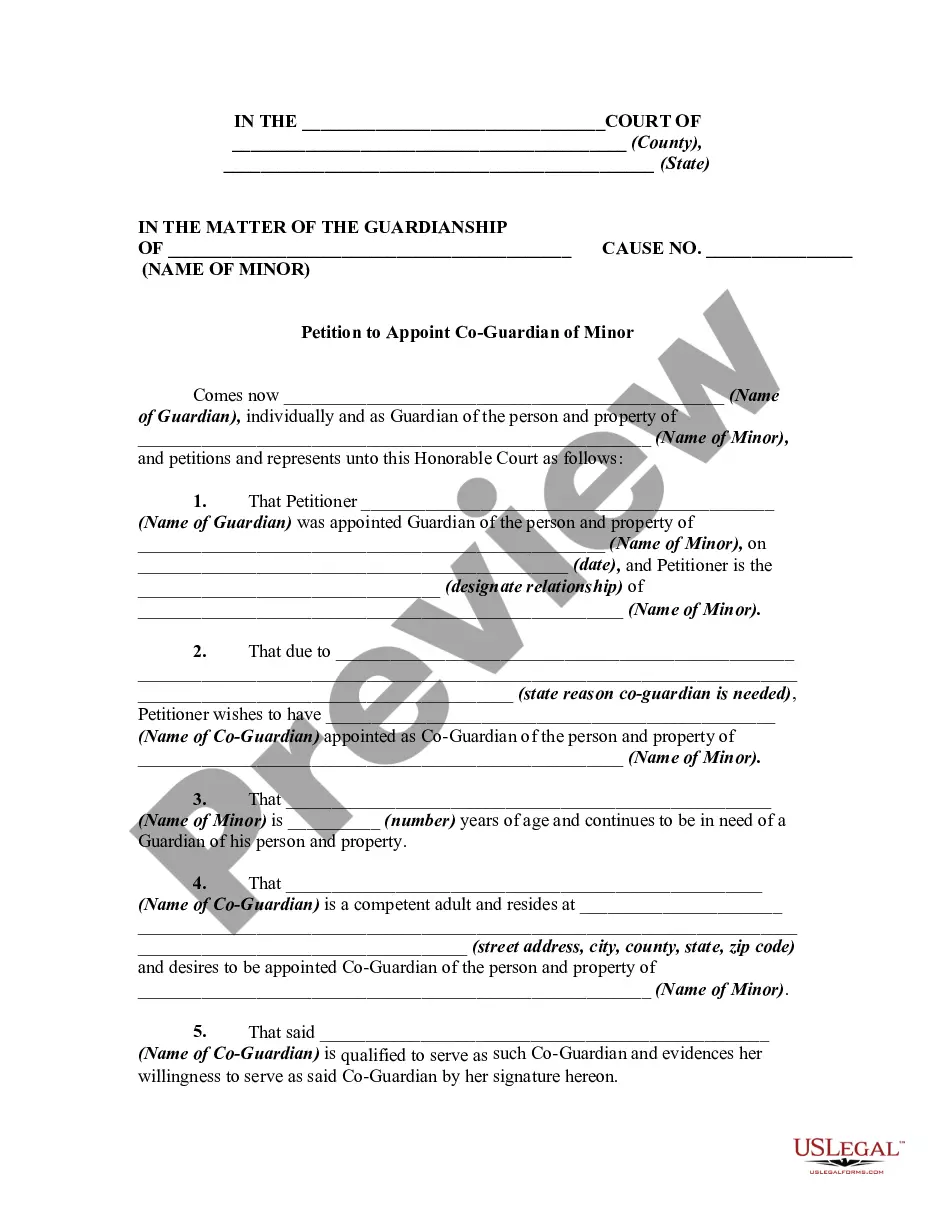

Wayne Michigan Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process whereby a partnership is dissolved and its assets are sold off to settle liabilities and distribute the remaining funds among the partners. This type of partnership liquidation is applicable specifically to partnerships located in Wayne, Michigan. The liquidation process typically involves the following steps: 1. Partnership Dissolution: The first step in the liquidation process is the dissolution of the partnership. This can be voluntary or involuntary and is usually triggered by various factors such as expiration of the partnership term, bankruptcy, or the decision of the partners to go separate ways. 2. Sale of Partnership Assets: Once the dissolution is confirmed, the partnership's assets are identified, evaluated, and ultimately sold off. These assets may include tangible assets like buildings, equipment, inventory, and intangible assets like patents, copyrights, and trademarks. The assets are liquidated to generate funds that will be used to settle outstanding liabilities. 3. Liability Assessment and Settlement: Simultaneously with the asset sale, the partnership's liabilities are assessed. These include debts, loans, outstanding payments, and contractual obligations. The liabilities are carefully examined, and funds generated from the asset sale are utilized to cover as much of these obligations as possible. 4. Allocation of Remaining Funds: After all the liabilities have been settled, any remaining funds are distributed among the partners according to their ownership interests in the partnership. The partnership agreement or the state's partnership laws usually dictate how these funds are distributed. It is important to note that there may be variations or specific types of liquidation processes within the Wayne, Michigan jurisdiction. Some common variations include: 1. Voluntary Liquidation: When partners mutually agree to dissolve the partnership and proceed with the liquidation process. 2. Involuntary Liquidation: Occurs when a partnership is forced into liquidation due to bankruptcy, court order, or breach of partnership agreement. 3. Creditors' Liquidation: In cases where the partnership fails to settle its liabilities, creditors may seek court intervention to liquidate the partnership's assets and distribute proceeds among the creditors. In conclusion, the Wayne Michigan Liquidation of Partnership with Sale of Assets and Assumption of Liabilities involves the dissolution of a partnership, sale of assets, settlement of liabilities, and distribution of remaining funds among partners. The specific type of liquidation may vary, including voluntary, involuntary, or creditors' liquidation, depending on the circumstances of the partnership's dissolution.

Wayne Michigan Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Wayne Michigan Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

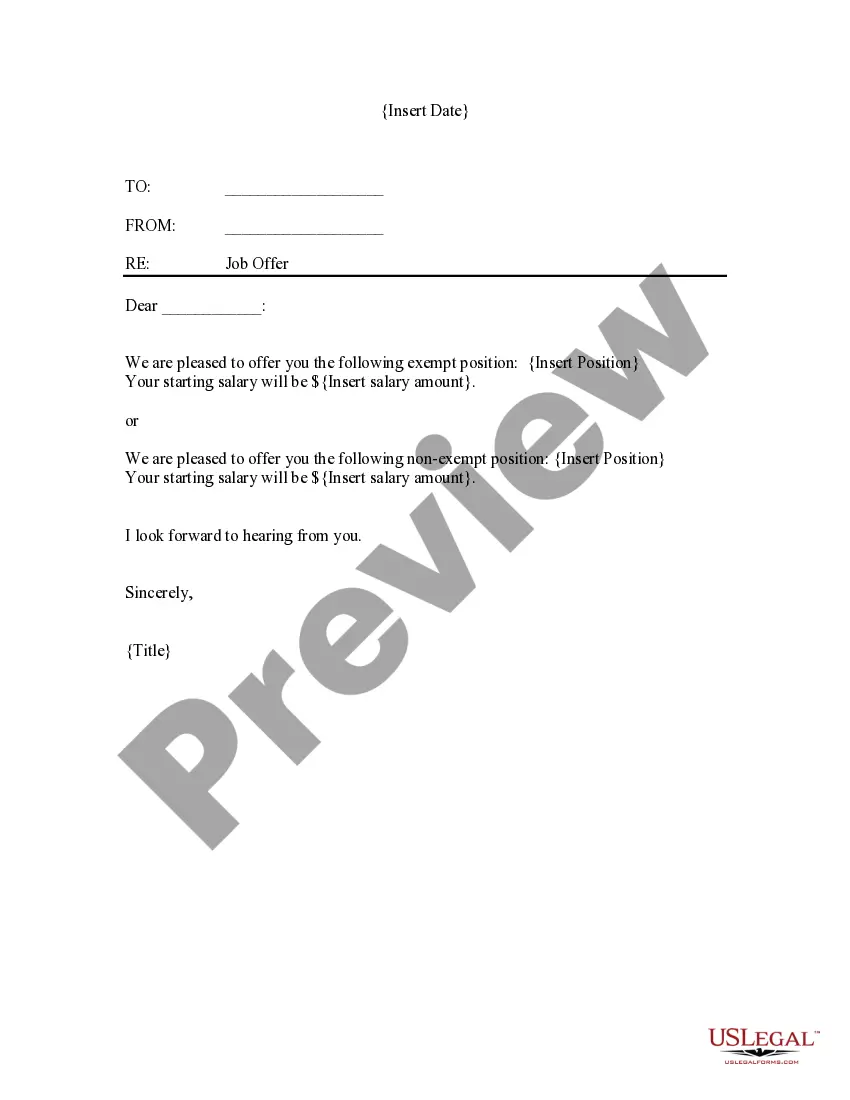

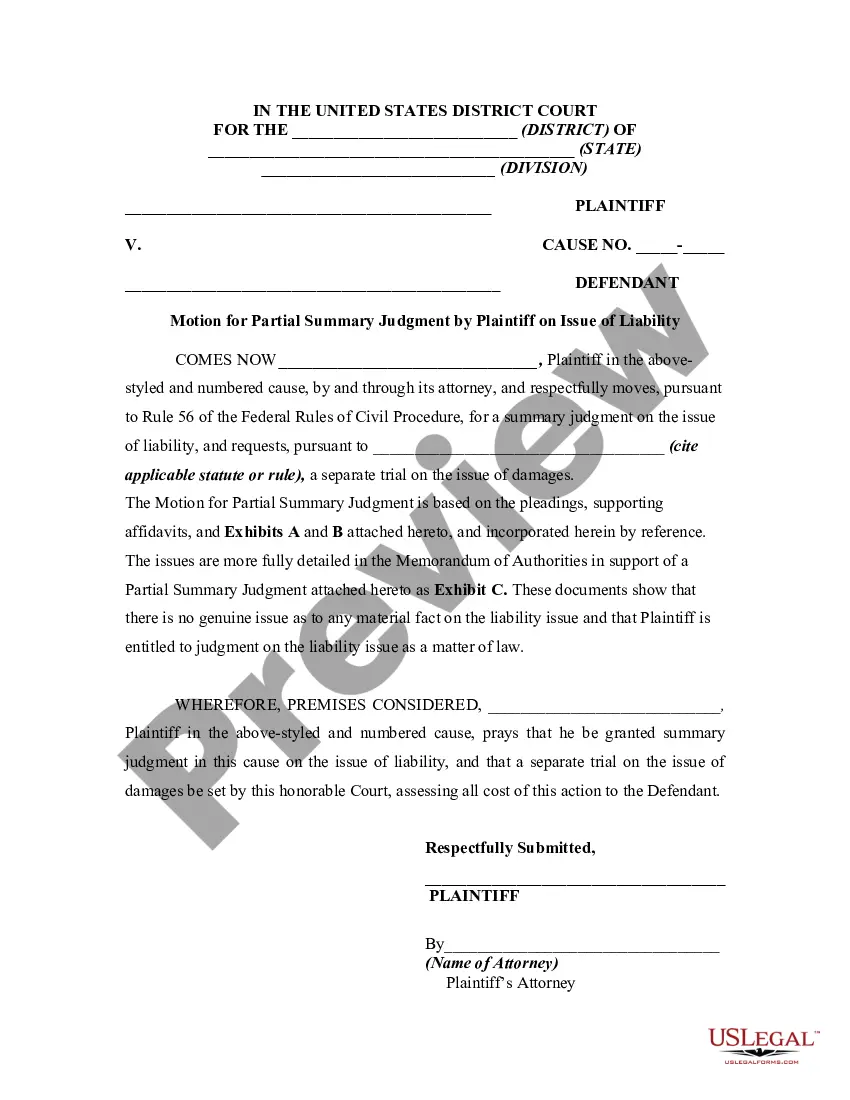

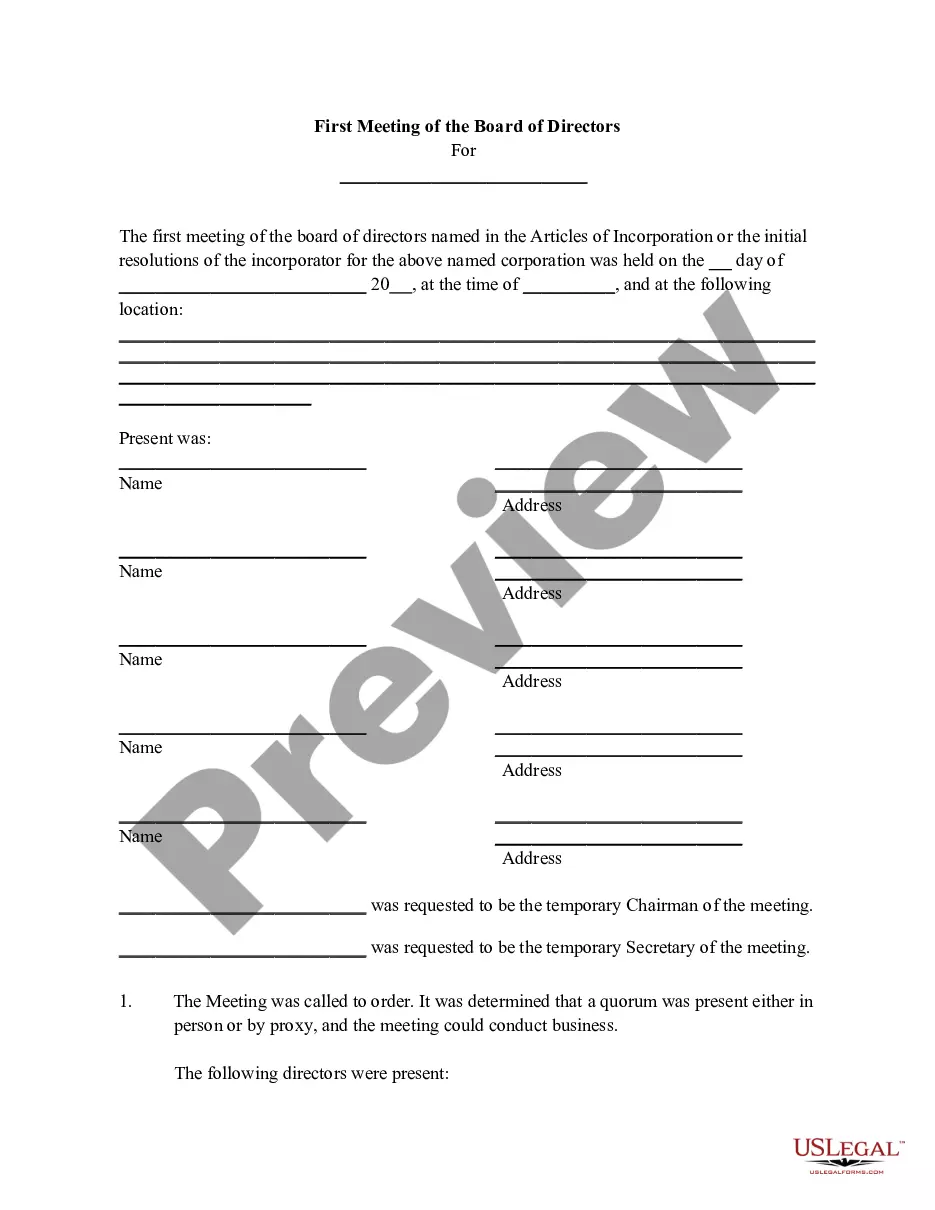

Creating documents, like Wayne Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, to manage your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for various cases and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Wayne Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Wayne Liquidation of Partnership with Sale of Assets and Assumption of Liabilities:

- Ensure that your template is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Wayne Liquidation of Partnership with Sale of Assets and Assumption of Liabilities isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our service and download the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!