Title: Understand San Jose, California Demand Letter to Partner to Contribute Capital: Types and Guidelines for Effective Communication Introduction: The San Jose, California Demand Letter to Partner to Contribute Capital is an essential communication tool used by businesses based in San Jose to request financial contributions or investments from their partners. This letter outlines the specific financial obligations, terms, and conditions required to secure partnership capital for various ventures. This article aims to provide a comprehensive understanding of the demand letter, its importance, and different types for specific business scenarios. 1. San Jose Demand Letter Overview: The San Jose Demand Letter to Partner to Contribute Capital is a formal written request sent by a business seeking financial support from a partner to fund a project, expand operations, acquire assets, or address financial needs. It serves as a legal document that defines the expectations and responsibilities of both parties involved. 2. Importance of a Demand Letter: — Establishes clarity: The letter ensures that the partner understands their financial obligations, investment terms, and helps mitigate any misunderstandings in the future. — Legal protection: A well-drafted demand letter can serve as evidence in case of a legal dispute, showcasing the partner's commitment and financial obligations toward the business. — Professional communication: The formal tone of the letter maintains a professional image while highlighting the seriousness of the request. 3. Types of San Jose Demand Letters to Partners to Contribute Capital: a. Project Investment Demand Letter: This type of demand letter is specific to projects requiring additional capital. It outlines the project details, expected contributions, expected returns on investment, and the proposed timeline. b. Equity Investment Demand Letter: Used when seeking investments in exchange for shares of ownership, this letter outlines the equity offered, percentage ownership, voting rights, and exit strategies for potential investors. c. Capital Contribution Demand Letter: Commonly used in partnership agreements, this letter outlines predetermined financial contributions from each partner and any agreed-upon obligations regarding future capital injections. d. Debt Financing Demand Letter: In situations where businesses are requesting a loan or borrowing funds from a partner, this letter outlines the loan amount, interest rates, repayment terms, and collateral agreements. 4. Guidelines for Writing a San Jose Demand Letter: a. Addressing: Ensure the letter is addressed to the correct partner or individual. Include their full name, title, and official contact information to ensure proper delivery. b. Concise and Clear: Compose a detailed yet concise letter by clearly stating the purpose, financial requirements, expectations, due dates, and any consequences of non-compliance. c. Professional Tone: Maintain a professional and polite tone throughout the letter, emphasizing the partnership's importance while highlighting the potential benefits to the partner. d. Timelines and Deadlines: Specify clear deadlines for the partner's contribution and include any penalties or consequences for non-adherence to the agreed-upon schedule. e. Seek Legal Advice: Consulting with legal professionals or business advisors is recommended to ensure compliance with relevant laws and regulations and to draft an effective demand letter. Conclusion: A San Jose, California Demand Letter to Partner to Contribute Capital is a vital instrument for generating financial support from partners. Understanding the various types and guidelines for drafting such letters can help businesses navigate partnership discussions smoothly, foster transparency, and protect their interests.

San Jose California Demand Letter to Partner to Contribute Capital

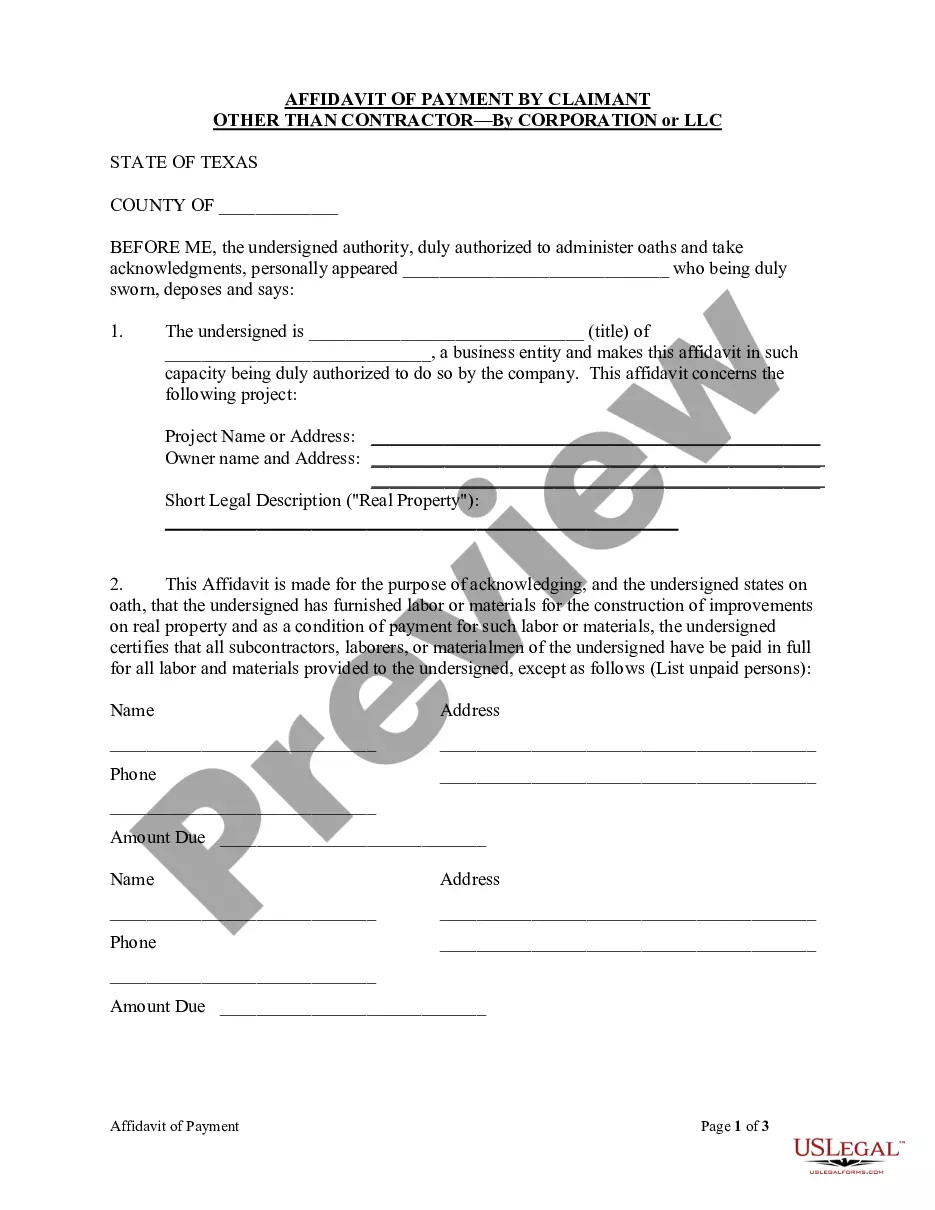

Description

How to fill out San Jose California Demand Letter To Partner To Contribute Capital?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the San Jose Demand Letter to Partner to Contribute Capital.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the San Jose Demand Letter to Partner to Contribute Capital will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the San Jose Demand Letter to Partner to Contribute Capital:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Jose Demand Letter to Partner to Contribute Capital on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!