Alameda California Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

How long does it typically take for you to prepare a legal document? Given that each state has its own laws and regulations for various aspects of life, finding an Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets that meets all local criteria can be laborious, and hiring a professional attorney is often expensive.

Many online platforms provide the most frequently utilized state-specific documents for download, but using the US Legal Forms library is the most advantageous.

US Legal Forms is the most extensive online collection of templates, categorized by states and uses. In addition to the Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets, you can find any necessary document to operate your business or personal affairs in accordance with your local standards. Professionals authenticate all templates for their relevance, ensuring you can prepare your documentation accurately.

You can print the document or utilize any preferred online editor to finalize it electronically. Regardless of how often you need to access the purchased document, all samples you’ve ever stored can be retrieved in your profile under the My documents tab. Give it a try!

- If you already have an account on the platform and your subscription is up-to-date, simply Log In, select the desired form, and download it.

- You can access the document in your profile at any time thereafter.

- If you are unfamiliar with the platform, some additional steps are required before you can obtain your Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Review the content of the current page.

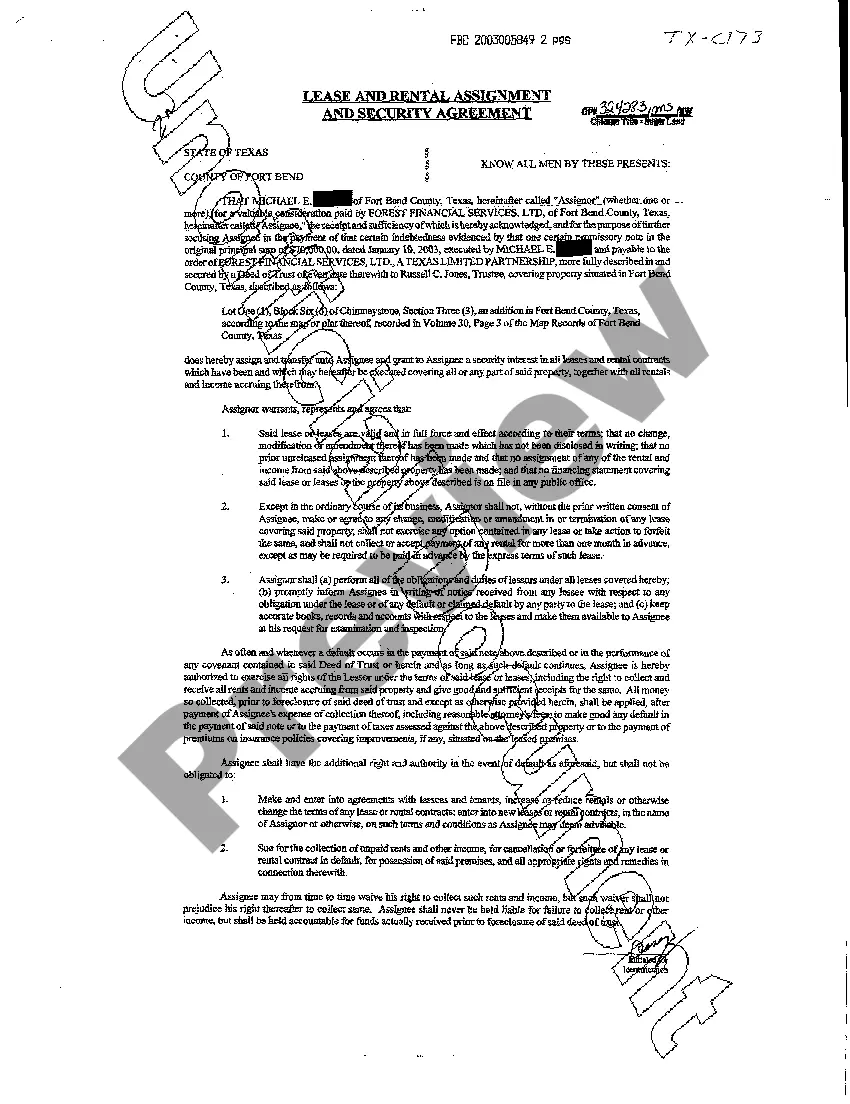

- Examine the description of the sample or Preview it (if available).

- Search for other documents using the related option in the header.

- Click Buy Now once confident in your selection.

- Choose the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to proceed with payment methods.

- Complete the payment through PayPal or by credit card.

- Change the file format if needed.

- Click Download to save the Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Form popularity

FAQ

Answer. Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

Any post-distribution gain or loss by the partner from the sale of unrealized receivables and from inventory held for less than five years will give rise to ordinary income. These items are reported on Form 4797.

If the liquidated distribution is in cash, the partner is liable to pay tax on it immediately. For the liquidated distribution of fixed assets, such as property that takes time to convert into cash, the tax effect may be delayed until it is converted into cash.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Cash or non-cash liquidating distribution reported on Form 1099-DIV, box 9 or box 10 (1040)

Upon liquidation of a partnership, the Internal Revenue Service views the distributions as a sale of a partnership interest; as a result, gains are generally taxed as long-term capital gains to partners.