Nassau New York Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that involves winding up the affairs of a partnership and distributing its assets among the partners in accordance with their ownership interests. This type of liquidation occurs when a partnership decides to dissolve or when the partnership agreement specifies dissolution procedures. The liquidation process typically involves several steps, including the sale of partnership assets, settlement of partnership liabilities, and the distribution of remaining funds or assets to the partners. The main objective is to ensure a fair and equitable division of assets among the partners based on their proportional ownership. During the liquidation, all partnership assets, including cash, property, inventory, and investments, are appraised and sold. The proceeds from the sale are then used to settle any outstanding debts and liabilities, such as loans, accounts payable, and taxes. After settling the debts, the remaining funds are distributed to the partners based on their respective ownership percentages as outlined in the partnership agreement. Nassau New York Liquidation of Partnership with Sale and Proportional Distribution of Assets can take different forms depending on the specific circumstances. Some common variations include: 1. Voluntary Liquidation: Occurs when the partners voluntarily agree to dissolve the partnership and initiate the liquidation process. This can happen due to various reasons such as retirement, changes in business goals, or disagreements among the partners. 2. Involuntary Liquidation: Occurs when the dissolution of the partnership is forced upon the partners by external factors, such as bankruptcy, court orders, or regulatory requirements. In these cases, the liquidation process is typically overseen by a court-appointed trustee or a designated professional. 3. Cross-Border Liquidation: In cases where the partnership operates across multiple jurisdictions, a cross-border liquidation may be necessary. This involves adhering to the specific legal requirements and tax regulations of each jurisdiction where the partnership holds assets or conducts business. 4. Insolvent Liquidation: If the partnership lacks sufficient assets to cover its debts and liabilities, it may undergo an insolvent liquidation. In this scenario, an insolvency practitioner is appointed to manage the liquidation proceedings and oversee the distribution of assets according to the priorities set forth in bankruptcy laws. In conclusion, Nassau New York Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that involves the winding up of a partnership's affairs and the fair distribution of its assets among the partners based on their proportional ownership interests. The process can take various forms, such as voluntary, involuntary, cross-border, or insolvent liquidation, depending on the circumstances of the partnership's dissolution.

Nassau New York Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Nassau New York Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

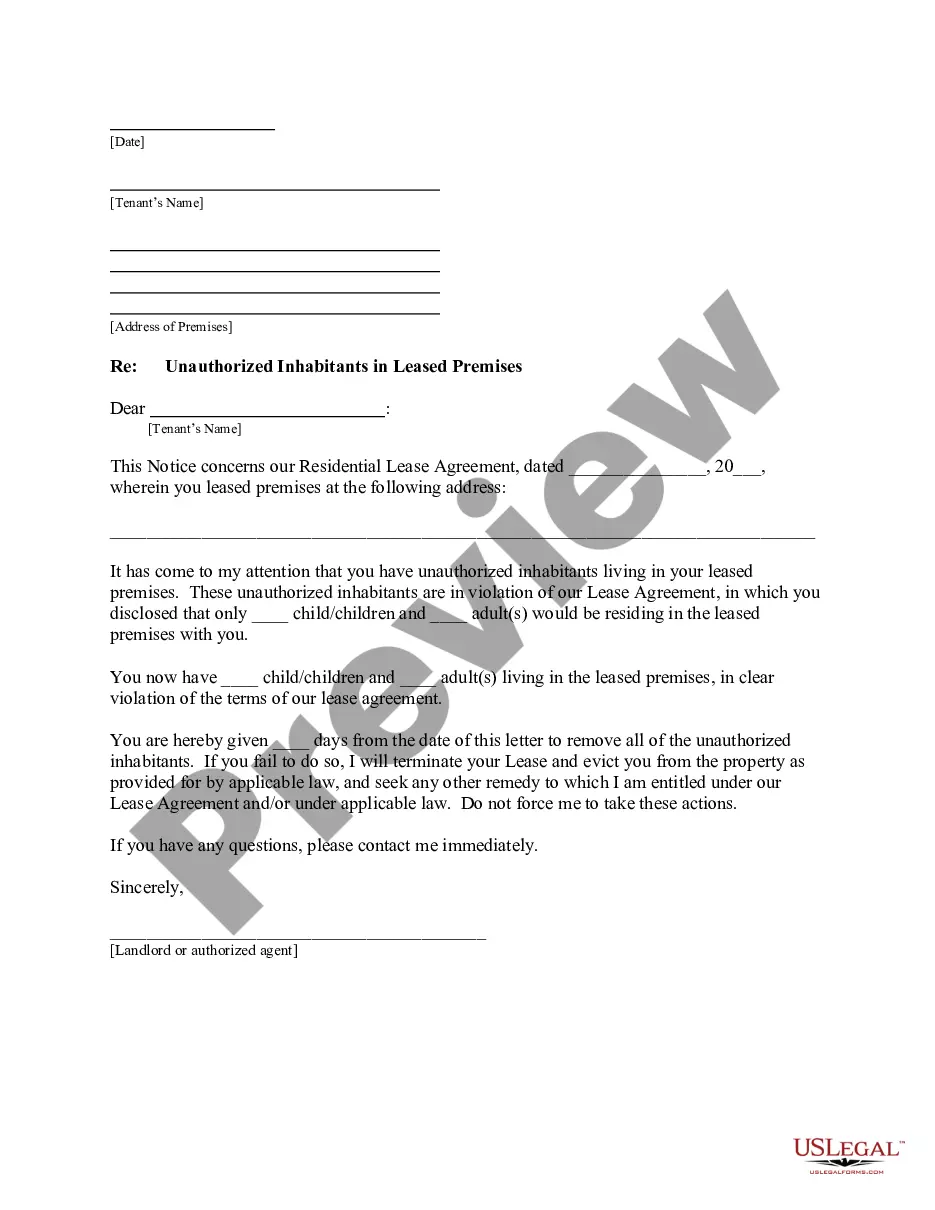

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Nassau Liquidation of Partnership with Sale and Proportional Distribution of Assets, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution straightforward.

Here's how you can locate and download Nassau Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Examine the similar document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Nassau Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Liquidation of Partnership with Sale and Proportional Distribution of Assets, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult case, we recommend using the services of an attorney to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!