Broward Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities refers to the process of winding up a partnership in Broward County, Florida, by selling its assets and assuming its liabilities. This legal procedure involves the distribution of partnership assets among partners and the settlement of outstanding debts and obligations. Here are some important aspects to consider: 1. Broward County, Florida: Broward County is located in Southeast Florida, known for its vibrant business environment and diverse industries. The local laws and regulations governing partnership liquidation are specific to this jurisdiction. 2. Partnership Liquidation: Partnership liquidation refers to the process of closing down a partnership business. It typically occurs when partners decide to dissolve the partnership or when the partnership reaches the end of its term. 3. Sale of Assets: In the liquidation process, the partnership's assets, such as properties, equipment, inventory, and intellectual property, may be sold to generate funds that will be used to pay off creditors or distribute to the partners. The sale may be conducted through auctions, private sales, or other appropriate methods. 4. Assumption of Liabilities: As part of the liquidation, the partnership's outstanding debts and liabilities are evaluated and settled. These can include loans, accounts payable, taxes, and other obligations. The assumed liabilities may be distributed among the partners or paid off using the proceeds from the sale of assets. Types of Broward Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities: 1. Voluntary Liquidation: This occurs when the partners collectively decide to end the partnership by liquidating its assets and settling the liabilities. It can happen for various reasons, such as retirement, disagreement among partners, or the achievement of the partnership's objectives. 2. Involuntary Liquidation: In certain situations, partnership liquidation may be forced upon the partners by external factors, such as bankruptcy, court orders, or any breach of legal obligations. In such cases, a court-appointed liquidator may oversee the process. 3. General Partnership Liquidation: This type of liquidation refers to the dissolution of a general partnership, where all partners hold joint liability for the partnership's debts and obligations. 4. Limited Partnership Liquidation: A limited partnership has both general and limited partners. The liquidation process for this type of partnership considers the different rights and responsibilities of general and limited partners regarding the distribution of assets and the assumption of liabilities. In summary, Broward Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities involves the winding up of partnership affairs, the sale of assets, and the settlement of outstanding debts and obligations. The specific type of liquidation can vary depending on the partnership's circumstances, such as voluntary or involuntary liquidation, and the nature of the partnership itself, such as general or limited. It is essential to consult with legal professionals experienced in Broward County's laws to navigate the process effectively.

Broward Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Broward Florida Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Broward Liquidation of Partnership with Sale of Assets and Assumption of Liabilities meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Broward Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Broward Liquidation of Partnership with Sale of Assets and Assumption of Liabilities:

- Check the content of the page you’re on.

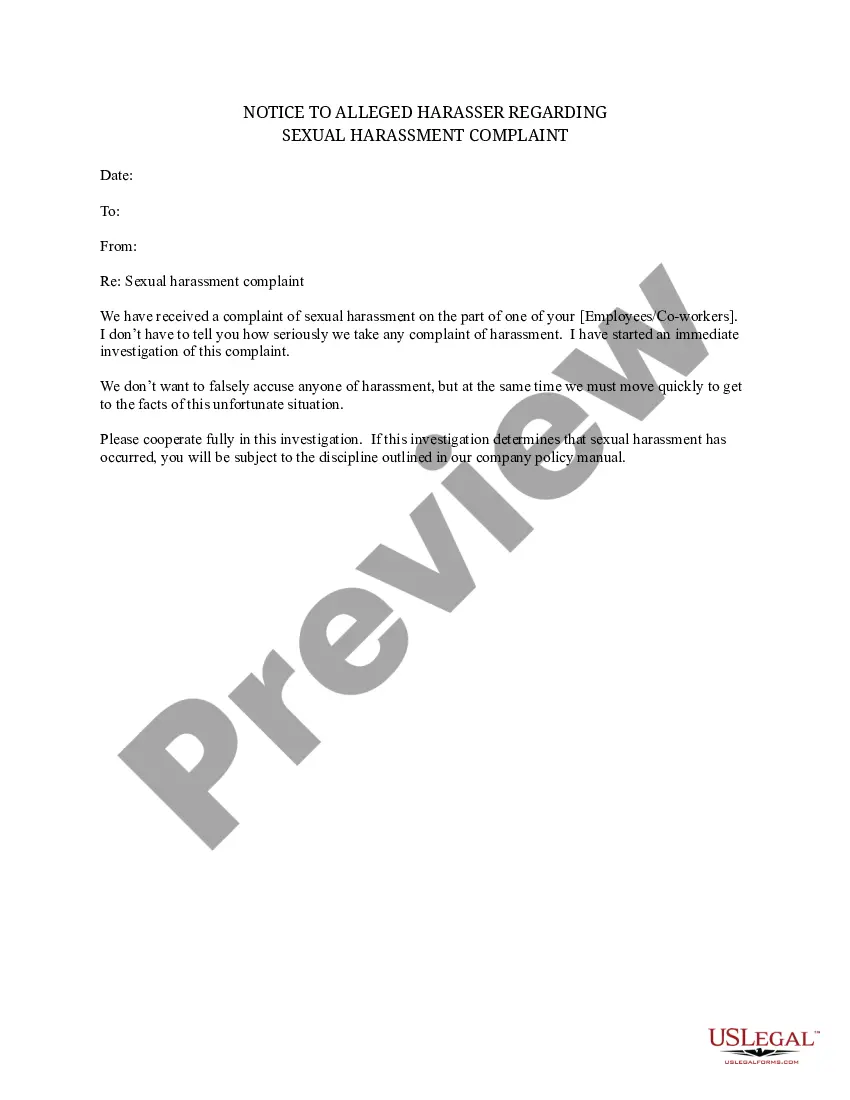

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Broward Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!