Maricopa Arizona Liquidation of Partnership with Sale of Assets and Assumption of Liabilities refers to the process of dissolving a partnership in Maricopa, Arizona, where the partners sell their assets to pay off debts and distribute the remaining proceeds among themselves. This procedure involves various legal steps and can occur in different scenarios. One type of Maricopa Arizona Liquidation of Partnership is Voluntary Liquidation. In this case, the partners mutually agree to dissolve the partnership, liquidate the assets, and distribute the proceeds accordingly. Another type is Involuntary Liquidation, which occurs when external factors such as bankruptcy, legal proceedings, or court orders force the partnership to dissolve. The process of Maricopa Arizona Liquidation of Partnership usually begins with a comprehensive evaluation of the partnership's assets, including tangible assets like real estate, inventory, equipment, and intangible assets like trademarks, copyrights, and intellectual property rights. Typically, a professional appraiser may assess the value of these assets to determine their fair market worth. Once the assets are appraised, the partnership may proceed with selling them to interested buyers. These assets can include physical property, contracts, licenses, patents, or any other valuable property owned by the partnership. The sale of assets helps generate funds to settle outstanding debts, repay creditors, and cover any other financial obligations. Simultaneously, liabilities are assessed and categorized into priority levels, considering secured and unsecured debts, tax obligations, employee compensations, and any pending legal issues. Partnerships need to comply with applicable federal, state, and local laws while addressing these liabilities. During the Maricopa Arizona Liquidation of Partnership, it is crucial to communicate with creditors, informing them about the dissolution and providing details of the liquidation process. Settling debts and liabilities in an orderly manner is necessary to maintain a positive business reputation and avoid potential legal disputes. After settling all financial obligations, remaining proceeds from the liquidation are divided among partners based on their ownership interests as outlined in the partnership agreement. This distribution is often subject to state and federal tax regulations, making it important to consult with tax professionals to avoid any unintended tax consequences. In summary, Maricopa Arizona Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a complex process involving the dissolution of a partnership, selling off assets, settling debts, and distributing remaining funds among partners. Whether voluntary or involuntary, this process requires careful evaluation, communication with creditors, adherence to legal procedures, and considerations for tax implications.

Maricopa Arizona Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Maricopa Arizona Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Drafting papers for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Maricopa Liquidation of Partnership with Sale of Assets and Assumption of Liabilities without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Maricopa Liquidation of Partnership with Sale of Assets and Assumption of Liabilities by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Maricopa Liquidation of Partnership with Sale of Assets and Assumption of Liabilities:

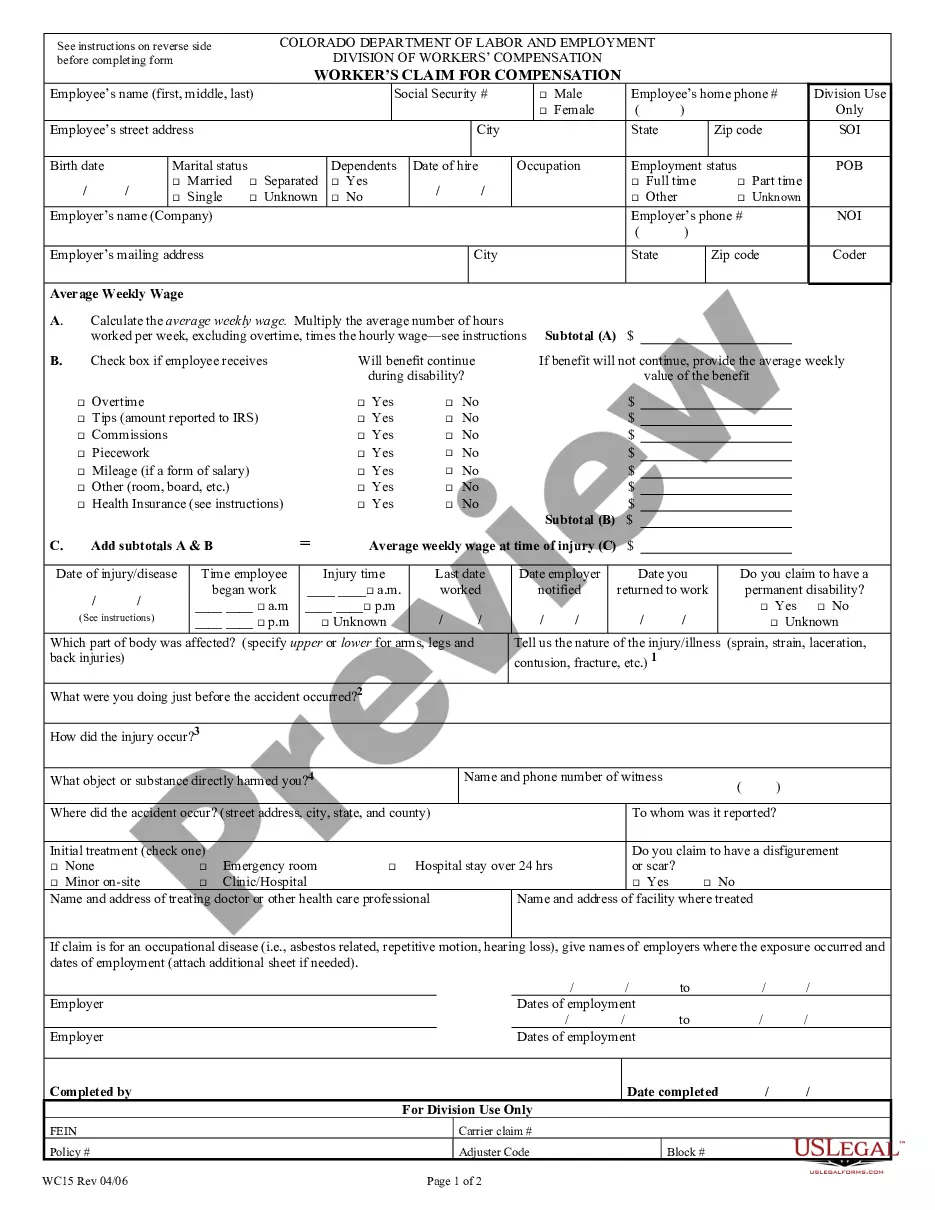

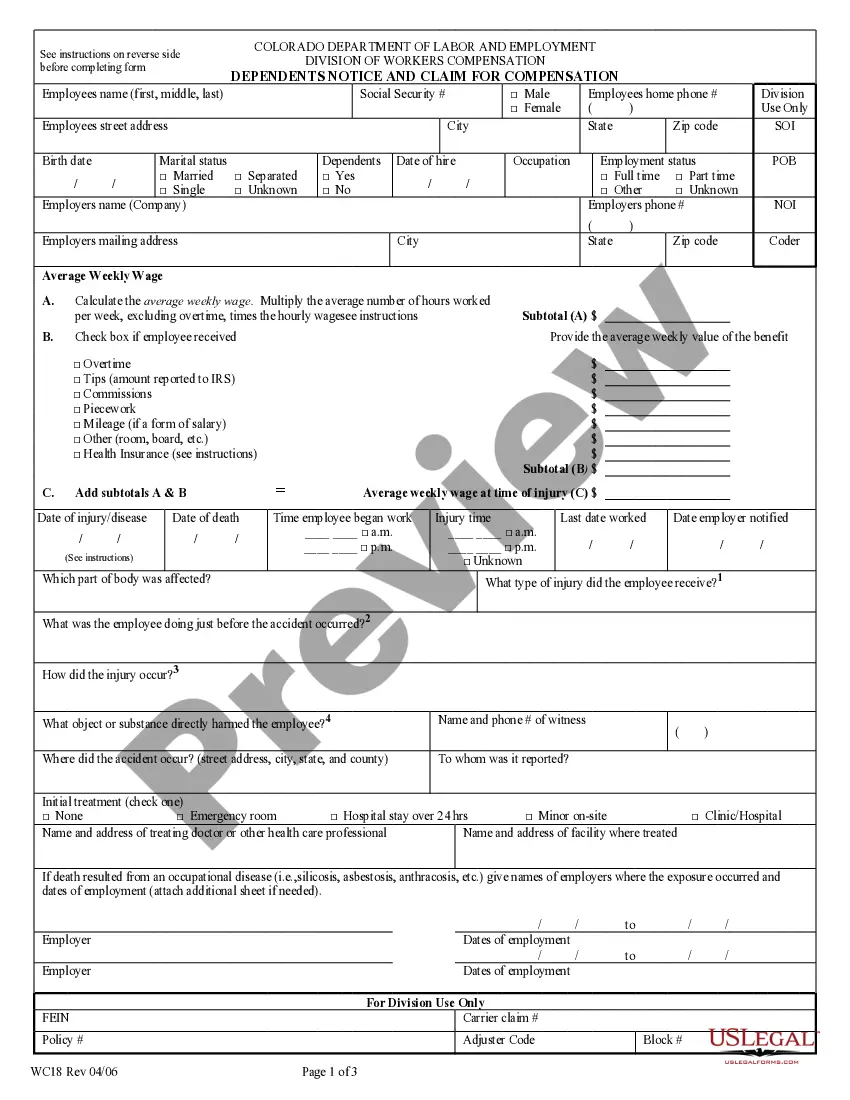

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!