Allegheny Pennsylvania Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that occurs when a partnership in Allegheny, Pennsylvania, comes to an end. It involves the sale of partnership assets and the subsequent distribution of proceeds amongst the partners in a proportionate manner. During the liquidation process, the partnership's assets, which may include cash, property, investments, and inventory, are assessed and valued. The partners then decide on the appropriate method of selling these assets, such as through public auctions, private sales, or direct negotiations with potential buyers. One type of Allegheny Pennsylvania Liquidation of Partnership with Sale and Proportional Distribution of Assets is voluntary liquidation. This occurs when the partners mutually agree to dissolve the partnership and proceed with the liquidation process. In such cases, the partners work together to determine the most advantageous way to sell off the assets and divide the proceeds based on their respective ownership interests. In some instances, however, a partnership may face involuntary liquidation due to bankruptcy, insolvency, or other legal issues. In this scenario, the sale of partnership assets and distribution of proceeds are carried out under the supervision of a court-appointed trustee or a bankruptcy administrator. This ensures fairness and compliance with applicable laws and regulations. Throughout the Allegheny Pennsylvania Liquidation of Partnership with Sale and Proportional Distribution of Assets, it is crucial to adhere to the terms and conditions outlined in the partnership agreement. The agreement may contain specific provisions regarding the order of asset liquidation, priority of repayment to creditors, settlement of outstanding debts, and calculation of partners' respective shares. Important keywords related to the liquidation process include Allegheny Pennsylvania, partnership, liquidation, assets, sale, proportional distribution, voluntary liquidation, involuntary liquidation, bankruptcy, insolvency, partnership agreement, court-appointed trustee, and creditors. Partners involved in an Allegheny Pennsylvania Liquidation of Partnership with Sale and Proportional Distribution of Assets should consult with legal and financial professionals to ensure compliance with applicable laws and maximize the value of their interests. The complexity of the liquidation process and the potential legal implications necessitate expert guidance to navigate through the various stages smoothly.

Allegheny Pennsylvania Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Allegheny Pennsylvania Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Allegheny Liquidation of Partnership with Sale and Proportional Distribution of Assets, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Allegheny Liquidation of Partnership with Sale and Proportional Distribution of Assets from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Allegheny Liquidation of Partnership with Sale and Proportional Distribution of Assets:

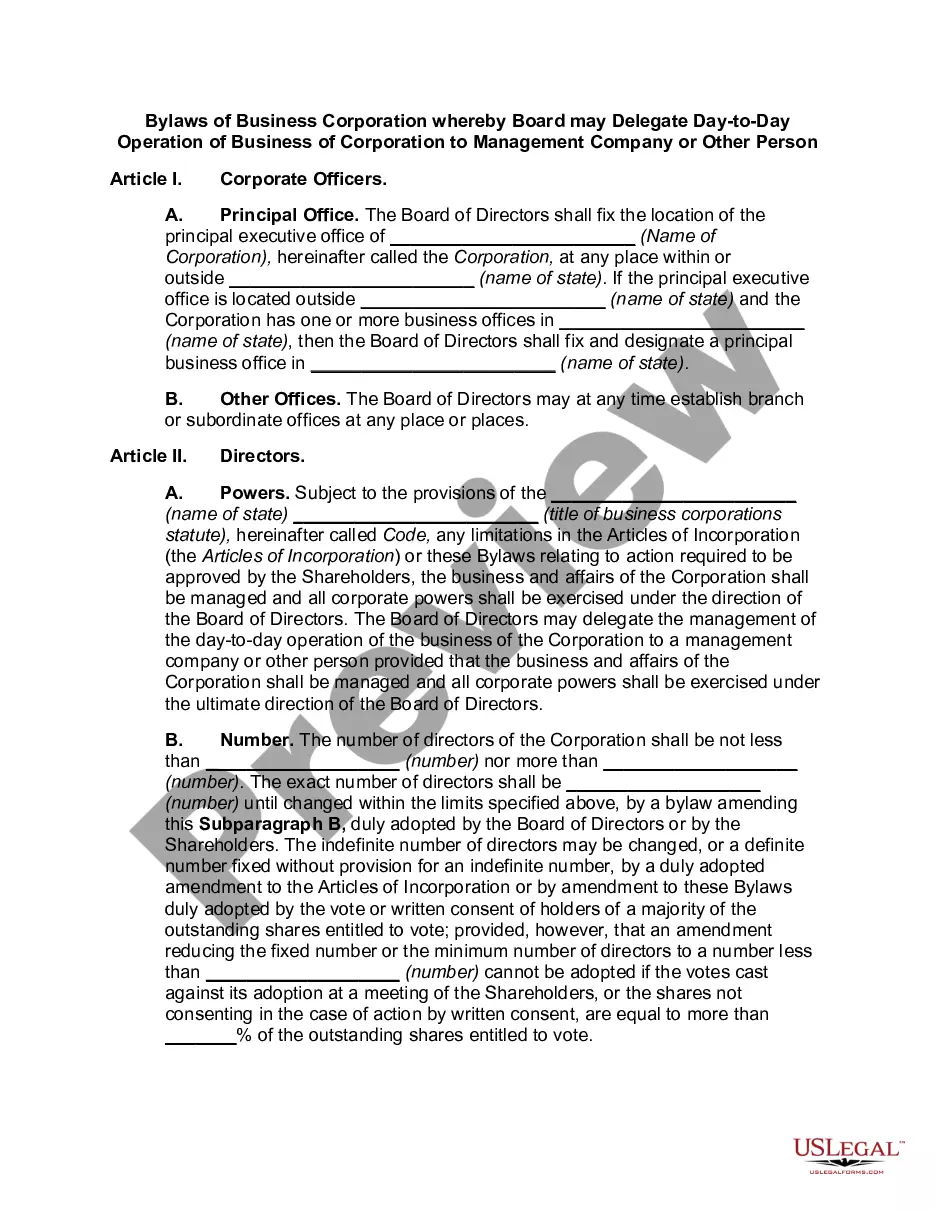

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!