Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets is a legally binding agreement that outlines the process of terminating a partnership in Allegheny, Pennsylvania, while also providing for the sale of one partner's interest to another partner along with an unequal distribution of partnership assets. In this type of agreement, the partners voluntarily agree to dissolve the partnership, either due to irreconcilable differences or the completion of the partnership's objectives. It provides a clear set of guidelines to follow, ensuring a smooth transition and fair distribution of assets. The agreement includes provisions for the sale of one partner's interest to another partner. This sale can occur for various reasons, such as one partner wishing to exit the partnership, retirement, or mutual agreement. It outlines the terms, conditions, and price of the sale, ensuring transparency and fairness for all parties involved. Furthermore, this particular agreement also involves a disproportionate distribution of partnership assets. Usually, during a dissolution, partnership assets are divided equally among partners. However, in the case of a disproportionate distribution, the partners agree to distribute the assets based on individual contributions, investments, or other predetermined criteria. This deviation from equal distribution allows for a more tailored division of assets, reflecting each partner's involvement and investment in the partnership. Different types of this agreement may include variations in the terms and conditions based on the specific needs and requirements of the partners involved. Some variations may address the distribution of specific assets, such as intellectual property, real estate, or inventory. Others may outline additional clauses and provisions regarding the transfer of liabilities, the payment of debts, tax obligations, or the valuation of partnership interests. The Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets enables partners to part ways amicably and fairly, preserving relationships and minimizing potential conflicts. It ensures the process of ending the partnership is done legally and equitably, benefiting all parties involved.

Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Allegheny Pennsylvania Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Drafting papers for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets without expert assistance.

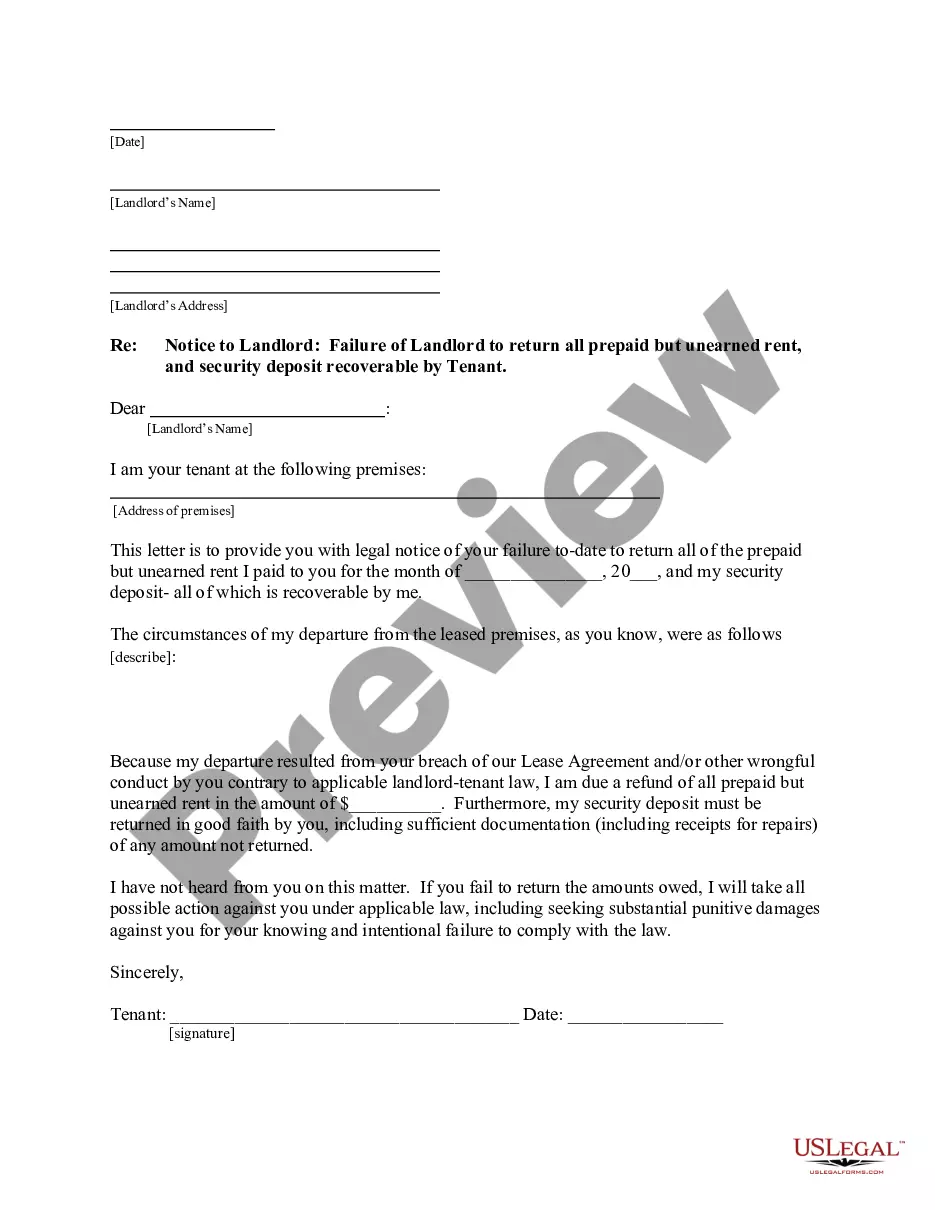

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!