San Antonio, Texas Liquidation of Partnership with Sale and Proportional Distribution of Assets: Explained In the world of business partnerships, it is not uncommon for circumstances to arise that necessitate the liquidation of a partnership. During such a process, the assets owned by the partnership are sold off, and the resulting proceeds are distributed among the partners in accordance with their proportional ownership. In San Antonio, Texas, the liquidation of partnership with sale and proportional distribution of assets follows a well-defined legal procedure. There are two primary types of San Antonio, Texas liquidation of partnership with sale and proportional distribution of assets: voluntary and involuntary. In a voluntary liquidation, the partners unanimously agree to dissolve the partnership and follow the liquidation process. On the other hand, involuntary liquidation occurs when external factors force the partnership to dissolve, such as bankruptcy, legal action, or death of a partner. The first step in the liquidation process is to evaluate the partnership's assets, liabilities, and outstanding debts. This includes assessing both tangible and intangible assets, such as real estate, equipment, accounts receivable, intellectual property rights, and investments. Additionally, any debts owed by the partnership, including loans, payables, and outstanding contracts, must be identified and accounted for. Once the assets and liabilities have been determined, the next step involves selling off the partnership's assets. This typically involves obtaining professional appraisals and finding potential buyers through various means, such as private sales, public auctions, or engaging the services of brokers. The assets are sold at fair market value, and the resulting proceeds are used to settle the partnership's outstanding debts. After the sale of assets, the remaining funds are proportionally distributed among the partners. The distribution is determined based on each partner's ownership interest, as outlined in the partnership agreement. If no partnership agreement exists, the distribution is typically based on the partners' capital contributions. During the liquidation process, it is crucial for the partners to communicate and cooperate effectively. They must work together to ensure the smooth sale of assets, the settlement of debts, and the fair distribution of remaining funds. It is advisable to seek legal counsel or consult with a professional accountant experienced in partnership liquidations to navigate the complex legal and financial aspects of the process. In conclusion, the San Antonio, Texas liquidation of partnership with sale and proportional distribution of assets involves the proper assessment, sale, and distribution of a partnership's assets and liabilities. Whether it is a voluntary or involuntary liquidation, careful planning and execution are essential to achieve a smooth and equitable dissolution of the partnership.

San Antonio Texas Liquidation of Partnership with Sale and Proportional Distribution of Assets

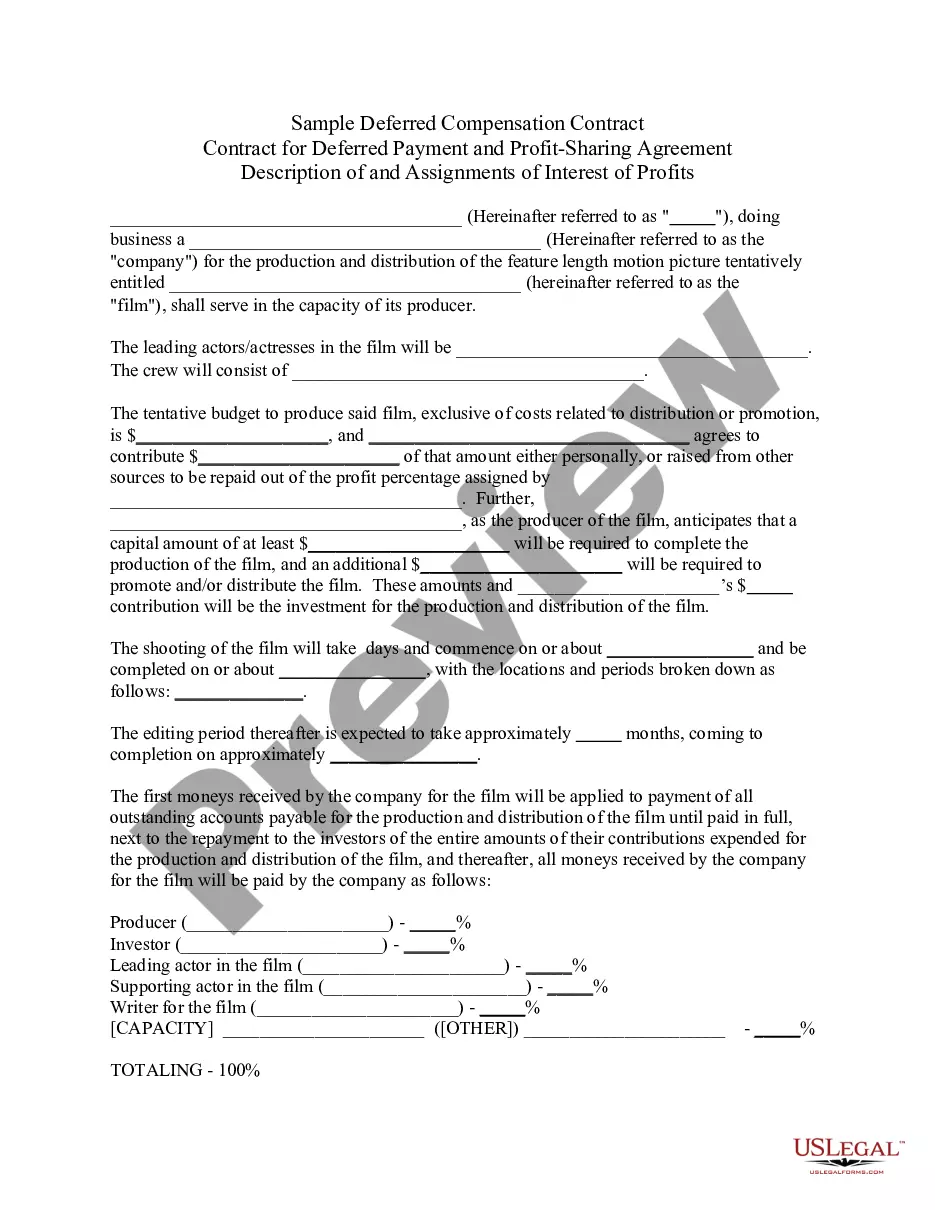

Description

How to fill out San Antonio Texas Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the San Antonio Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the San Antonio Liquidation of Partnership with Sale and Proportional Distribution of Assets will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the San Antonio Liquidation of Partnership with Sale and Proportional Distribution of Assets:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the San Antonio Liquidation of Partnership with Sale and Proportional Distribution of Assets on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!