San Diego California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process that occurs when a partnership decides to dissolve its business operations and settle its financial obligations. This process involves selling the partnership's assets to generate funds, which are then used to pay off liabilities. In San Diego, there are different types of liquidation processes, including: 1. Voluntary Liquidation: This occurs when partners collectively agree to dissolve the partnership voluntarily. It requires a formal resolution to be passed by the partners, followed by the sale of assets and distribution of proceeds to creditors and partners. The assumption of liabilities is crucial in this process, as it determines how outstanding debts will be resolved. 2. Involuntary Liquidation: In some cases, a partnership may be forced into liquidation by external parties, such as creditors or the court. This typically happens when the partnership fails to meet its financial obligations or has legal disputes that cannot be resolved. The court then appoints a liquidator to oversee the process and ensure fair distribution of assets and assumption of liabilities. 3. Cross-Border Liquidation: This type of liquidation involves partnerships with assets and liabilities in multiple jurisdictions. It presents additional challenges due to differing legal systems and complexities of international business transactions. San Diego, being a major business hub, often deals with cross-border liquidation cases that require specialized legal expertise. During the liquidation process, the partnership's assets, such as property, equipment, and inventory, are sold to generate funds. The proceeds are then used to settle outstanding debts, including loans, accounts payable, and any other obligations the partnership may have incurred. It is important to ensure a proper assessment and valuation of assets to maximize their selling price. Assumption of liabilities is a crucial aspect of the liquidation process. While the partnership's assets are sold, the liabilities must be addressed to avoid any legal consequences for the partners. Depending on the nature of the liabilities, they may be assumed by the partners individually, shared among the partners based on their agreed-upon contribution, or negotiated with creditors. In San Diego, businesses undergoing liquidation should seek legal counsel to navigate the complex process and ensure compliance with all applicable laws and regulations. Understanding the different types of liquidation, asset sale processes, and assumption of liabilities is essential to successfully conclude a partnership liquidation in San Diego, California.

San Diego California Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out San Diego California Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like San Diego Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the San Diego Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law requirements.

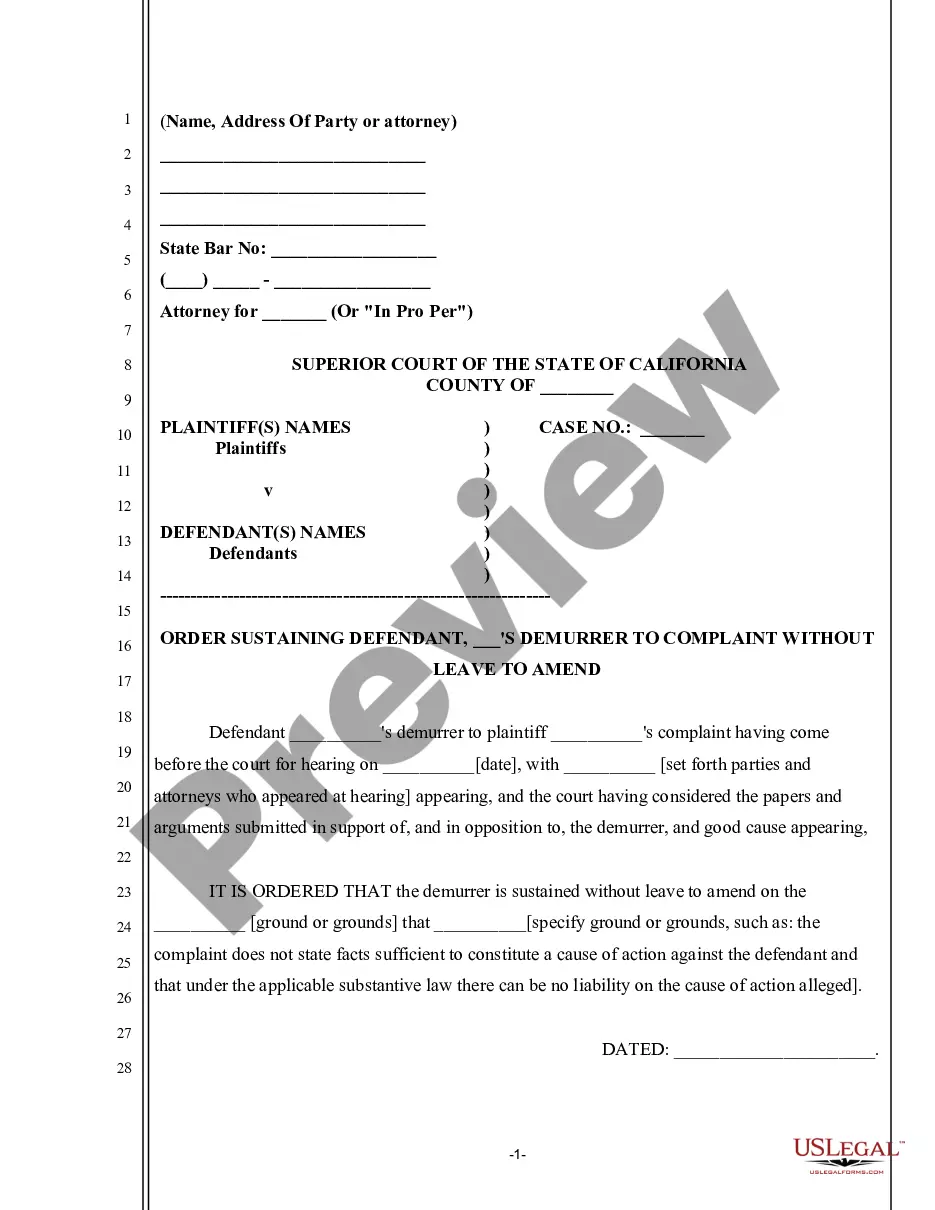

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Liquidation of Partnership with Sale of Assets and Assumption of Liabilities in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!