Riverside California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process involving the dissolution and termination of a business partnership based in Riverside, California. This procedure typically includes the sale of partnership assets to pay off outstanding debts and distribute remaining assets among partners. Here, we will explore the various types of Riverside California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. 1. Voluntary Liquidation: This type of liquidation occurs when partners willingly decide to terminate the partnership and liquidate its assets. It usually happens when partners no longer wish to continue with the business or have reached the end of the partnership agreement. 2. Involuntary Liquidation: In some cases, a Riverside California partnership may be forced into liquidation due to circumstances such as bankruptcy, court order, or if partners fail to fulfill their legal obligations. Involuntary liquidation is typically initiated by external entities or creditors seeking to collect outstanding debts. 3. Assets Sale: During the liquidation process, the partnership's assets, including property, equipment, inventory, and intellectual property, are sold to generate funds to repay creditors or distribute among partners. The sale may be conducted through auctions, private negotiations, or third-party sales agents. 4. Assumption of Liabilities: As part of the liquidation, partners take responsibility for settling the partnership's liabilities, which include debts, outstanding loans, legal obligations, and contractual agreements. This process ensures that creditors' claims are addressed, and the partnership's financial affairs are properly resolved. 5. Distribution of Remaining Assets: Once all debts and liabilities have been settled, any remaining assets are distributed among the partners according to their agreed-upon shares in the partnership agreement. This distribution is typically based on each partner's capital contributions and any profit-sharing arrangements previously established. 6. Tax Considerations: Riverside California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities involves important tax considerations that partners must address. This includes filing the necessary forms with relevant tax authorities, reporting capital gains or losses from asset sales, and ensuring compliance with state and federal tax regulations. Overall, the Riverside California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities process aims to wind down a partnership systematically, settle debts, and distribute remaining assets to the partners. It is essential to seek legal and financial advice from professionals specializing in partnership liquidations to navigate this complex procedure successfully.

Riverside California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Riverside California Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Riverside Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the current version of the Riverside Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Riverside Liquidation of Partnership with Sale of Assets and Assumption of Liabilities:

- Glance through the page and verify there is a sample for your area.

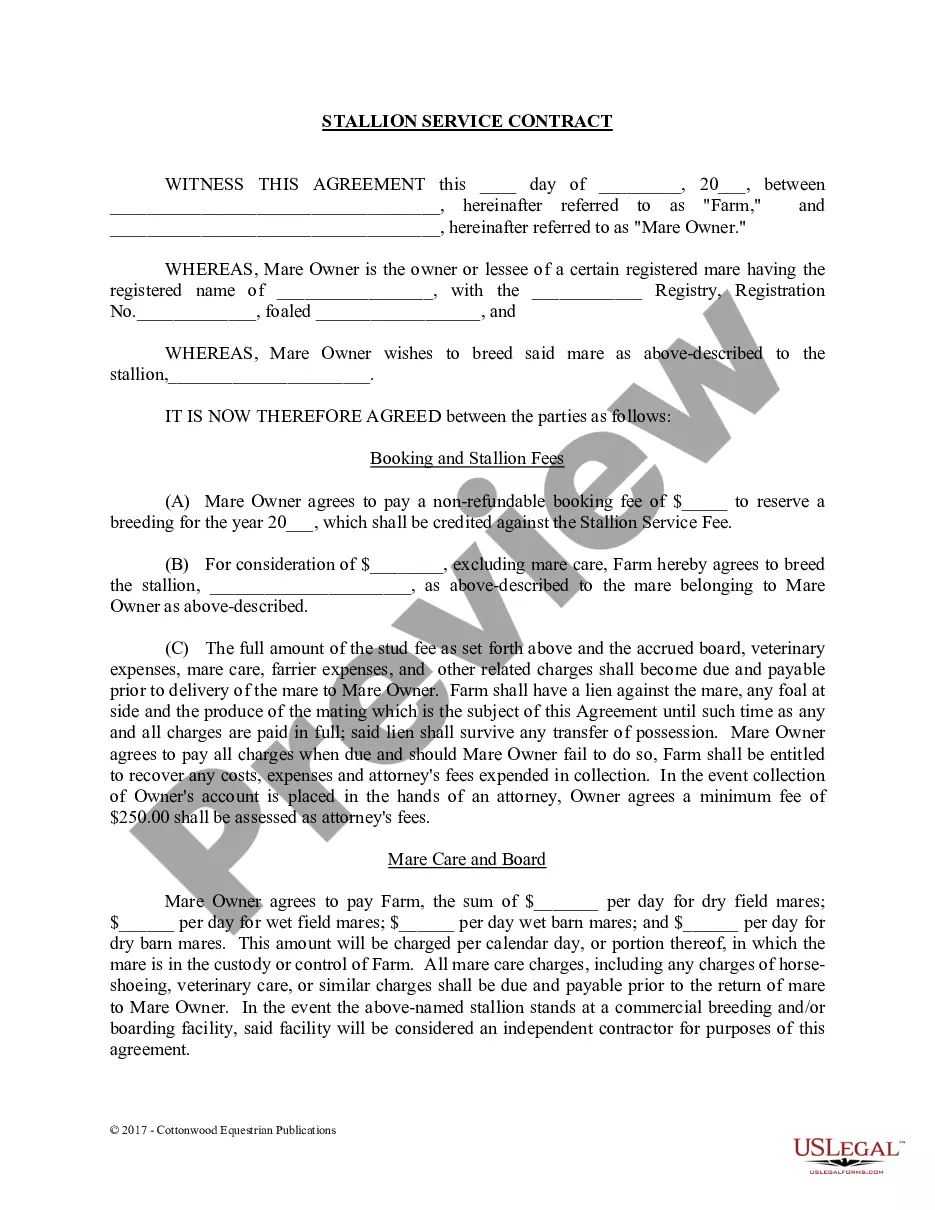

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Riverside Liquidation of Partnership with Sale of Assets and Assumption of Liabilities and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!