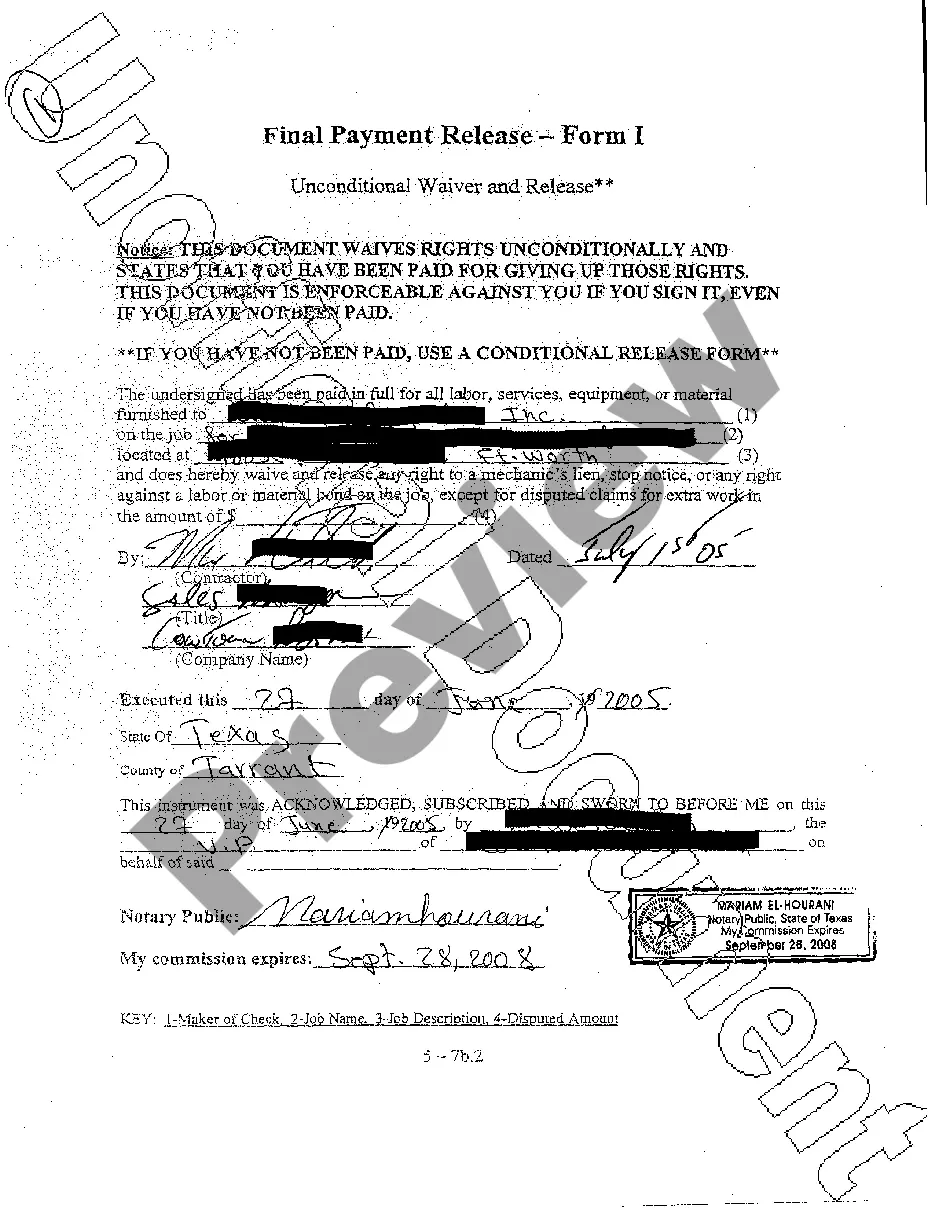

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life situation, locating a San Jose Liquidation of Partnership with Authority, Rights and Obligations during Liquidation meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the San Jose Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your San Jose Liquidation of Partnership with Authority, Rights and Obligations during Liquidation:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Jose Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!